Incyte Corporation

INCY

is scheduled to release

first-quarter 2022 results

on May 3, before the market opens.

The company’s earnings surprise history has not been impressive so far, with its earnings beating the Zacks Consensus Estimate in three of the trailing four quarters and missing the same once, the average surprise being -4.70%. In the last-reported quarter, Incyte delivered an earnings miss of 88.10%.

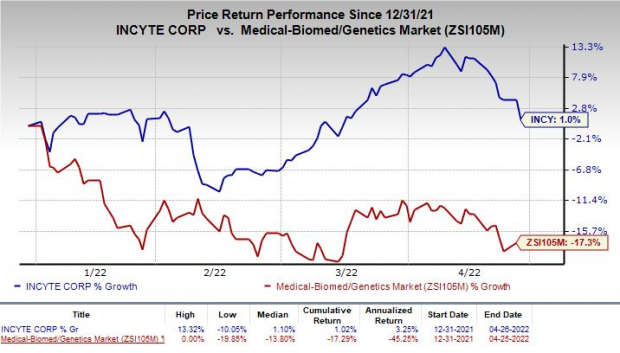

Shares of Incyte have rallied 1% in the year so far against the

industry

’s decrease of 17.3%.

Image Source: Zacks Investment Research

Let’s see how things are shaping up for the quarter to be reported.

Factors at Play

Incyte primarily derives product revenues from sales of its lead drug, Jakafi (ruxolitinib), in the United States, and from those of Iclusig. Patient demand for Jakafi, a first-in-class JAK1/JAK2 inhibitor, in all approved indications (polycythemiavera, myelofibrosis and refractory acute graft-versus-host disease [GvHD]) increased sequentially in the fourth quarter. The trend most likely continued in the to-be-reported quarter as well.

Jakafi sales grew year over year in the previous quarter, which is expected to have continued in the first quarter. The Zacks Consensus Estimate for Jakafi sales stands at $549 million.

Incyte also earns product royalty revenues from

Novartis AG

NVS

for the commercialization of Jakafi in ex-U.S. markets. Novartis licensed ruxolitinib from Incyte for development and commercialization outside the United States.

Incyte is likely to have received higher royalties from NVS in the first quarter.

Incyte also receives royalties from sales of Tabrecta (capmatinib) for the treatment of adult patients with metastatic non-small cell lung cancer. Its partner, Novartis, has exclusive worldwide development and commercialization rights to Tabrecta.

Jakafi sales and royalties are key catalysts for the company’s revenue growth. Iclusig sales and Olumiant royalties from Eli Lilly also contribute to the top line. Hence, these are likely to have aided the company’s revenues in the to-be-reported quarter.

Net product revenues of Iclusig were down year over year in the previous quarter, and a similar trend is likely to have been witnessed by INCY in the to-be-reported quarter.

Olumiant’s product royalty revenues were up significantly due to an increase in net product sales as a result of the use of Olumiant for the treatment of COVID-19. Similar levels of growth are likely to have boosted the top line in the to-be-reported quarter.

Incremental sales from newly approved drugs are likely to have boosted sales in the first quarter as well.

Operating expenses are likely to have increased due to a rise in R&D expenses, and selling, general and administrative expenses.

Key Pipeline Updates

Apart from the top- and bottom-line numbers, we expect investors to focus on the company’s pipeline updates.

In March 2022, the FDA extended the review period for the supplemental New Drug Application (sNDA) for ruxolitinib cream.

The sNDA is seeking approval of the cream for the treatment of vitiligo. The regulatory body has extended the target action date by three months to Jul 18, 2022, which was previously set at Apr 18, 2022.

Also, during the same time, the Committee for Medicinal Products for Human Use of the European Medicines Agency adopted a positive opinion recommending the approval of Jakavi (name outside the United States) to treat patients aged 12 years and older with acute graft versus host disease or chronic GvHD who have an inadequate response to corticosteroids or other systemic therapies.

Per the company, a potential approval will make Jakavi the first JAK1/2 inhibitor available for patients with GvHD in Europe.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Incyte this time around. The combination of a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here, as you will see below. You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

Earnings ESP:

Earnings ESP for Incyte is +11.89% as the Zacks Consensus Estimate is pegged at 57 cents per share while the Most Accurate Estimate is 64 cents.

Zacks Rank:

INCY currently carries a Zacks Rank #5 (Strong Sell). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Stocks to Consider

Here are a few stocks you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat.

Vertex Pharmaceuticals Incorporated

VRTX

has an Earnings ESP of +0.87% and a Zacks Rank #2.

Vertex has an excellent track record, with the company exceeding earnings expectations in each of the trailing four quarters. VRTX delivered a four-quarter earnings surprise of 10.01%, on average. Earnings estimates for 2022 have gone up from $14.52 to $14.56 over the past 60 days. Vertex’s stock has risen 21.9% year to date.

Biogen Inc.

BIIB

has an Earnings ESP of +1.32% and a Zacks Rank #3.

Biogen has an excellent track record, with the company exceeding earnings expectations in each of the trailing four quarters. BIIB delivered a four-quarter earnings surprise of 11.72%, on average. Earnings estimates for 2022 are down from $15.84 to $15.38 over the past 60 days.

Stay on top of upcoming earnings announcements with the

Zacks Earnings Calendar

.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report