During the pandemic’s initial phases, a handful of stocks benefitted massively from the world shutting down, while others suffered. It was a fascinating time to be an investor, and those who flocked to the stay-at-home type of stocks were rewarded handsomely with considerable gains, undoubtedly limiting drawdowns in other portfolio positions.

Fast-forward to 2022, and those high-flying days that these pandemic winners experienced has come to a screeching halt. Investors are undoubtedly disappointed in the adverse price action these stocks have recently come under, with many market participants simply writing these stocks off for good until a more precise picture is available.

Three of the significant pandemic winners were Peloton Interactive

PTON

, Shopify

SHOP

, and Teladoc

TDOC

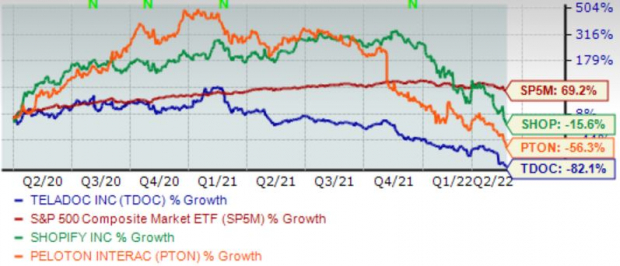

. All three companies benefitted from the stay-at-home environment the world was stuck in. The chart below shows the performance of all three companies’ share performances since April 1

st

, 2020, while blending in the S&P 500 for a benchmark.

Image Source: Zacks Investment Research

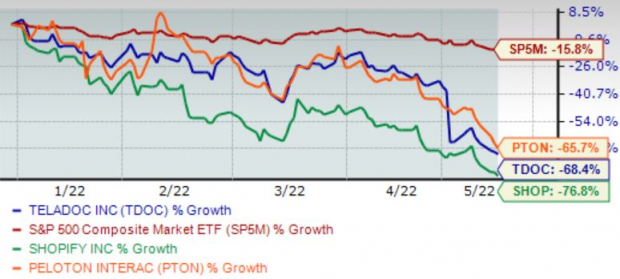

As we can see, once big-time winners have suddenly become big-time losers. The picture becomes even more disappointing when creating a chart that shows the share performances throughout 2022.

Image Source: Zacks Investment Research

All three companies are currently down more than 60% year-to-date. It’s quite a massive change in sentiment, and it raises a valid question – are these companies worth your hard-earned cash after sizable valuation slashes? Let’s find out.

Peloton

When stay-at-home orders shocked the world and gyms closed down, many people were left with no option to exercise. However, Peloton

PTON

came to the rescue with its in-home fitness equipment, fueling the massive run that shares went on.

Peloton’s rough stretch has caused its forward price-to-sales ratio to retrace down to 1.1X, well below its Q1 2021 high of 12.6X and a fraction of its median of 6.5X since the company went public in September 2019. This level is much more reasonable for the company.

The company’s balance sheet showed that cash and equivalents declined 24% from the year-ago quarter. However, it does have a cash ratio of 1.08, meaning that there is just enough cash on hand to meet current liability obligations. It’s worth noting that the ratio was 2.09 in 2021 Q3, a stark difference from where it stands now. Additionally, the company has yet to turn a positive free cash flow.

Recent quarterly reports are not great, to say the least. The company has acquired a four-quarter trailing average EPS surprise of a disappointing -44%, and in its latest quarter, the company missed earnings estimates by nearly 16%. Furthermore, earnings are expected to shrink by a massive 515% for the current year.

Shopify

With the world shut down, e-commerce absolutely boomed. Shopping in-store was no longer an option, and investors noticed Shopify’s

SHOP

unique business, driving shares upward with no end in sight.

SHOP’s forward price-to-sales ratio has come way down to 7.1X, an absolute fraction of its high of 58.2X in 2020 and well below the median of 22.6X over the last five years. Additionally, the value is the lowest that it has ever been in this same timeframe.

The company ended 2022 Q1 with $7.2 billion cash on hand, an 8% decrease from the value in the year-ago quarter. The company has a cash ratio of 10.6, which displays an excellent ability to meet current liability obligations, although the value has decreased in four consecutive quarters. Additionally, the company’s free cash flow turned positive in 2021 Q4 but has since gone negative in 2022 Q1, attributed to a slowdown in online shopping.

Over the last four quarters, the company has acquired a 5% average EPS surprise, and in its latest report, the company missed EPS estimates by a sizable 75%. Looking ahead, earnings are forecasted to shrink 52% year-over-year for FY22.

Teladoc Health

Like PTON and SHOP, the company’s business operations benefitted massively from the shutdown of the world. With the world gripped by fear and uneasiness, Teladoc

TDOC

provided consumers with high-quality healthcare and solutions from a few buttons instead of being forced into a physical hospital.

TDOC’s forward price-to-sales ratio has come down tremendously off its 2020 high of 33.9X and is well below the median of 10.2X over the last five years. Furthermore, the ratio value of 1.9X is the lowest that it has been in this timeframe.

TDOC ended 2022 Q1 with $839 million cash on hand, a 16% increase from the year-ago quarter. Although total liabilities outweigh the cash currently on hand, the company’s cash ratio of 2.7 displays an ability to meet short-term debt obligations. Additionally, free cash flow for the company turned negative in 2022 Q1 after a positive value in the prior quarter.

Over its last four quarters, the company has tallied a respectable 20% average EPS surprise, and in its latest quarter, TDOC beat the consensus EPS estimate by a sizable 14%. However, earnings are expected to free fall by quad-digits for the current fiscal year.

Bottom Line

Many have cut ties with these stocks, and for a good reason. The valuation multiples and growth rates got entirely out of control during their runs; the high-flying days of these stocks are well over for some time. While the ride was undoubtedly beautiful and fun, it’s been a long time coming for these stocks to decline just as far as well.

However, they’re all three exciting investments, and investors shouldn’t give up on two of them just yet. The only stock out of the three that I advise investors to heed caution with is Peloton. The company may have to resort to negative ways to raise cash, which is never a good sign. Additionally, a quickly declining cash ratio is also unsettling.

SHOP and TDOC, on the other hand, are very innovative investments that won’t be going anywhere anytime soon. Investors need to look at the long-term picture for these stocks and slowly build themselves into a position over the next few years rather than jumping in; these stocks could still have some more room down.

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report