This week, the FDA granted emergency authorization to booster shots of

Pfizer

PFE

/BioNTech’s COVID-19 vaccine for use in children 5 to 11 years of age and also approved

Lilly

’s

LLY

novel diabetes treatment, Mounjaro (tirzepatide) injection.

AbbVie

ABBV

and

AstraZeneca

AZN

announced new licensing deals with small private biotechs.

Recap of the Week’s Most Important Stories

FDA Approves Lilly’s Novel Diabetes Treatment

: The FDA approved Lilly’s

dual GIP and GLP-1 receptor agonist

, Mounjaro (tirzepatide) injection for treating type II diabetes. Mounjaro is a novel diabetes treatment, which has shown impressive blood sugar reductions and weight loss in a broad range of type II diabetes patients in the SURPASS studies. Mounjaro will be available in six doses as an auto-injector pen. It is expected to be launched in the United States in the next few weeks.

FDA Gives Emergency Nod to Pfizer’s COVID Jab for Kids 5-11:

The FDA granted emergency use authorization (EUA) to a booster/third dose of Pfizer/BioNTech’s mRNA-based COVID-19 vaccine, Comirnaty

for children aged between 5 years and 11 years

. The expanded EUA to include a booster dose for children was based on data from a phase II/III study, which showed a 36-fold increase in neutralizing antibodies against the Omicron variant in children who were given the booster dose. A booster dose of Comirnaty is already authorized for all adults and adolescents aged 12 years to 15 years while a second booster dose or “fourth” dose is authorized for older adults and some immunocompromised individuals. Comirnaty is the only COVID-19 vaccine with a EUA for use in children as primary series as well as for a third dose.

AbbVie Buys Option Rights to Novel Inflammation Candidate:

AbbVie received an

option to license worldwide rights

for certain IL-2 muteins, including the next-generation inflammatory candidate, CUG252 from precision medicines biotech, Cugene. CUG252 is being evaluated in a phase I study in healthy volunteers while Cugene plans to conduct a phase Ib study in patients with autoimmune/inflammatory disease during the option period. For the deal, AbbVie will make an upfront payment of $48.5 million to Cugene while also being entitled to make future development and regulatory milestone payments. If AbbVie chooses to exercise the option, it will have to make an option exercise payment and will then take care of all future clinical development and commercialization activities related to CUG252.

AstraZeneca Buys Rights to COVID Antibody:

AstraZeneca

acquired an exclusive worldwide licence

from London-based private biotech, RQ Biotechnology Ltd to develop and market monoclonal antibodies (mAbs) against the COVID-19 virus, SARS-CoV-2. For the rights, RQ Bio will receive upfront and milestone payments of up to $157 million while also being eligible for single-digit royalties on future sales of mAbs.

AstraZeneca’s cocktail mAb, Evusheld, a combination of two long-acting antibodies, tixagevimab and cilgavimab, is already authorized for pre-exposure prophylaxis (prevention) of COVID-19.

The NYSE ARCA Pharmaceutical Index rose 0.7% in the last five trading sessions.

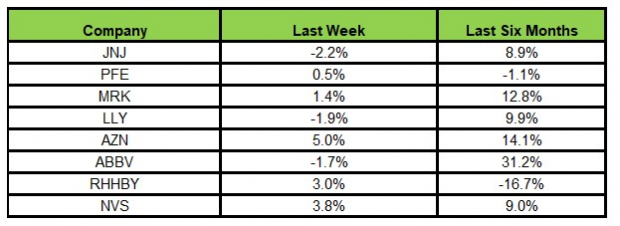

Here’s how the eight major stocks performed in the last five trading sessions.

Image Source: Zacks Investment Research

In the last five trading sessions, AstraZeneca rose the most (5%) while J&J declined the most (2.2%).

In the past six months, AbbVie rose the most (31.2%) while Roche declined the most (16.7%).

(See the last pharma stock roundup here:

PFE’s Biohaven Buyout Offer, BAYRY’s Q1 Earnings Update

)

What’s Next in the Pharma World?

Watch for regular pipeline and regulatory updates next week.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report