Fate Therapeutics

FATE

reported a loss of 68 cents per share in the first quarter of 2022, narrower than the Zacks Consensus Estimate of a loss of 78 cents but wider than the year-ago loss of 49 cents.

Increased research & development (R&D) and general & administrative (G&A) expenses led to a wider year-over-year loss.

The company earned collaboration revenues of $18.4 million in the first quarter, which easily surpassed the Zacks Consensus Estimate of $10 million and were up from $11.1 million reported in the year-ago quarter. Revenues are primarily derived from Fate’s collaborations with Janssen, a unit of

Johnson & Johnson

(JNJ), and Ono Pharmaceutical.

R&D expenses surged to $72.1 million from $44.8 million in the year-ago quarter.

G&A expenses jumped to $20.7 million from $12.5 million in the year-ago quarter.

Cash, cash equivalents and investments at the end of the first quarter were $6417.7 million.

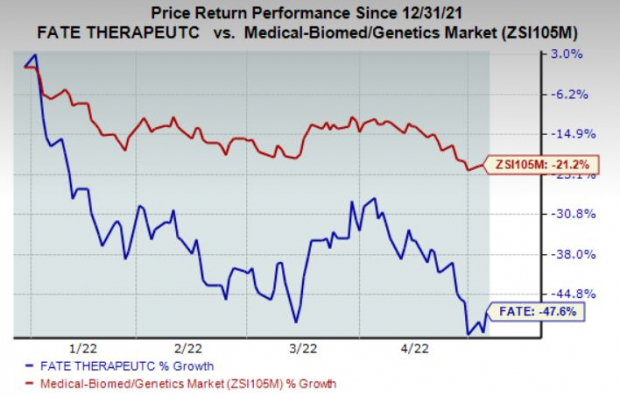

Shares of Fate have declined 47.6% in the year so far compared with the

industry

’s fall of 21.2%.

Image Source: Zacks Investment Research

Pipeline Update

Enrollment is ongoing in the company’s multi-center phase I study of FT596 in combination with rituximab (FT596+R) for relapsed / refractory (r/r) B-cell lymphoma (BCL) in the following cohorts to further assess dose and treatment schedule: multi-dose at 900 million cells per dose with FT596 being administered on day 1 and day 15; single-dose at 1.8 billion cells; and single-dose at 900 million cells.

In December, Fate announced that the FDA granted Regenerative Medicine Advanced Therapy (RMAT) designation to FT516 to treat r/r diffuse large B-cell lymphoma (DLBCL). Fate plans to hold a multi-disciplinary meeting with the FDA in mid-2022 to discuss key CMC topics and pivotal study design in patients who have progressed or relapsed following prior treatment with FDA approved CD19 directed chimeric antigen receptor (CAR) T-cell therapy.

The multi-center phase I study of FT516 in combination with rituximab (FT516+R) for r/r BCL is currently enrolling patients in multiple disease-specific multi-dose, multi-cycle expansion cohorts at 900 million cells per dose, including patients with r/r aggressive lymphomas who have previously been treated with CD19-targeted CAR T-cell therapy.

A phase I study to assess three once-weekly doses of FT538 as monotherapy is currently enrolling patients in the third multi-dose escalation cohort (1 billion cells per dose) for r/r acute myeloid leukemia (AML).

An investigator-initiated study of FT538 in combination with the CD38-targeted monoclonal antibody daratumumab, which is designed to assess the therapeutic potential of targeting CD38+ leukemic blasts, is enrolling patients in the third multi-dose escalation cohort at 1 billion cells per dose.

In April 2022, Janssen nominated a third iPSC-derived, CAR-targeted cell product candidate incorporating a Janssen proprietary antigen binding domain, triggering a milestone fee payment to the company.

Fate currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks are

Vertex Pharmaceuticals Incorporated

VRTX

and

Voyager Therapeutics, Inc

.

VYGR

, both carrying Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The consensus estimate for Vertex’s 2022 earnings has increased 25 cents over the past 60 days to $14.58. Shares of VRTX have gained 24.6% in the year so far.

Loss estimates for VYGR have narrowed to $1.35 from $2.20 for 2022 in the past 60 days. Earnings of Voyager surpassed estimates in three of the trailing four quarters and missed the same once, the average surprise being 41%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report