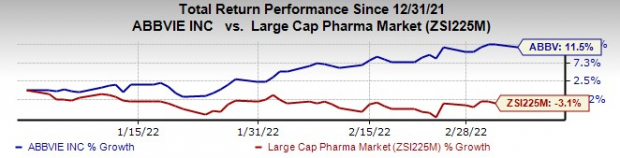

AbbVie

ABBV

stock has risen 11.6% this year so far compared with a decrease of 3.1% for the

industry

.

Image Source: Zacks Investment Research

AbbVie has become one of the top-most pharma companies after it acquired Botox maker Allergan in a cash-and-stock deal for $63 billion in May 2020. The deal has transformed AbbVie’s portfolio by lowering its dependence on Humira, its flagship product, which has already lost patent protection in Europe and is due to face biosimilar competition in the United States in 2023. AbbVie has one of the most popular cancer drugs in its portfolio, Imbruvica, which it markets in partnership with

J&J

JNJ

. Its newest immunology drugs Skyrizi (risankizumab) and Rinvoq (upadacitinib) position it well for long-term growth.

AbbVie’s fourth-quarter results, announced last month, were mixed as it beat estimates for earnings while missing the same for sales. However, its sales rose 7.4% year over year driven by the immunology and aesthetics franchises. Its oncology franchise is also contributing to sales growth. Its financial outlook for 2022 was also quite encouraging.

Humira continues to witness strong demand trends in the United States despite new mechanisms of action and competition from indirect biosimilars. Currently approved for several indications, Humira sales have increased consistently, backed by robust demand trends.

Among AbbVie’s other immunology medicines, Skyrizi and Rinvoq demonstrated differentiated clinical profiles versus Humira and are already contributing meaningful revenues, including $4.6 billion in combined sales in 2021. Both Skyrizi and Rinvoq were approved for active psoriatic arthritis in 2021/early 2022. Rinvoq was also approved for atopic dermatitis. With such new indications coming in the next couple of years, sales of these drugs could be higher and have the potential to replace Humira when generics are launched in 2023.

In 2022, AbbVie expects its immunology sales to grow in double digits, including U.S. Humira growth of 8%, Skyrizi global sales of $4.4 billion and Rinvoq global sales of $2.7 billion.

AbbVie expects combined sales of Skyrizi and Rinvoq to be more than $15 billion by 2025.

In its oncology franchise, the strong growth of Venclexta sales is making up for lower U.S. sales of J&J-partnered Imbruvica. U.S. sales of AbbVie/J&J’s Imbruvica are being hurt by lower new patient starts in CLL due to a slower-than-expected market recovery from the COVID-19 pandemic and increasing competition from newer therapies.

AbbVie markets Venclexta/Venclyxto in partnership with

Roche

RHHBY

. AbbVie and Roche jointly commercialize Venclexta in the United States while AbbVie markets it outside the country.

Strong share performance across all approved indications is boosting sales of Venclexta/Venclyxto.

In 2022, Imbruvica global revenues are expected to be approximately $5.4 billion. The Imbruvica guidance assumes recovery of the CLL market, which is expected to be partially offset by share erosion from increased competition. Venclexta global sales are expected to be approximately $2.3 billion.

Robust demand for Botox Cosmetic and Juvederm is boosting sales of AbbVie’s aesthetics franchise, helped by a strong recovery from the pandemic. In 2022, AbbVie expects the global aesthetics franchise to generate global sales of approximately $5.9 billion including $2.6 billion for Botox Cosmetic and $1.7 billion from Juvederm.

Some of AbbVie’s newer medicines like Ubrelvy and Qulipta have started off well and sales are expected to pick up in 2022.

AbbVie also has an impressive late-stage pipeline with several early/mid-stage candidates that have blockbuster potential. Several data readouts are expected in 2022, which could be catalysts for the stock.

Zacks Rank & Stock to Consider

AbbVie currently carries a Zacks Rank #3 (Hold).

A better-ranked stock in the drug/biotech sector is

Vertex Pharmaceuticals

VRTX

which has a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Vertex Pharmaceuticals’ stock has risen 7.3% this year. Estimates for Vertex Pharmaceuticals’ 2022 earnings have gone up from $13.32 to $14.52 per share, while those for 2023 have increased from $14.10 to $15.31 per share over the past 60 days.

Vertex Pharmaceuticals’ earnings performance has been strong, with the company beating expectations in each of the last four quarters. Vertex Pharmaceuticals has a four-quarter earnings surprise of 10.01%, on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report