The larger tech stocks were testing resistance levels last week before they bounced back. And since these stocks are heavily represented in the major indexes, this was reflected in them. Small and mid-cap stocks continued to slide for the week although they too climbed higher on Friday.

This, of course, doesn’t mean that our concerns are behind us. We still have the issues of rising inflation and the Fed rate hikes. And as Michael Kushma, Global CIO of Fixed Income at Morgan Stanley Investment Management is also

saying

, there is the added concern that rate hikes while roiling the markets, may not be enough to control inflation.

That may sound like a cliché since everybody knows that the current supply chain issues are a logistics nightmare that these Fed actions aren’t targeted at. And that’s what’s really sending prices up. Then there’s the semiconductor shortage that is more of a capacity issue, so that too is outside the scope of these Fed actions.

But the Fed is targeting inflation of around 3% by year end that is expected to drop back to the targeted 2-2.5% by the end of 2023. The quantitative easing started last November is already doing its thing by reducing the money flowing into the market and therefore, reducing the rate of expansion of the balance sheet.

But now we are talking about a reduction of the balance sheet. If the Fed does this by selling bonds, the resultant increase in bond supply will hit prices and increase bond yields. So money will flow out of stocks. Or it could decide to hold bonds to maturity, leading to relative stability in the financial markets even as it hikes interest rates, which has a similar effect. Whatever action it takes, a broad impact on the economy takes about a year, although the stock market reaction is sharper.

So, the bottom line is, there is more bad news out there.

What should we do with tech stocks then?

I would say that since technology is central to almost everything we do today, and it also plays an important role in increasing operational efficiency, demand for technology is going nowhere. Technology is also creating new markets, such as artificial intelligence tools, automated driving solutions, drones and the like, which has an expansionary impact on the market. On the other hand, any upheaval of significant magnitude, such as what we are seeing right now is a good opportunity to buy. So buying the dip seems to be the answer.

Just as some investors got in last week and were immediately rewarded, there’s scope for much more of that this year as a hawkish Fed works to lower the historically high inflation.

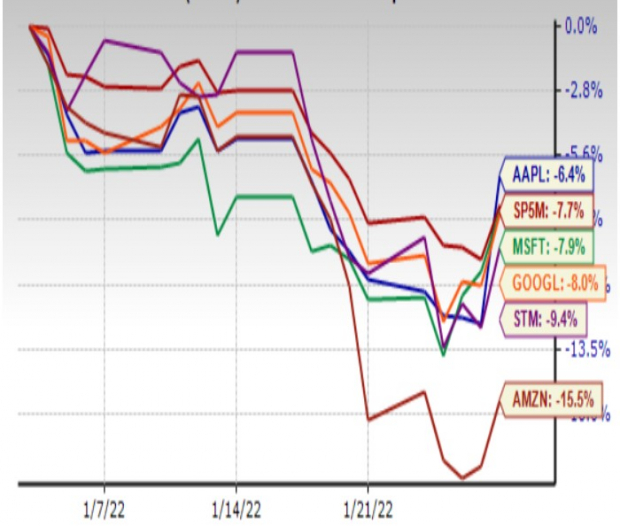

Zacks #3 (Hold) ranked Apple

AAPL

, Alphabet

GOOGL

, Microsoft

MSFT

and Amazon

AMZN

and #1 (Strong Buy) ranked STMicroelectronics

STM

were some of the gainers last week. But many others that are still down for the week moved notably higher on Friday. And since we are in the middle of tech earnings of the season, this may be just the turn in the sentiment that we were hoping for.

Image Source: Zacks Investment Research

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

As one investor put it, “curing and preventing hundreds of diseases…what should that market be worth?” This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report