Theravance Biopharma, Inc.

TBPH

reported first-quarter 2022 net loss of 34 cents per share, narrower than the year-ago period’s loss of $1.24.

Adjusted loss (excluding restructuring and related expenses) was 24 cents per share, wider than the Zacks Consensus Estimate of a loss of 12 cents but narrower than the year-ago loss of $1.24.

Total revenues of $13.2 million missed the Zacks Consensus Estimate of $16.5 million. Revenues were down 7.4% year over year.

The top line comprised licensing revenues worth $2.5 million from

Pfizer

PFE

, and revenues worth $10.7 million from the collaboration agreement with

Viatris

VTRS

in relation to Yupelri (revefenacin).

Theravance and Viatris are jointly developing and commercializing Yupelri, a long-acting muscarinic antagonist, as a once-daily nebulized treatment of chronic obstructive pulmonary disease (COPD). Viatris and Theravance are sharing U.S. profits and losses related to the commercialization of Yupelri. While Viatris gets 65% of the profits, Theravance earns 35%.

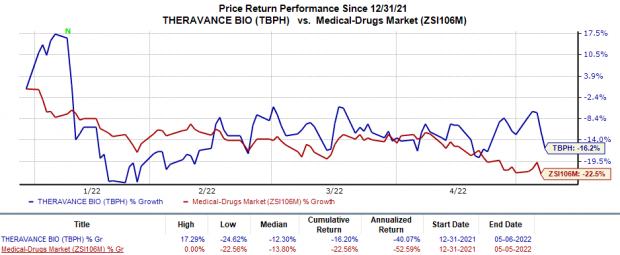

Shares of Theravance have declined 16.2% so far this year compared with the

industry

’s decrease of 22.6%.

Image Source: Zacks Investment Research

Quarter in Detail

The milestone payment of $2.5 million received from Pfizer was driven by Theravance’s dosing of the first patient in a phase I study, evaluating a skin-selective pan-Janus kinase (JAK) inhibitor program. This milestone payment is part of a global license agreement finalized between TBPH and Pfizer in 2019 to develop skin-selective pan-JAK inhibitors, specifically designed to target validated pro-inflammatory pathwayswith minimal systemic exposure.

Research & development expenses were $23.3 million, down 65.6% from the year-ago quarter’s figure.

Selling, general & administrative expenses were down 37.4% year over year to $19.1 million.

TBPH recorded $9.3 million as restructuring and related expenses during first-quarter 2022.

As of Mar 31, 2022, Theravance had cash, cash equivalents and marketable securities worth $147.5 million compared with $173.5 million as of Dec 31, 2021.

2022 Guidance

Theravance reiterated its financial guidance for 2022. TBPH expects adjusted research & development expenses (excluding one-time restructuring expenses and share-based compensation) in the range of $45-$55 million, while adjusted selling, general and administrative expenses are projected between $35 million and $45 million.

TBPH expects to achieve sustainability in cash flow and become cash flow positive in the second half of 2022.

Other Updates

In January 2022, Theravance announced that it enrolled the first patient in the phase IV study to evaluate Yupelri against Boehringer Ingelheim’s Spiriva HandiHaler in adults with severe-to-very-severe COPD over a 12-week treatment period. TBPH believes that potential success in this study will not only help Yupelri acquire the new market share but also strengthen its competitive edge. Top-line data from the study is expected in first-quarter 2023.

Following the failure of its two non-respiratory disease-related programs, namely izencitinib and ampreloxetine in a phase II and phase III study, respectively, Theravance

announced

that it will prioritize respiratory therapeutics to maximize its shareholder value in the long run. The restructuring, which involved reduction of workforce by 75%, was completed in first-quarter 2022.

Previously, Theravance had decided to complete the ongoing studies on ampreloxetine and izencitinib for symptomatic neurogenic orthostatic hypotension (nOH) and Crohn’s disease (CD), respectively, and then discontinue further developmental activity on these candidates.

However, last month, Theravance

reported data

from a phase III study (Study 0170) on ampreloxetine for symptomatic nOH. Although the study did not achieve any statistical significance in terms of its primary endpoint, a sub-group analysis based on the disease type showed that the drug achieved a 72% reduction in the odds of treatment failure as compared to placebo in multiple system atrophy (MSA) patients. Based on this data, TBPH plans to explore ampreloxetine’s potential for the MSA indication.

Zacks Rank & Key Pick

Theravance Biopharma currently carries a Zacks Rank #4 (Sell).

A better-ranked stock in the overall healthcare sector is

Alkermes

ALKS

, sporting a Zacks Rank #1 (Strong Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Alkermes’ loss per share estimates for 2022 have narrowed from 14 cents to 3 cents in the past 30 days. Shares of ALKS have risen 20% in the year-to-date period.

Earnings of Alkermes beat estimates in each of the last four quarters, the average being 350.5%. In the last reported quarter, Alkermes delivered an earnings surprise of 1,100%.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +25.4% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report