The biotech sector has been in focus in the past week with earnings updates from most of the bigwigs. Other important pipeline and regulatory updates were also in focus.

Recap of the Week’s Most Important Stories

:

Earnings Updates From Bristol Myers, Gilead and Others

: Quite a few bigwigs of the biotech sector reported first-quarter results in the past week.

Bristol-Myers’

BMY

performance was decent as earnings and sales

beat

estimates. However, the company lowered its annual guidance as multiple myeloma drug Revlimid is facing generics, which will adversely impact sales.

Biogen

BIIB

performance

was, however, disappointing. Biogen reported first-quarter 2022 earnings per share of $3.62, which missed the Zacks Consensus Estimate of $4.41. The earnings reflect the impact of the write-off of its Alzheimer’s disease drug, Aduhelm inventory. Sales came in at $2.52 billion, down 6% reportedly from the year-ago quarter, hurt by continued lower sales of its key drugs. Sales beat the Zacks Consensus Estimate of $2.50 billion.

Gilead Sciences, Inc

.

GILD

reported

strong

first-quarter results driven by sales from its antiviral COVID-19 treatment, Veklury (remdesivir). The company reported earnings of $2.12 per share in the quarter, which beat the Zacks Consensus Estimate of $1.77 and jumped from $2.04 in the year-ago quarter. Total revenues of $6.6 billion surpassed the Zacks Consensus Estimate of $6.2 billion and increased 3% from the year-ago quarter due to higher demand for HIV therapy Biktarvy and Veklury.

Amgen

AMGN

reported first-quarter 2022 earnings of $4.25 per share, which beat the Zacks Consensus Estimate of $4.22. Amgen’s earnings rose 15% year over year, driven by higher revenues and lower share count. Total revenues of $6.24 billion beat the Zacks Consensus Estimate of $6.06 billion and were up 6% year over year, driven by growth in product sales and higher Other Revenue.

Vertex Down on Regulatory Update

: Shares of

Vertex Pharmaceuticals

VRTX

were down after the company provided updates on its phase I/II study of VX-880. The candidate is an investigational allogeneic stem cell-derived, fully differentiated, insulin-producing islet cell therapy manufactured using proprietary technology. VX-880 is being evaluated for patients who have type 1 diabetes (T1D) with impaired hypoglycemic awareness and severe hypoglycemia. Two patients in part A received VX-880 at half the target dose.

The first patient dosed in part A of the study achieved insulin independence at day 270, with a HbA1c of 5.2%. The second patient dosed in Part A has shown robust increases in fasting and stimulated C-peptide and reductions in exogenous insulin requirements through day 150. The Independent Data Monitoring Committee reviewed the totality of the safety and efficacy data from the first two patients dosed in part A of the study and recommended advancement to part B, where patients receive the full target dose of VX-880.

However, shares declined as the FDA placed a clinical hold on the study due to a determination that there is insufficient information to support dose escalation with the product.

Vertex carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Bristol Myers’ Heart Drug Approval

: Bristol Myers Squibb announced that the FDA approved Camzyos (mavacamten, 2.5 mg, 5 mg, 10 mg, 15 mg capsules) for the treatment of adults with symptomatic New York Heart Association (NYHA) class II-III obstructive hypertrophic cardiomyopathy (obstructive HCM) to improve functional capacity and symptoms. The approval was based on phase III EXPLORER-HCM study demonstrating benefit in patients receiving Camzyos versus placebo. However, the prescribing Information for Camzyos includes a boxed warning for the risk of heart failure.

The FDA had earlier extended the review of the candidate. The drug was added to the company’s portfolio from the MyoKardia acquisition in 2020.

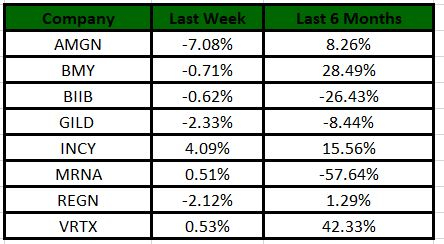

Performance

The Nasdaq Biotechnology Index has lost 1.02% in the past five trading sessions. Among the biotech giants, Biogen has declined 0.62% during the period. Over the past six months, shares of Moderna have lost 57.64%. (See the last biotech stock roundup here:

Biotech Stock Roundup: GILDs COVID-19 Drug Update, AXSM Down on Regulatory Update

)

Image Source: Zacks Investment Research

What’s Next in Biotech?

Stay tuned for more pipeline and regulatory updates, along with earnings updates.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report