JinkoSolar Holding Co. Ltd

.’s

JKS

subsidiary, Jinko Solar Co. Ltd, recently signed a distribution generation (“DG”) agreement for its solar modules with Latin America’s Aldo Solar. The deal highlights the distribution of 600 megawatts (MW) of N-type Tiger Neo Modules through Aldo Solar, the pre-sale of which is anticipated to commence in the beginning of July.

With the latest agreement, which makes Brazil the first market in Latin America to make JinkoSolar’s new N-type modules available, the company thus further strengthens its position in the solar market in Brazil through its innovative range of products.

Benefits of the Agreement

JinkoSolar’s Tiger Neo modules, the Tiger Neo series is the next-generation product range that boasts features like better power generation performance, higher bifacial factor and lower temperature coefficient. Such features make it one of the most-accomplished solar modules in the market to date.

It is imperative to mention that Brazil’s solar energy market may witness a CAGR of nearly 5.5% during the 2022-2027 period, per the report from Mordor Intelligence. The latest DG agreement will enable JKS to tap the growth prospects of the solar market in Brazil through this state-of-the-art product, thereby boosting its growth.

Before this agreement, JinkoSolar signed a DG agreement with Aldo Solar in 2021 to provide nearly four million photovoltaic modules in 2022.

Moreover, JinkoSolar anticipates doubling its business volume, primarily in the distributed generation operation in 2022. Undoubtedly, the latest agreements will aid the company in achieving this goal and open more avenues to ink more deals, which may further assist in achieving its target.

Global Solar Market Boom

The increased focus on transitioning to renewable sources of energy has propelled demand for solar-based energy globally. Moreover, due to its feature of a lower cost-oriented source of energy, its demand is poised to increase manifold amid rising energy prices.

In this context, per a Mordor Intelligence report, the global solar market is expected to witness a CAGR of 13.8% during the 2022-2027 period. This entails immense growth opportunities for solar companies like JinkoSolar, which already enjoy a dominant position in the manufacturing of solar modules.

Opportunity for Peers

Solar players that have already carved out a position in the solar market and can further enjoy the perks of the pent-up demand are:

Canadian Solar

CSIQ

shipped 3.63 gigawatts (GW) of solar modules in the first quarter of 2022, which represented an increase of 42% from the prior-period figure. It currently has a total project pipeline of 23.8 gigawatt peak (GWp), including 1.1 GWp under construction, 4.2 GWp in the backlog and 18.5 GWp of an earlier stage pipeline.

Canadian Solar’s 2022 estimated earnings indicate a growth rate of a solid 170.8% from the prior-year reported figure. CSIQshares have rallied 12.5% in the past month.

In the first quarter,

SolarEdge Technologies

SEDG

witnessed record solar revenues, driven by the strong demand for its solar products across all segments and geographies. In 2021, the company launched several new products like the Energy Bank residential battery and higher power optimizers and inverters in residential and commercial offerings.

SolarEdge’s long-term earnings growth rate is pegged at 28.5%. SEDG stock has rallied 12.8% in the past year.

First Solar

FSLR

produced 2.1 gigawatt-direct current (GWdc) of solar modules in the first quarter of 2022, which represented a 19% increase in the Series 6 module production from the same period in 2021. It expects to produce between 8.2 GW and 8.8 GW of Series 6 and Series 6 Plus modules in 2022.

First Solar boasts a long-term earnings growth rate of 13.2%. FSLR has delivered an average earnings surprise of 2.49% in the trailing four quarters.

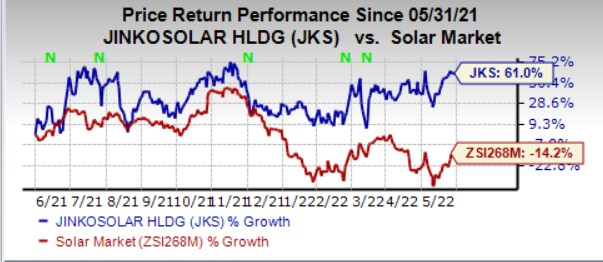

Price Movement

In a year, shares of JinkoSolar have surged 61% against the

industry

’s decline of 14.2%.

Image Source: Zacks Investment Research

Zacks Rank

JinkoSolar currently carries a Zacks Rank #4 (Sell). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report