Karuna Therapeutics

KRTX

reported first-quarter 2022 loss of $1.95 per share, narrower than the Zacks Consensus Estimate of a loss of $2.06 but wider than the year-ago loss of $1.10.

In absence of any marketed product and revenue-generating collaborations, Karuna Therapeutics did not record any revenues during the quarter.

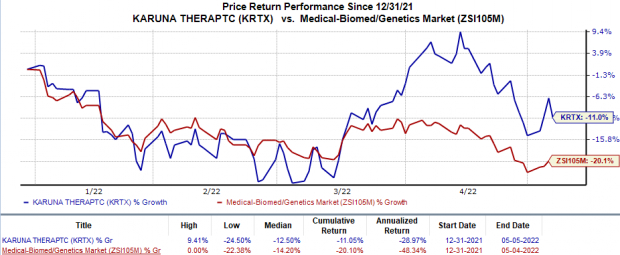

In the year so far, the stock has declined 11.1% compared with the

industry

’s fall of 20.1%.

Image Source: Zacks Investment Research

Quarter in Detail

For the reported quarter, research and development expenses were $43.8 million, up 117% from the year-ago figure due to increased costs for developing Karuna Therapeutics’ clinical programs plus higher employee-related expenses.

General and administrative expenses also surged 51.3% year over year to $14.8 million due to higher employee-related costs.

As of Mar 31, 2022, KRTX had cash, cash equivalents and marketable securities of $443.2 million compared with $494 million on Dec 31, 2021.

Karuna Therapeutics expects its current cash balance to fund its operations for at least 12 months following the potential new drug application (NDA) submission to the FDA for KarXT concerning schizophrenia.

Pipeline Update

Karuna Therapeutics has only one candidate in its pipeline, KarXT, which is also its lead candidate. KarXT consists of two components, namely xanomeline, a novel muscarinic agonist acting as an antipsychotic and procognitive therapeutic agent, and trospium, a muscarinic antagonist to limit side-effects of xanomeline.

Currently, the only candidate in Karuna Therapeutics’ pipeline undergoing a clinical development is KarXT, currently being evaluated in multiple late-stage studies as a potential treatment of psychosis in adults with schizophrenia.

KRTX is evaluating KarXT as part of the EMERGENT clinical program for the treatment of acute psychosis in adults with schizophrenia. Currently, two phase III studies, such as EMERGENT-2 and EMERGENT-3 are evaluating the efficacy and safety of KarXT against placebo. While top-line data from the EMERGENT-2 study is expected in third-quarter 2022, data from the EMERGENT-3 study is expected in first-quarter 2023.

Karuna Therapeuticsis also evaluating KarXT in two other phase III studies, namely EMERGENT-4 and EMERGENT-5, presently evaluating the long-term safety and tolerability of KarXT in adults with schizophrenia.

Given the potential of KarXT over the existing standard-of-care therapies, Karuna Therapeuticsis also evaluating the candidate in the phase III ARISE study as an adjunctive treatment of schizophrenia in adults who experience an inadequate response to their current antipsychotic therapy. KRTX is currently enrolling patients in this study.

Apart from schizophrenia, Karuna Therapeutics is developing KarXT as a potential treatment of dementia related psychosis (DRP). KRTX is initially focusing on developing KarXT for the treatment of psychosis in Alzheimer’s disease (AD), one of the most prevalent subtypes of DRP. KRTX remains on track to start a phase III clinical program in mid-2022, which will evaluate the candidate for psychosis in elderly patients with AD.

Additionally, KRTX showed an interest in other DRP subtypes and intends to start development studies in the future.

Zacks Rank & Stocks to Consider

Karuna Therapeutics currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector are

Alkermes

ALKS

,

Amicus Therapeutics

FOLD

and

Angion Biomedica

ANGN

. While Alkermes and Angion Biomedica sport a Zacks Rank #1 (Strong Buy) at present, Amicus Therapeutics carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Alkermes’ loss per share estimates for 2022 have narrowed from 14 cents to 3 cents in the past 30 days. The stock of ALKS has risen 24.5% in the year-to-date period.

Earnings of Alkermes beat estimates in each of the last four quarters, the average being 350.5%. In the last reported quarter, ALKS delivered an earnings surprise of 1,100%.

In the past 30 days, estimates for Angion Biomedica’s 2022 loss per share have narrowed from $1.92 to $1.79. The stock has plunged 44.1% in the year-to-date period.

Earnings of Angion Biomedica beat estimates in three of the last four quarters and missed the mark just once, witnessing a surprise of 47.5%, on average. In the last reported quarter, ANGN delivered an earnings surprise of 198.3%.

Amicus Therapeutics’ loss per share estimates for 2023 have narrowed from 19 cents to 16 cents in the past 30 days. Shares of FOLD have declined 37.9% in the year-to-date period.

Earnings of Amicus Therapeutics missed estimates in three of the last four quarters and beat the mark on one occasion, witnessing a negative surprise of 28%, on average. In the last reported quarter, FOLD delivered a negative earnings surprise of 107.1%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report