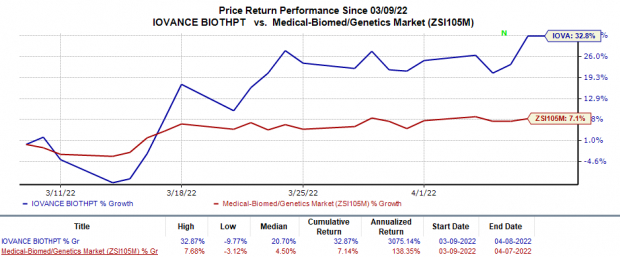

Shares of

Iovance Biotherapeutics

IOVA

have surged 32.9% in the past month, outperforming the

industry

’s 7.1% rise.

Image Source: Zacks Investment Research

Last month, Iovance

announced

that the FDA had accepted its regulatory filing to start clinical studies for its first TALEN-edited tumor infiltrating lymphocyte (TIL) therapy, IOV-4001. IOVA intends to start a clinical study later this year evaluating this candidate for two advanced cancers, namely metatstatic melanoma and Stage III or IV non-small cell lung cancer (NSCLC). Per management, IOV-4001 provides an opportunity to assess the safety and efficacy of the combination of a TIL therapy and a PD-1 checkpoint inhibitor in a single formulation.

IOV-4001 utilizes the TALEN technology licensed from

Cellectis

CLLS

. This license is part of a collaboration finalized between Iovance and CLLS in 2020. Per the agreement terms, IOVA has an exclusive worldwide license to use Cellectis’ proprietary TALEN technology to develop gene-editing TIL therapies targeting cancer. In return, Cellectis will be entitled to receive milestones and royalty payments from IOVA upon potential development and successful commercialization of the products developed using the TALEN technology.

Iovance’s share price received a further boost earlier this week after management

announced

that it received a positive feedback from the FDA with regard to the potency assays and assay matrix for its lead pipeline candidate lifileucel concerning the treatment of melanoma. This favorable opinion from the regulatory agency movesIovance a step closer to its planned biologic license application (BLA) filing for lifileucel in relation to metastatic melanoma. The BLA filing is expected to be completed by August 2022.

Iovance currently lacks a marketed product in its portfolio and therefore has no stable source of revenue generation. IOVA had been engaged with the FDA since the past two years trying to align with the regulatory body on potency assay and assay matrix for lifileucel pertaining to melanoma. An alignment with the FDA on potency assays is essential for a TIL therapy like lifileucel to support its BLA submission. This alignment with the FDA will also enable IOVA to discuss its plans for a BLA filing to address cervical cancer.

Alongside the positive response, Iovance announced plans to start a phase III study evaluating the combination of lifileucel and

Merck

’s

MRK

blockbuster PD-1 inhibitor Keytruda (pembrolizumab) for melanoma later this year. The late-stage study will evaluate this combo as apotential treatment of immune checkpoint inhibitor naïve frontline metastatic melanoma. IOVA already evaluated this combination for the given indication in a cohort of the phase II study (IOV-COM-202). Data from the same demonstrated an overall response rate of 67%.

A multi-center study, IOV-COM-202 comprises seven cohorts evaluating Iovance’s TIL therapies in multiple settings and for several indications, both as a monotherapy and in combination with Keytruda or

Bristol-Myers

’

BMY

Opdivo/Yervoy.

A key revenue generator for Merck, Keytruda is approved for the treatment of many cancer indications, globally. For 2021, Merck recorded $17.2 billion of sales from Keytruda. The novel combination of lifileucel and Merck’s Keytruda demonstrated a safe clinical profile and showed encouraging results for multiple solid tumor indications across multiple studies conducted by IOVA when compared to either lifileucel or the Keytruda monotherapy.

Opdivo and Yervoy are two of the many blockbuster drugs marketed by Bristol Myers and are key drivers of BMY’s top line. During 2021, Bristol Myers generated $7.5 billion from Opdivo sales and recorded $2 billion as product revenues from Yervoy.

Zacks Rank

Iovance currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report