Mergers & acquisitions (M&As) are back in the spotlight in the pharma/biotech sector with two recent announcements.

Pharma giant

GlaxoSmithKline plc

GSK

recently announced that it will acquire California-based, late-stage biopharmaceutical company Sierra Oncology for $1.9 billion. Sierra Oncology is focused on targeted therapies to treat rare forms of cancer. The acquisition will add momelotinib to Glaxo’s hematology franchise. Concurrently,

Halozyme Therapeutics, Inc.

HALO

announced that it will acquire Antares Pharma, Inc. for $960 million to diversify its revenue base and extend its strategy to include specialty products. The acquisition will add Antares’ commercial portfolio and its auto injector drug delivery technology to Halozyme’s portfolio.

Last month, Pfizer acquired Arena Pharmaceuticals to expand its portfolio. In 2021, Sanofi was also quite active on the M&A front.

M&A has always taken center stage in the

biotech

industry as leading pharma/biotech companies constantly eye lucrative acquisitions to diversify their revenue base in the face of dwindling sales of high-profile drugs. However, the scale and pace of M&A activity slowed down significantly in the last couple of years due to the COVID-19 pandemic as most companies were more focused on developing vaccines and treatments for the deadly disease. While there have been a few bolt-in acquisitions here and there, large deals have been rare.

However, as the world at large learns to live with the pandemic and the economic situation improves, the pace is picking up. Bigwigs like Gilead, Bristol Myers, Novartis are evidently on the lookout to bolster their portfolios.

While oncology and immuno-oncology are the key areas of focus, treatments for rare diseases and gene-editing companies also promise potential, making them lucrative investment areas. Moreover, companies investing in mRNA technology are gaining a lot of attention, given the success of the technology in the development of COVID-19 vaccines. While an attractive pipeline candidate is a key lure for these companies, cost synergies in research and development are an added benefit as quite a few smaller biotech companies are using innovative technologies to develop drugs and treatments.

Below we discuss companies that have promising drugs/candidates in the pipeline and could be potential takeover targets:

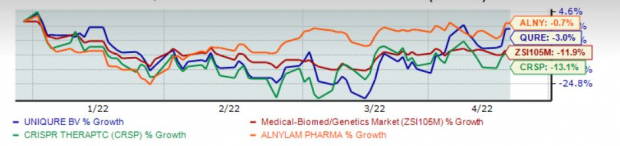

Image Source: Zacks Investment Research

Gene therapy companies have attracted a lot of attention in the last few years, and

uniQure

QURE

is one such company with an impressive pipeline. The company is advancing proprietary gene therapies to treat patients with hemophilia B, Huntington’s disease, refractory temporal lobe epilepsy, Fabry disease and other diseases. uniQure has entered into an agreement with CSL Behring, thereby handing the global rights to commercialize an investigational adeno-associated virus five (AAV5)-based gene therapy etranacogene dezaparvovec to CSL as a one-time treatment for hemophilia B patients with a severe bleeding phenotype. The EMA recently accepted the Marketing Authorization Application (MAA) for etranacogene dezaparvovec under its accelerated assessment procedure. The company has made pipeline progress with its other candidates as well and should be on the radar of companies looking to gain a presence in this space.

uniQure currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

CRISPR Therapeutics

CRSP

is one of the leading gene-editing companies. It is focused on developing transformative gene-based medicines for serious diseases using its proprietary CRISPR/Cas9 platform. CRISPR’s lead product candidate, CTX001, is an investigational, autologous, gene-edited hematopoietic stem cell therapy that is being evaluated for the treatment of transfusion-dependent beta thalassemia (TDT) and severe sickle cell disease (SCD). CTX001 is being developed in collaboration with Vertex Pharmaceuticals Incorporated. The company and partner Vertex completed enrollment in the CTX001 trials and are on track for planned regulatory submissions in late 2022. It is also advancing its wholly-owned immuno-oncology pipeline and has initiated dosing of patients in the CTX110 trial.

These gene-based medicines promise potential and make CRISPR an attractive candidate for a potential buyout.

Alnylam Pharmaceuticals

ALNY

is another company that should attract eyeballs. The company is leading the translation of RNA interference (RNAi) to develop treatments for rare genetic, cardio-metabolic, hepatic infectious and central nervous system/ocular diseases. Alnylam’s commercial RNAi therapeutic products are Onpattro (patisiran), Givlaari (givosiran), Oxlumo (lumasiran), and Leqvio (inclisiran) with partner Novartis, which has obtained global rights to develop, manufacture and commercialize inclisiran under a license and collaboration agreement. The uptake of all these products has been good. ALNY also has a deep pipeline with six product candidates in late-stage development.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the

Zacks Top 10 Stocks

portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report