CRISPR Therapeutics AG

CRSP

reported first-quarter 2022 net loss per share of $2.32, wider than the Zacks Consensus Estimate of a loss of $1.91. The company had posted a loss of $1.51 per share in the year-ago period.

CRISPR Therapeutics’ total revenues, which comprise grants and collaboration revenues, came in at $0.9 million for the first quarter compared with $0.5 million reported in the year-ago period. The revenues included $0.17 million in collaboration revenues and $0.76 million in grant revenues. Revenues substantially missed the Zacks Consensus Estimate of $5.67 million.

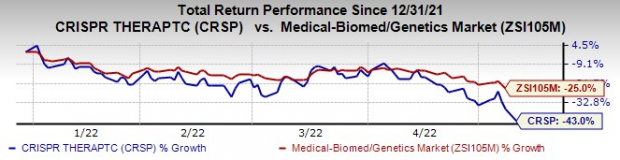

Shares of CRISPR Therapeutics have plunged 43% so far this year compared with the

industry

’s 25% decline.

Image Source: Zacks Investment Research

Quarter in Detail

For the reported quarter, research and development expenses were $118.2 million, up 67.4% from the year-ago figure to support the development of its immuno-oncology programs and costs related to the new U.S. R&D headquarters.

General and administrative expenses rose 14.3% year over year to $28.0 million.

As of Mar 31, 2022, the company had cash, cash equivalents and marketable securities of $2.2 billion compared with $2.37 billion as of Dec 31, 2021.

Pipeline Updates

CRISPR Therapeutics is developing CTX001 — an investigational ex-vivo CRISPR gene-edited therapy for treating sickle cell disease (SCD) and transfusion-dependent beta thalassemia (TDT) — in partnership with

Vertex Pharmaceuticals

VRTX

. The candidate is currently being evaluated in two separate phase III studies, CLIMB THAL-111 and CLIMB SCD-121, for treating TDT and severe SCD, respectively. Target enrolment in both the studies has been achieved and more than 75 patients have been dosed across both studies to date. The regulatory submission for the therapy in both indications is anticipated in late 2022. CRISPR Therapeutics and Vertex have initiated two new phase III studies of CTX001 in pediatric patients with TDT and SCD.

Apart from CTX001, CRISPR Therapeutics is also developing three chimeric antigen receptor T cell (CAR-T) therapy candidates — CTX110, CTX120, and CTX130 — for hematological and solid-tumor cancers.

The company is currently evaluating CTX110 in a phase I CARBON pivotal study for the treatment of relapsed/refractory B-cell malignancies. The company is expected to report additional data from this study later this year.

A phase I study is investigating the safety and efficacy of several dose levels of CTX120 for the treatment of relapsed or refractory multiple myeloma. Two independent ongoing phase I studies are also evaluating the safety and efficacy of several dose levels of CTX130 for treating solid tumors and certain hematologic malignancies. Updates from both the studies is expected in first-half 2022.

Enrollment and dosing are ongoing in a phase I study of VCTX210, an allogeneic, gene-edited, stem cell-derived product, in type I diabetes that CRISPR Therapeutics is developing with partner ViaCyte.

Zacks Rank & Stocks to Consider

CRISPR Therapeutics currently carries a Zacks Rank #3 (Hold).

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report