We expect investors to focus on the updates related to

CRISPR Therapeutics AG

’s

CRSP

progress with its pipeline candidates when it reports first-quarter 2022 results.

CRSP’s earnings surpassed expectations in two of the trailing four quarters and missed the same on the other two occasions, with the average surprise being 29.2%. In the last reported quarter, CRISPR Therapeutics witnessed a negative earnings surprise of 5.8%.

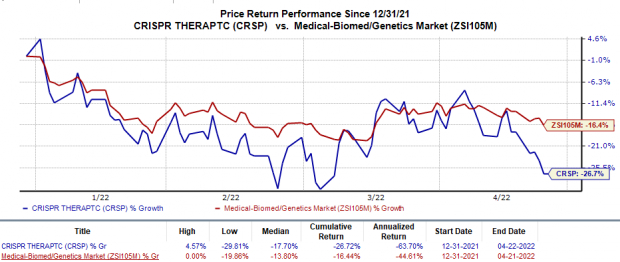

In the year so far, shares of CRISPR Therapeutics have declined 26.7% compared with the

industry

’s 16.4% fall.

Image Source: Zacks Investment Research

Let’s see how things have shaped up for the quarter to be reported.

Factors to Consider

With no marketed product in its portfolio, we expect the focus of the first-quarter conference call to be on the updates related to CRISPR Therapeutics’ pipeline. CRSP’s top line mainly comprises grants and collaboration revenues and on this front, it is mainly dependent on

Vertex Pharmaceuticals

VRTX

.

As part of its collaboration with Vertex, CRISPR Therapeutics is evaluating CTX001, an investigational ex-vivo CRISPR gene-edited therapy, for sickle cell disease and transfusion-dependent beta thalassemia indications in two separate phase I/II studies. CRISPR Therapeutics and Vertex Pharmaceuticals already achieved the target enrolment in both these studies and intend to file regulatory applications for CTX001 to treat both indications by this year-end.

CRISPR Therapeuticsis also advancing its wholly-owned immuno-oncology pipeline, which currently consists of three chimeric antigen receptor T cell (CAR-T) therapy candidates, namely CTX110, CTX120 and CTX130, for the treatment of hematological and solid-tumor cancers.

CRSP is currently evaluating CTX110 in the phase I CARBON study for the treatment of relapsed/refractory B-cell malignancies. Earlier this February, management announced that CRISPR Therapeutics expanded the ongoing early-stage CARBON study into a pivotal one and implemented consolidation dosing in patients. CRSP is expected to report additional data from this study later this year.

A phase I study is investigating the safety and efficacy of several dose levels of CTX120 for the treatment of relapsed or refractory multiple myeloma. Two ongoing independent phase I studies are also evaluating the safety and efficacy of several dose levels of CTX130 for treating solid tumors and certain hematologic malignancies. Top-line data from all these studies is expected in first-half 2022.

Apart from the above, CRISPR Therapeutics is expanding its ex-vivo expertise in the field of regenerative medicines. In February, management had announced that CRSP dosed the first patient in an early-stage study to evaluate the safety, tolerability and immune evasion of its investigational allogeneic stem cell-derived therapy VCTX210 for the type I diabetes.

Activities related to the development of pipeline candidates are likely to have escalated operating expenses in the to-be-reported quarter.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for CRISPR Therapeuticsthis time around. The combination of a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. Unfortunately, that is not the case here as you will see below. You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

Earnings ESP:

CRISPR Therapeutics has an Earnings ESP of 0.00% as both the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at a loss of $1.91.

Zacks Rank:

CRISPR Therapeutics currently carries a Zacks Rank #4 (Sell).

Stocks to Consider

Here are a few stocks you may want to consider as our model shows that these have the right combination of elements to beat on earnings this reporting cycle.

Angion Biomedica

ANGN

currently has an Earnings ESP of +15.71% and a Zacks Rank #1. You can

see the complete list of today’s Zacks #1 Rank stocks here

.

Angion Biomedica’s loss per share estimates for 2022 have narrowed from $2.59 to $1.79 in the past 30 days. The same for 2023 has narrowed from $3.11 to $2.19 in the past 30 days. Earnings of Angion Biomedicabeat estimates in three of the last four quarters and missed the mark once, the average surprise being 47.5%.

Applied Therapeutics

APLT

has an Earnings ESP of +21.95% and a Zacks Rank #2 at present.

In the past 30 days, estimates for Applied Therapeutics’2022 loss per share have narrowed from $3.39 to $2.47. The same for 2023 has narrowed from $2.52 to $2.01 in the past 30 days. Earnings of Applied Therapeuticstopped estimates in three of the last four quarters and missed the mark on one occasion, delivering a surprise of 2.6%, on average.

Stay on top of upcoming earnings announcements with the

Zacks Earnings Calendar

.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report