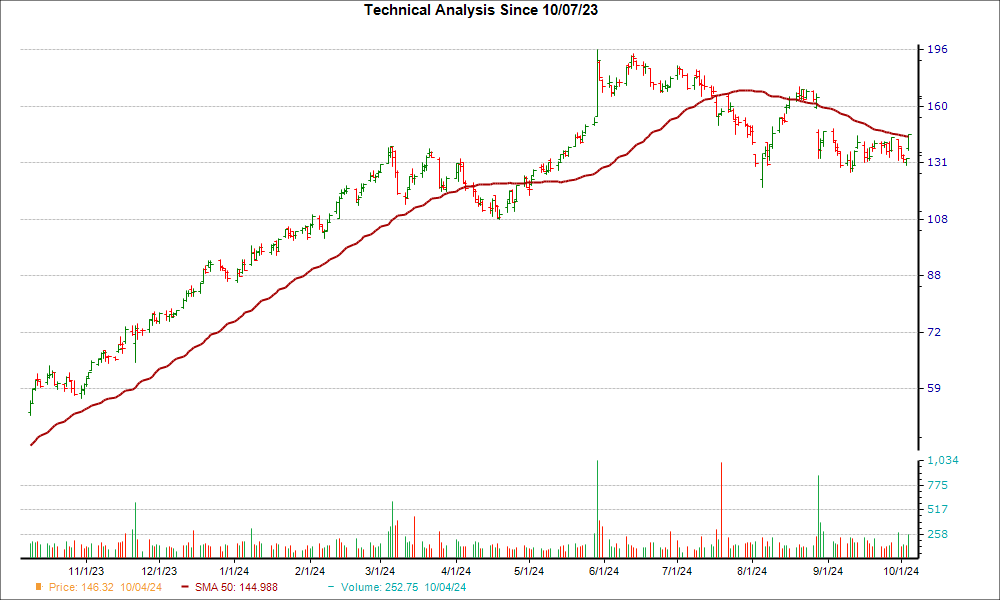

Abercrombie & Fitch (ANF) reached a significant support level, and could be a good pick for investors from a technical perspective. Recently, ANF broke through the 50-day moving average, which suggests a short-term bullish trend.

One of the three major moving averages, the 50-day simple moving average is commonly used by traders and analysts to determine support or resistance levels for different types of securities. However, the 50-day is considered to be more important since it’s the first marker of an up or down trend.

Over the past four weeks, ANF has gained 7.5%. The company is currently ranked a Zacks Rank #1 (Strong Buy), another strong indication the stock could move even higher.

The bullish case only gets stronger once investors take into account ANF’s positive earnings estimate revisions. There have been 4 higher compared to none lower for the current fiscal year, and the consensus estimate has moved up as well.

Given this move in earnings estimate revisions and the positive technical factor, investors may want to keep their eye on ANF for more gains in the near future.

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%.

You’re invited to check out

Zacks’ Marijuana Moneymakers

:

An Investor’s Guide

. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report