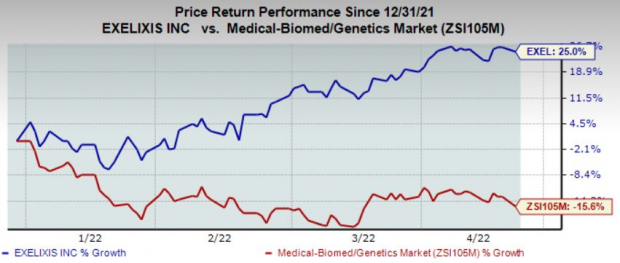

Shares of

Exelixis, Inc

.

EXEL

have gained 25% in the year so far against the

industry

’s decline of 15.5%.

In fact, Exelixis is one of the few stocks that has outperformed the market this year.

Exelixis is an oncology-focused biotechnology company. Lead drug Cabometyx continues to perform well. Cabometyx tablets are approved for the treatment of patients with advanced renal cell carcinoma (RCC) and patients with HCC who have been previously treated with Nexavar.

Image Source: Zacks Investment Research

It is also approved for patients with advanced RCC as a first-line treatment in combination with

Bristol Myers’

BMY

Opdivo (nivolumab) and for adult and pediatric patients 12 years of age and older with locally advanced or metastatic differentiated thyroid cancer that has progressed following prior VEGFR-targeted therapy and who are radioactive iodine-refractory or ineligible. The drug’s sales have shown a strong uptake following its approval in combination with Opdivo in 2021.

In 2021, Exelixis generated revenues of more than $1 billion from the cabozantinib franchise in the United States. A strong performance from the franchise is expected in 2022 as well.

Bristol-Myers’ Opdivo is one of the leading revenue generators of the company and is approved for various oncology indications.

Exelixis is working on expanding the drug’s label further, and the successful development should boost sales.

It is also looking to develop its portfolio beyond lead drug Cabometyx and has a strong pipeline.

In December 2021, Exelixis announced the initiation of the dose-escalation stage of STELLAR-002, a phase Ib trial evaluating XL092 in combination with immuno-oncology therapies in advanced solid tumors.

The company recently announced that it has initiated the dose-escalation stage of the first-in-human phase I study of investigational candidate XL114.

XL114 is a novel anti-cancer compound that inhibits the CARD11-BCL10-MALT1 complex, a key component of signaling downstream of B- and T-cell receptors, promoting B- and T-cell lymphoma survival and proliferation.

The study will evaluate the candidate as a monotherapy in patients with non-Hodgkin’s lymphoma (NHL) who have received prior standard therapies.

Other candidates include XB002, an antibody-drug conjugate (ADC) targeting tissue factor. In January 2022, Exelixis amended its option and license agreement for XB002 with Iconic Therapeutics. Per the amended agreement, Exelixis acquired broad rights to use the anti-TF antibody incorporated into XB002 for any application, including conjugated to other payloads, and rights within oncology to a number of other anti-TF antibodies developed by Iconic, including for use in ADCs and multispecific biotherapeutics. A phase I study on XB002 is ongoing.

Exelixis plans to evaluate XB002, both as a monotherapy and in combination with immune checkpoint inhibitor (ICIs) and other targeted therapies, across a wide range of tumor types, including indications other than those currently addressed by commercially available TF-targeted therapies.

The successful development of these candidates will broaden its portfolio and reduce its dependence on Cabometyx.

Competition is stiff in this space, and capturing additional market share might become tough for Exelixis.

Merck’s

MRK

Keytruda in combination with

Pfizer’s

PFE

Inlyta is also indicated for the first-line treatment of patients with advanced RCC.

Merck’s Keytruda, an anti-PD-1 therapy, is approved for the adjuvant treatment of patients with RCC at intermediate-high or high risk of recurrence following nephrectomy or nephrectomy and resection of metastatic lesions.

Pfizer’s Inlyta has shown strong performance, driven by continued adoption in the United States and Europe. PFE’s older drug Sutent is also approved for advanced RCC.

Exelixis currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +25.4% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report