AbCellera Biologics Inc.

ABCL

announced that it entered a multi-target strategic collaboration with pharma giant

AbbVie

ABBV

to develop new antibody therapies.

Per the agreement, AbCellera is eligible to receive research payments, as well as certain milestone payments and royalties on net sales, if a product is commercialized from the above collaboration. AbbVie will have the right to develop/commercialize therapeutic antibodies developed under the partnership.

Per the company, the latest deal is looking to leverage ABCL’s antibody drug discovery engine to deliver optimized pipeline candidates for up to five targets that are selected by ABBV across multiple indications.

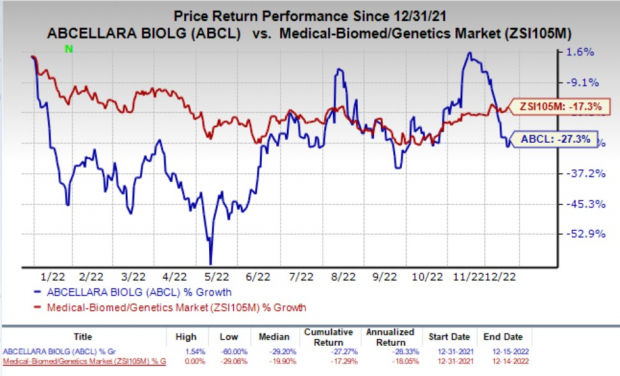

Shares of AbCellera were up 2.7% on Thursday, following the announcement of the news. The stock has declined 27.3% so far this year compared with the

industry

’s fall of 17.3%.

Image Source: Zacks Investment Research

Apart from the deal with AbbVie, ABCL’s technology stack led to collaborations with several big and small healthcare companies for the discovery of antibodies across multiple indications.

Earlier this month, AbCellera inked a strategic alliance with Connecticut-based

Rallybio Corporation

RLYB

to discover, develop and commercialize novel antibody-based therapeutics for rare diseases.

This multi-year partnership is looking to combine AbCellera’s antibody discovery engine with Rallybio’s expertise in rare diseases to identify optimal candidates while delivering therapies to patients.

AbCellera and RLYB will develop up to five rare disease therapeutic targets.

AbCellera’s top line currently comprises royalties, research fees from partnerships, and revenues from milestone payments and licensing revenues. Such partnership deals remain key factors for the company’s growth in the long run.

Zacks Rank & Stocks to Consider

AbCellera currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the biotech sector is

ASLAN Pharmaceuticals Limited

ASLN

, carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Loss per share estimates for ASLAN Pharmaceuticals have narrowed to 6.1% for 2022 and 5.7% for 2023 in the past 60 days.

Earnings of ASLAN Pharmaceuticals surpassed estimates in two of the trailing four quarters and missed on the remaining two occasions. ASLN witnessed an earnings surprise of 1.64% on average.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the

Zacks Top 10 Stocks

portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report