Accuray Incorporated

ARAY

has been gaining on the back of its solid global reach. A solid second-quarter fiscal 2022 performance, along with the adoption of its products, is expected to contribute further. However, overdependence on technologies and reimbursement uncertainties persist.

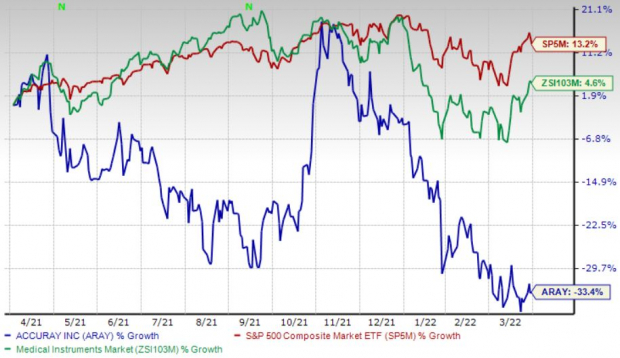

Over the past year, this Zacks Rank #3 (Hold) stock has lost 33.4% against 4.6% growth of the

industry

and 13.2% rise of the S&P 500 composite.

The renowned radiation oncology company has a market capitalization of $306.9 million. Accuray projects 150% growth for fiscal 2023, in which it expects to maintain its strong performance. The company surpassed estimates in one of the trailing four quarters, missed the same in two and broke even in the other, the average earnings surprise being -33.3%.

Image Source: Zacks Investment Research

Let’s delve deeper.

Global Reach:

Accuray has been fortifying its foothold globally, thus raising our optimism. During the fiscal 2022 second-quarter earnings call, the company confirmed that its strong order numbers continued in Japan, with 23% year-over-year growth in the quarter. In the same quarter, the Americas region delivered its highest quarterly revenues in Accuray’s history and finished the first half of fiscal 2022 with 27% year-over-year order growth.

The EIMEA region, Accuray’s largest order region, delivered 3% growth in the fiscal second quarter. The APAC region posted solid results, with China driving 83% of the quarter’s year-over-year growth in orders.

Product Adoption:

We are upbeat about robust adoption of Accuray’s products. In March, the CARTI medical care team in Little Rock, AR used the Accuray CyberKnife S7 System for the first time to treat patients in the state.

In February, Accuray announced that the National Institute for Health and Care Excellence had endorsed the use of radiosurgery for trigeminal neuralgia. The same month, the company announced that the Royal Brisbane and Women’s Hospital in Queensland, Australia had selected two Radixact Systems with ClearRT helical fan-beam kVCT imaging and Synchrony artificial intelligence-driven four-dimensional dynamic delivery technology to expand access to potentially life-saving radiotherapy treatments to more patients.

Strong Q2 Results:

Accuray’s robust second-quarter fiscal 2022 revenues buoy optimism. The company registered upticks in both its overall top line and Products revenues. Strong demand for the ClearRT Helical kVCT Imaging for the Radixact System is impressive. Accuray’s restructuring initiatives also raise optimism. Strength in the company’s TomoTherapy and CyberKnife platforms is encouraging.

Downsides

Overdependence on Technologies:

Achieving consumer and third-party payor acceptance of the CyberKnife and TomoTherapy platforms as preferred methods of tumor treatment is crucial to Accuray’s continued success. Physicians will not begin to use or increase the use of the CyberKnife or TomoTherapy platforms unless they determine, based on experience, clinical data and other factors, that the two platforms are safe and effective alternatives to traditional treatment methods.

Reimbursement Uncertainties:

Accuray’s customers rely significantly on reimbursement from public and private third-party payors for the CyberKnife and TomoTherapy platform procedures. The company’s ability to commercialize its products successfully and increase market acceptance of the same will significantly depend on the extent to which public and private third-party payors provide adequate coverage and reimbursement for procedures that are performed with Accuray’s products.

Estimate Trend

Accuray is witnessing a negative estimate revision trend for fiscal 2022. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved from 7 cents per share to a loss of 14 cents.

The Zacks Consensus Estimate for the company’s third-quarter fiscal 2022 revenues is pegged at $99.5 million, suggesting a 2.9% decline from the year-ago quarter’s reported number.

Key Picks

A few stocks from the broader medical space that investors can consider are

AMN Healthcare Services, Inc.

AMN

,

IDEXX Laboratories, Inc.

IDXX

and

Henry Schein, Inc.

HSIC

.

AMN Healthcare has an estimated long-term growth rate of 16.2%. AMN’s earnings surpassed estimates in the trailing four quarters, the average surprise being 20%. It currently sports a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcare has gained 41.3% against the

industry

’s 54.4% fall over the past year.

IDEXX, carrying a Zacks Rank #2 (Buy), has an estimated long-term growth rate of 13%. IDXX’s earnings surpassed estimates in the trailing four quarters, the average surprise being 18.6%.

IDEXX has gained 12.5% compared with the industry’s 4.6% growth over the past year.

Henry Schein has an estimated long-term growth rate of 11.8%. HSIC’s earnings surpassed estimates in the trailing four quarters, the average surprise being 25.5%. It currently has a Zacks Rank #2.

Henry Schein has gained 26.9% compared with the

industry

’s 9.7% growth over the past year.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report