First Solar, Inc.

FSLR

recently signed a master supply agreement (MSA) with Silicon Ranch for delivering 4 gigawatts-direct current (GWdc) of its solar modules during the 2023-2025 period. This should get facilitated by the company’s plan to expand America’s domestic PV solar manufacturing capacity by 3.3 GW annually, by building its third U.S. manufacturing facility in Lake Township, OH.

The latest MSA further strengthens the partnership between First Solar and Silicon Ranch, which started in 2015, for supplying modules to Aerojet Rocketdyne Solar Farm in Arkansas.

U.S Solar Market Prospects & First Solar

The need for clean energy has accelerated the shift to renewable sources of energy from fossil fuels, leading to the widespread adoption of solar-based energy in the United States.

Per the Annual Energy Outlook report published by the U.S. Energy Information Administration in March 2022, the new wind and solar power will constitute the majority of this renewable energy increase, with total solar generation projected to surpass wind generation by the early 2030s.

Considering such solar market prospects in the United States, First Solar has been taking important initiatives to expand its footprint in this nation, which will help it in maintaining its position as the largest U.S. solar module manufacturer.

Notably, First Solar has invested over $2 billion in its US manufacturing footprint, and aims to invest $680 million in the nation’s third manufacturing facility. The company recently inked a deal with Florida’s Origis involving the delivery of 750 megawatts (MW) of its thin-film photovoltaic (PV) solar modules to the latter.

The solid investments aimed by First Solar in enhancing its capacity will enable timely delivery of PV modules to Origis as well as Silicon Ranch.

Peer Moves

The aforementioned solar market prospects in the United States bring the spotlight not only on First Solar but also on prominent solar players like

Enphase Energy

ENPH

,

SolarEdge Technologies

SEDG

and

Canadian Solar

CSIQ

. These have already established a position in the U.S solar energy market either through the development of solar projects or by manufacturing-related components or battery storage technologies.

In March 2022, Enphase Energy revealed that the Vermont-based utility, Green Mountain Power decided to offer the Enphase Energy System to its customers as part of its battery lease grid services pilot program.

The Zacks Consensus Estimate for Enphase Energy’s 2022 earnings indicates an upward revision of 2.9% in the past 60 days. Shares of ENPH have rallied 32.5% in the past year.

In 2021, SolarEdge Technologies launched several new products like the Energy Bank residential battery and higher power optimizers and inverters in residential and commercial offerings in the United States.

SolarEdge boasts a long-term earnings growth rate of 24.7%. Shares of SEDG have returned 20.3% in the past year.

In April 2022, Canadian Solar sold its Gaskell West 2 and 3 solar-plus-storage projects to Matrix Renewables. Located in Kern County, CA, it has a generation capacity of 105 megawatt-alternate current plus 80 megawatt-hour energy storage.

The Zacks Consensus Estimate for Canadian Solar’s 2022 sales indicates a 37.7% improvement over the prior-year quarter’s reported figure. CSIQ shares have appreciated 21.7% in the past three months.

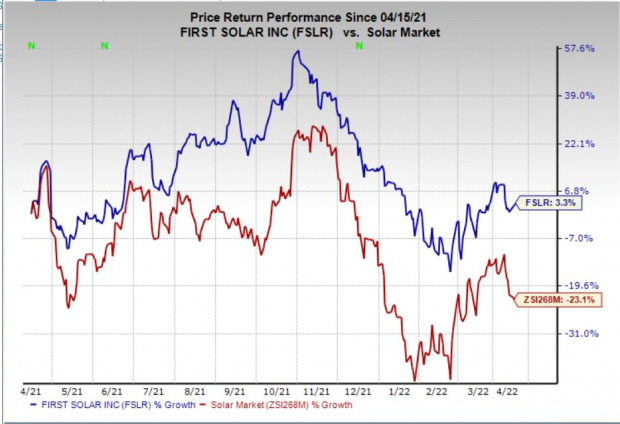

Price Movement

In the past month, shares of First Solar have rallied 3.3% against the

industry

’s decline of 23.1%.

Image Source: Zacks Investment Research

Zacks Rank

First Solar currently carries a Zacks Rank #4 (Sell).

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the

Zacks Top 10 Stocks

portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report