GlaxoSmithKline

GSK

announced that the FDA accepted its new drug application (NDA) seeking approval of daprodustat, an oral hypoxia-inducible factor prolyl hydroxylase inhibitor, for anemia associated with chronic renal disease (CKD). The FDA granted the NDA a standard review and a decision is expected on Feb 1, 2023.

Daprodustat is only approved in Japan as Duvroq for patients with renal anemia. An application seeking the approval of daprodustat for a similar indication is also under review in Europe.

The NDA was based on data from the ASCEND phase III program, which consisted of five studies. All the studies met their primary efficacy and safety endpoints in non-dialysis and dialysis CKD patients. Data from the five phase III studies demonstrated that daprodustat improved or maintained hemoglobin within target levels, without increased cardiovascular risk when compared to the standard of care treatment, an erythropoietin stimulating agent (“ESA”).

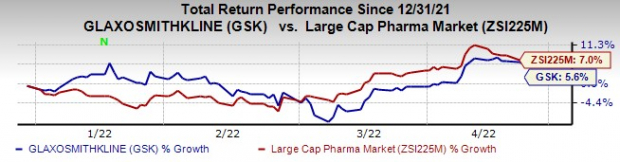

Glaxo’s stock has risen 5% this year so far compared with an increase of 7% for the

industry

.

Image Source: Zacks Investment Research

Anemia is a common complication of CKD. The major cause of anemia in patients with CKD is the decreased ability of kidneys to produce erythropoietin (“EPO”), which leads to insufficient oxygen supply in organs, affecting a person’s quality of life.

Amgen

’s

AMGN

Epogen and Aranesp and

J&J

’s

JNJ

Procrit/Eprex are popular ESAs used to treat anemia in patients with chronic kidney failure.

Amgen’s ESA franchise, consisting of Epogen and Aranesp, contributed 8% to its 2021 product sales. However, Amgen is seeing declining sales of these drugs due to biosimilar competition.

J&J is also seeing declining sales of Procrit/Eprex due to biosimilar competition.

Zacks Rank and Stocks to Consider

Glaxo currently has a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

A better-ranked large drug stock is

Eli Lilly

LLY

with a Zacks Rank #2 (Buy).

Lilly’s stock has risen 8% this year so far. Estimates for Lilly’s 2022 earnings have gone up from $8.71 to $8.78 while that for 2023 have increased from $9.78 to $9.90 per share over the past 30 days.

Lilly’s earnings performance has been rather weak, with the company missing earnings expectations in each of the last four quarters. Lilly has a four-quarter negative earnings surprise of 3.92%, on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report