Jazz Pharmaceuticals

JAZZ

reported adjusted earnings of $3.73 per share for the first quarter of 2022, missing the Zacks Consensus Estimate of $3.75. Earnings declined 4.8% year over year.

Total revenues in the reported quarter rose 33.9% year over year to $813.7 million but missed the Zacks Consensus Estimate of $852.43 million. The year-over-year increase was driven by sales of new drugs and drugs added from the acquisition of GW Pharmaceuticals.

Net product sales increased 34.2% from the year-ago quarter to $809.8 million. Royalties and contract revenues declined 4.1% to $3.9 million in the quarter.

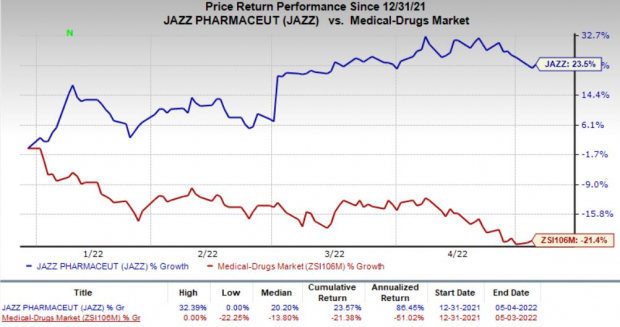

This year so far, Jazz’s shares have risen 23.5% in contrast to the

industry

’s decrease of 21.4%.

Image Source: Zacks Investment Research

Neuroscience Products

Sales of Jazz’s neuroscience products increased 44.8% to $612.1 million.

Net product sales for the combined oxybate business (Xyrem + Xywav) increased 5.5% to $433.6 million in the quarter. Sales of Xyrem, approved to treat cataplexy and excessive daytime sleepiness (“EDS”) in narcolepsy patients, declined 26% year over year to $247.5 million due to patients switching to Xywav. Jazz expects an authorized generic version of Xyrem to be launched by Hikima Pharmaceuticals in the second half of 2022.

Xywav is a low sodium formulation and a Xyrem follow-on product to treat EDS or cataplexy in narcolepsy patients. Xywav recorded sales of $186.1 million in the quarter compared with $182.7 million in the previous quarter. At the end of the first quarter, Jazz had approximately 7,800 active Xywav patients, up from 6,900 at the end of fourth-quarter 2021. Jazz launched Xyway for a new indication — idiopathic hypersomnia (IH) — in November 2021. The company reported the favorable launch uptake of the drug in IH indication during the quarter. The company ended the first quarter with approximately 750 active Xywav patients with IH compared with 250 patients as of the end of the fourth quarter.

Another new drug, Sunosi recorded sales of $15.9 million in the quarter, up 36.8%. In March, Jazz inked an agreement to sell its rights to Sunosi to

Axsome Therapeutics

AXSM

. Axsome will make an upfront payment of $53 million to Jazz upon closing of the deal, expected later in the second quarter. Axsome will also pay Jazz royalties on U.S. net sales of Sunosi.

Sales of Epidiolex/Epidyolex rose 6% (on a proforma basis) to $157.9 million. Epidiolex, which is approved for the treatment of seizures associated with two rare and severe forms of epilepsy, Lennox-Gastaut syndrome and Dravet syndrome, was added to Jazz’s pipeline with the GW Pharmaceuticals acquisition in 2021. Jazz is making significant progress with respect to the launch of Epidyolex in Europe.

Jazz is planning to initiate a late-stage study on Epidiolex in the second half of 2022 to support its label expansion to include epilepsy patients with myoclonic-atonic seizures.

Another drug added with the GW Pharma acquisition was Sativex, a cannabis-based mouth spray for multiple sclerosis-related spasticity, which is approved in Europe but not in the United States. The drug recorded sales of $4.7 million in the quarter.

Oncology Products

Oncology product sales increased 10.5% to $196.8 million.

New drug Zepzelca (lurbinectedin) recorded sales of $59.3 million in the quarter compared with $64.8 million in the previous quarter. However, sales increased 9.2% year over year.

Acute myeloid leukemia drug, Vyxeos generated sales of $33.8 million, up 1.8% from the year-ago period.

New drug Rylaze recorded sales of $54.2 million in the quarter compared with $65.0 million in the previous quarter. Although drug sales declined sequentially, Jazz stated that demand remained strong during the first quarter. Rylaze was launched in July in the United States for treating acute lymphoblastic leukemia patients who have developed hypersensitivity to E.coli-derived asparaginase. Regulatory applications in Europe are expected to be filed in mid-2022.

Defitelio sales were almost flat year over year at $49.5 million in the quarter.

Cost Discussion

Adjusted selling, general and administrative (SG&A) expenses rose 13.3% to $258.7 million to support higher headcount costs and recent launches. Adjusted research and development (R&D) expenses surged 71.4% to $116.5 million mainly to support ongoing clinical activities of pipeline candidates of GW Pharmaceuticals as well as for a couple of other candidates.

2022 Guidance Raised

The company raised its guidance for revenues and adjusted earnings in 2022. The company expects adjusted earnings to be in the range of $16.70-$17.70 per share versus the previous guidance of $16.00-$17.00 per share. The Zacks Consensus Estimate stands at $16.51 per share.

Total revenues are now expected to be in the range of $3.5-$3.7 billion, up from the previously guided range of $3.46-$3.66 billion. In 2022, Jazz expects at least 65% of net product sales to come from newly approved or acquired products.

Neuroscience sales are now expected higher in the range of $2.6 billion-$2.8 billion compared with $2.56 billion-$2.76 billion guided previously. The sales guidance for the Oncology franchise remains the same in the range of $840 million-$920 million.

Adjusted SG&A expenses are anticipated to be between $1.08 billion and $1.13 billion, down from the previous guidance range of $1.12-$1.19 billion. Adjusted R&D expenses are expected to be in the band of $560 million to $600 million.

Zacks Rank & Stocks to Consider

Jazz currently carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks from the same sector include

Xencor

XNCR

and

Lyell Immunopharma

LYEL

. While Xencor sports a Zacks Rank #1 (Strong Buy), Exscientia and Lyell carry a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Xencor’s loss per share estimates have improved from $2.96 to $2.67 for 2022 and from $3.24 to $3.03 for 2023 in the past 30 days. XNCR has declined 35.7% so far this year.

Xencor delivered an earnings surprise of 125.72%, on average, in the last four quarters.

Lyell loss per share estimates have narrowed from $1.19 to $1.09 for 2022 and from $1.52 to $1.41 for 2023 in the past 30 days. LYEL has declined 30% so far this year.

Lyell delivered an earnings surprise of 25.26%, on average, in the last four quarters.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report