Reata Pharmaceuticals, Inc.

RETA

reported first-quarter 2022 loss of $2.03 per share, narrower than the Zacks Consensus Estimate of a loss of $2.26.

However, the above loss included stock-based compensation and a non-cash interest expense. Adjusted loss for the quarter was $1.33 per share, wider than the loss of $1.16 per share recorded in the year-ago period.

Total revenues, comprising collaboration revenues, were $0.9 million, flat year over year. Revenues missed the Zacks Consensus Estimate of $1.91 million.

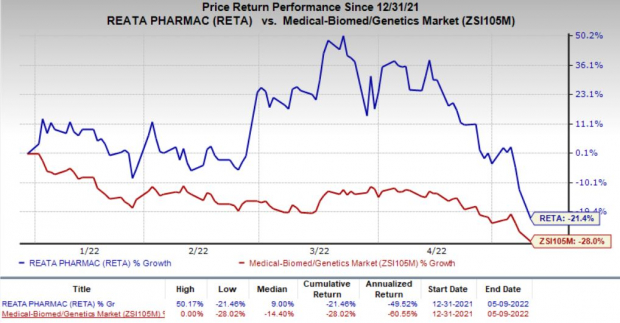

Shares of Reata have declined 21.4% so far this year compared with the

industry

’s decrease of 28%.

Image Source: Zacks Investment Research

Quarter in Detail

Adjusted research and development expenses rose 14.7% year over year to $32.2 million.

Adjusted general and administrative expenses were $17 million, up 32.5% from the year-ago period.

The company had cash and cash equivalents of $532 million as of Mar 31, 2022, compared with $590.3 million as of Dec 31, 2021. The company expects its cash resources to fund operations through 2024-end.

Pipeline Update

Reata has developed its lead pipeline candidates — bardoxolone methyl (bardoxolone) and omaveloxolone — for rare forms of chronic kidney disease (“CKD”) and neurological diseases, respectively. Reata had reacquired the development, manufacturing and commercialization rights for omaveloxolone and bardoxolone from

AbbVie

ABBV

in 2019.

The company also reacquired ex-U.S. rights to bardoxolone, omaveloxolone and its proprietary Nrf2 product platform from AbbVie during the same time. With this move, Reata is likely to record total sales following potential launches instead of royalties, had the rights belonged to AbbVie.

Reata is developing omaveloxolone as a potential treatment for Friedreich’s ataxia (“FA”).

In March 2022, the company completed a rolling submission of an NDA seeking approval for omaveloxolone for the treatment of patients with FA. The company plans to file a regulatory application seeking approval for omaveloxolone as a treatment for FA patients in Europe in the fourth quarter of 2022.

Reata has started commercial preparation to support the launch of omaveloxolone as a FA therapy in early 2023.

Reata is currently evaluating bardoxolone for treating autosomal dominant polycystic kidney disease in a late-stage study, FALCON. The company recently met with the FDA to discuss the study’s protocol amendment in a Type A meeting. The company stated that the FDA is aligned with the proposed primary endpoint of eGFR change from baseline at week 108 for the FALCON study. The FDA stated that data from the FALCON study can support a regulatory filing, if positive.

Reata has developed bardoxolone as a treatment for patients with CKD caused by Alport syndrome and also filed a new drug application for the same last year. However, the FDA issued a complete response letter in February. Reata is likely to work with the FDA to decide the next step forward for bardoxolone in CKD caused by Alport syndrome.

In December 2021, an FDA advisory committee voted against the approval of the bardoxolone NDA, stating that the clinical data provided with the NDA does not support the effectiveness of the candidate in slowing the progression of CKD.

Zacks Rank and Stocks to Consider

Reata currently has a Zacks Rank #3 (Hold).

A couple of better-ranked drug/biotech stocks include

Eliem Therapeutics

ELYM

and

Lyell Immunopharma

LYEL

, both carrying a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Eliem’s loss per share estimates have improved from $2.62 to $2.43 for 2022 and from $3.30 to $2.86 for 2023 in the past 30 days. ELYM stock has declined 35.7% so far this year.

Eliem delivered an earnings surprise of 15.94%, on average, in the last four quarters.

Lyell loss per share estimates have narrowed from $1.19 to $1.09 for 2022 and from $1.52 to $1.41 for 2023 in the past 30 days. LYEL has declined 30% so far this year.

Lyell delivered an earnings surprise of 25.26%, on average, in the last four quarters.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report