Intercept Pharmaceuticals, Inc.

ICPT

incurred a loss of 58 cents per share in first-quarter 2022, narrower than the Zacks Consensus Estimate of a loss of 89 cents and the year-ago quarter’s loss of $1.22.

Total revenues of $88.6 million in the quarter missed the Zacks Consensus Estimate by 2.51%. The top line, however, registered 8% year over year growth.

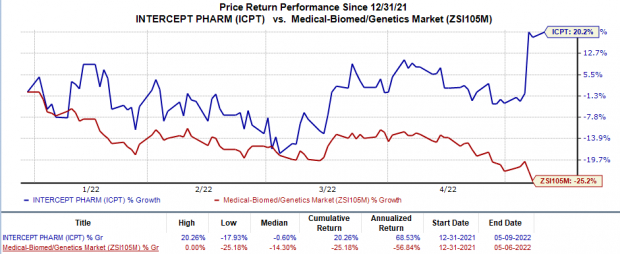

Intercept’s shares have gained 20.3% in the year so far against the

industry

’s decrease of 25.2%.

Image Source: Zacks Investment Research

Quarter in Detail

Total revenues generated in the quarter comprised only Ocaliva (obeticholic acid or OCA) net sales. Net sales came in at $59.2 million in the United States and $29.4 million outside the country. Ex-U.S. sales of the drug were up 21% year over year, driven by new patient initiations, demonstrating encouraging growth.

OCA is approved under the brand name Ocaliva for treating primary biliary cholangitis (PBC) in combination with ursodeoxycholic acid (UDCA) in adults with an inadequate response to UDCA alone or as a monotherapy for adults intolerant to UDCA. While the approval to Ocaliva was granted by the FDA under accelerated pathway, the drug received conditional approval from the European Commission.

Selling, general and administrative expenses decreased to $50.0 million from $59.3 million in the prior-year quarter. The decline was primarily driven by ICPT’s ongoing efforts to manage its operational costs.

Research and development expenses decreased to $48.1 million from $50.8 million in the year-ago quarter.

As of Mar 31, 2022, Intercept had cash, cash equivalents, restricted cash and marketable securities of $406.9 million.

Other Updates

Intercept is currently in the process of compiling data from the post-marketing phase IV COBALT study. ICPT plans to submit data from this study to both the FDA and the EMA later this year to support the continued approval of Ocalvia for PBC indication.

ICPT is also on track to compile a new data package from the phase III REGENERATE study on fibrosis due to Nonalcoholic Steatohepatitis (NASH) to support a potential resubmission meeting with the FDA heads next month.

Intercept expects to report top-line results in the third quarter from the phase III REVERSE study, a late-stage program on compensated cirrhosis due to NASH.

Last week, Intercept announced that it entered into an agreement with Europe-based Advanz Pharma whereby the latter will acquire the international operations of the former, including the rights to commercialize Ocalvia for PBC indication in the ex-U.S. markets.

In return, ICPT will be eligible to receive up to $450 million, including $405 million as an upfront payment and another $45 million as contingent payments. As a result of inking this transaction deal, which is subject to customary conditions and regulatory approvals, Intercept decided to temporarily suspend its financial guidance for the current year. ICPT expects the transaction to be completed during the second quarter of 2022.

Zacks Stock and Stocks to Consider

Intercept currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector are

Abeona Therapeutics

ABEO

,

Alkermes

ALKS

and

Vertex Pharmaceuticals

VRTX

, each of which has a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Abeona Therapeutics’ loss per share estimates for 2022 have narrowed from 34 cents to 33 cents in the past 30 days. Shares of ABEO have declined 51.2% in the year-to-date period.

Abeona Therapeutics has a mixed surprise history, with its earnings having surpassed expectations in one of the trailing four quarters, missing the mark in another and meeting the same on the remaining two occasions, the average surprise being 0.7%. In the last reported quarter, Abeona Therapeutics missed earnings estimates by 7.7%.

Alkermes’ loss per share estimates for 2022 have narrowed from 14 cents to 3 cents in the past 30 days. Shares of ALKS have risen 18.8% in the year-to-date period.

Earnings of Alkermes beat estimates in each of the last four quarters, the average being 350.5%. In the last reported quarter, Alkermes delivered an earnings surprise of 1,100%.

Vertex Pharmaceuticals’ earnings per share estimates for 2023 have increased from $15.31 to $15.33 in the past 30 days. VRTX has rallied 15.6% in the year so far.

Earnings of Vertex Pharmaceuticals beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 7.6%. In the last reported quarter, Vertex Pharmaceuticals missed earnings estimates by 2.2%.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report