Biogen

BIIB

stock was down 2.0% in after-hours trading on Tuesday after the Centers for Medicare & Medicaid Services (“CMS”) released its final National Coverage Determination (NCD) decision for the class of anti-amyloid antibodies approved by the FDA like its new Alzheimer’s drug (AD) Aduhelm.

Per the final NCD decision, Medicare said it will cover FDA-approved drugs like Aduhelm only for patients enrolled in CMS-approved studies. This means Medicare will not cover Aduhelm for patients treated outside of clinical studies. CMS took the decision as it believes that presently there is not enough evidence demonstrating that Aduhelm leads to improved health outcomes.

In the final decision, CMS also said that if other new drugs in this class obtain FDA’s traditional approval and show evidence of a clinical benefit, CMS will allow them broader coverage in the Medicare program.

Despite being the first medicine to be approved for reducing the clinical decline of AD, sales of Aduhelm, approved (on an accelerated basis) in June last year, were disappointing in 2021 due to limited patient access amid a lack of clarity on reimbursement. Aduhelm’s accelerated approval was based on evidence that it may reduce plaque in the brain and slow down cognitive decline for people with early AD. In 2021, Biogen recorded just $3.0 million in revenues from Aduhelm.

In January, CMS had released a draft NCD decision in which it proposed to cover FDA-approved AD drugs like Aduhelm only for patients enrolled in qualifying clinical studies. Back then, CMS took the decision after analyzing “robust evidence,” which showed that though these AD treatments had promising potential, they could also have side effects like headaches, dizziness, resulting in falls, as well as other potentially serious complications such as brain bleeds.

With the CMS now abiding by the draft decision, it will restrict patient access to Aduhelm and limit its commercial potential. Though CMS’ final decision was quite expected, it probably is the final blow to Aduhelm’s sales prospects.

Biogen, in response to the final NCD decision, said that it will deprive nearly all Medicare beneficiaries from accessing Aduhelm. Biogen urged CMS to reconsider the decision when additional data from other treatments in this class become available. Biogen is evaluating the impact of the decision on its financials and will provide an update soon.

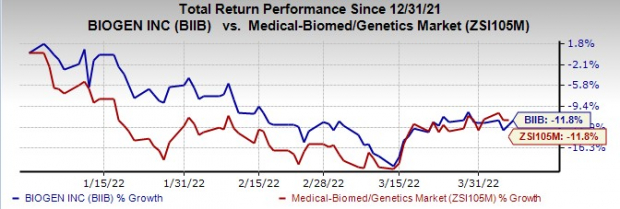

So far this year, Biogen’s shares have declined 11.8%, similar to the

industry

. In fact, the stock has declined almost 47% since the FDA approved Aduhelm on Jun 7.

Image Source: Zacks Investment Research

Aduhelm’s FDA approval faced criticism about its mixed efficacy results, the FDA selection of the accelerated approval path and the regulatory process in general. The FDA approved Aduhelm despite an FDA advisory committee voting against its approval in November 2020 due to mixed outcomes data from ENGAGE and EMERGE phase III studies. All these issues seem to have affected demand, patient access and reimbursement for Aduhelm, which resulted in its slow launch. Many doctors have refrained from prescribing the treatment.

Aduhelm was also launched with a huge price tag of $56,000 a year, which was widely condemned and was considered a significant cost burden on Medicare. In December 2021, Biogen lowered the wholesale acquisition cost of Aduhelm by approximately 50%, effective Jan 1, 2022.

Biogen has another AD candidate in its portfolio, lecanemab, an anti-amyloid beta (Aβ) protofibril antibody that it is developing in partnership with Japan’s Eisai. In September 2021, Eisai initiated a rolling submission of a biologics license application (BLA) for lecanemab to the FDA under the accelerated approval pathway.

The final CMS ruling will also affect

Roche

RHHBY

and

Eli Lilly

LLY

. These companies’ AD candidates are in late-stage development and are expected to be launched in a few months. The final NCD decision may also limit coverage for these drugs, which may be approved by the FDA in the future.

Roche’s pipeline candidate for AD, gantenerumab, is an anti-amyloid beta antibody developed for subcutaneous administration. Roche expects to file a regulatory application for gantenerumab later this year.

Roche’s gantenerumab has also been granted Breakthrough Therapy Designation by the FDA.

Lilly has developed donanemab, also an anti-amyloid beta antibody for AD.

Lilly has already initiated a rolling submission with the FDA, seeking approval for donanemab for early AD under the accelerated approval pathway based on data from TRAILBLAZER-ALZ.

Lilly plans to complete its regulatory filing for donanemab in 2022, delayed from earlier expectations of first-quarter 2022 end. Lilly delayed its filing timeline for donanemabas it plans to focus on data readout from the TRAILBLAZER-ALZ 2 confirmatory phase III study on donanemab to demonstrate the efficacy and safety of donanemab that can support broad coverage for the medicine.

A smaller company,

Cassava Sciences’

SAVA

simufilam is also in late-stage development for mild to moderate AD. In November 2021, Cassava Sciences initiated a second phase III study of simufilam for the treatment of patients with AD.

Cassava Sciences’ phase III studies on simufilam are being conducted under Special Protocol Assessments from the FDA.

Biogen currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report