STERIS plc

STE

has been gaining from a robust performance across three of its reporting segments in the fourth quarter of fiscal 2022. A significant revenue contribution from acquisitions in the quarter buoys optimism. However, mounting operating expenses and stiff competition are concerning.

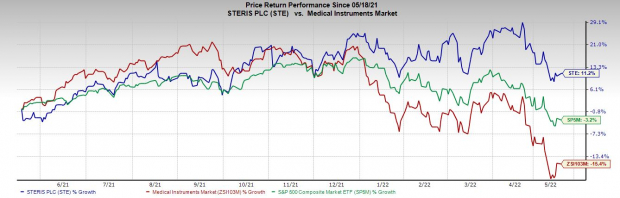

Over the past year, shares of this Zacks Rank #3 (Hold) company have gained 11.2% against the

industry

’s 15.4% rise. The S&P 500 fell 3.2% in the same period.

The renowned provider of infection prevention as well as other procedural products and services has a market capitalization of $21.82 billion. Its earnings for the fourth quarter of fiscal 2022 surpassed the Zacks Consensus Estimate by 2%.

Let’s delve deeper

Factors at Play

Impressive Q4 Results:

STERIS exited fourth-quarter fiscal 2022 with better-than-expected earnings and revenues. Year-over-year growth in revenues and earnings appears promising. Robust performances across three of STERIS’ reporting segments contributed to top-line growth. A significant revenue contribution from acquisitions in the quarter buoys optimism. The expansion in the gross margin is an added advantage. The bullish guidance for fiscal 2023 is indicative that the growth momentum will continue.

STERIS’ Infection Prevention and Sterilization Wing Grows Globally:

With the acquisition of the U.K.-based outsourced sterilization services provider Synergy Health, STERIS has become the new global leader in infection prevention and sterilization. The company is currently providing improved healthcare services to medical device companies, pharma companies, hospitals and other healthcare facilities across the globe.

Image Source: Zacks Investment Research

The company continues to benefit from the acquisition of Synergy Health. The consolidation has boosted STERIS’ presence in the international markets since its inception, as it combines STERIS’ strong presence in North America with Synergy’s solid footprint across Europe, which is encouraging. It has also provided STERIS an opportunity to better serve the emerging markets of the Asia-Pacific and Latin America.

Overall Strong Solvency Position:

STERIS exited fiscal 2022 with cash and cash equivalents of $348.3 million compared with $220.5 million at the end of fiscal 2021. Total debt (short and long term) at the end of 2022 was $2.95 billion compared with $1.65 billion a year ago. However, the company has no short-term debt on its balance sheet at the end of fiscal 2022. This is good news for its solvency level, at least during the pandemic when companies have been majorly facing manufacturing and supply halts.

Downsides

Mounting Expenses:

In the fourth quarter of fiscal 2022, SG&A expenses climbed 105.2% year over year, whereas R&D expenses rose 49% year over year. These escalating operating expenses led to an 858-basis-points (bps) contraction in the operating margin, building pressure on the bottom line.

Competitive Landscape:

STERIS competes for pharmaceutical, research and industrial customers against several large companies that have robust product portfolios and global reach, and a number of small companies with limited product offerings and operations in one or a few countries. In the Healthcare segment, STERIS’ notable competitors are 3M, Belimed, Ecolab, Getinge, Go Jo, Johnson & Johnson, Kimberly-Clark, Skytron and Stryker.

Estimate Trend

STERIS has been witnessing a positive estimate revision trend for fiscal 2023. In the past 90 days, the Zacks Consensus Estimate for STERIS’ earnings has moved 0.1% north to $8.79.

The Zacks Consensus Estimate for fiscal 2023 revenues is pegged at $4.89 billion, suggesting 6.7% growth from the fiscal 2022 reported number.

Key Picks

A few better-ranked stocks in the broader medical space are

UnitedHealth Group Incorporated

UNH

,

Medpace Holdings, Inc.

MEDP

and

Alkermes plc

ALKS

.

UnitedHealth, with a Zacks Rank #2 (Buy), reported first-quarter 2022 earnings per share (EPS) of $5.49, which beat the Zacks Consensus Estimate by 1.7%. Revenues of $80.1 billion outpaced the consensus mark by 14.2%.

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

UnitedHealth has an estimated long-term growth rate of 14.8%. UNH’s earnings surpassed estimates in the trailing four quarters, the average surprise being 3.7%.

Medpace reported first-quarter 2022 adjusted EPS of $1.69, which surpassed the Zacks Consensus Estimate by 34.1%. Revenues of $330.9 million outpaced the Zacks Consensus Estimate by 1.1%. It currently has a Zacks Rank #2.

Medpace has a historical growth rate of 27.3%. MEDP’s earnings surpassed estimates in the trailing four quarters, the average surprise being 17.1%.

Alkermes reported first-quarter 2022 adjusted EPS of 12 cents, which surpassed the Zacks Consensus Estimate of a penny. Revenues of $278.6 million outpaced the Zacks Consensus Estimate by 6.2%. It currently sports a Zacks Rank #1.

Alkermes has an estimated long-term growth rate of 25.1%. ALKS’ earnings surpassed estimates in the trailing four quarters, the average surprise being 350.5%.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the

Zacks Top 10 Stocks

portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report