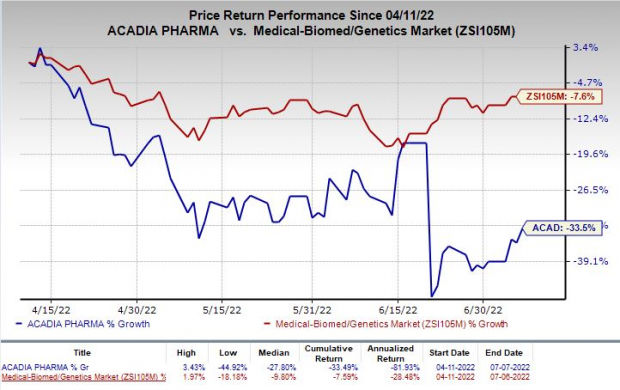

Shares of

Acadia Pharmaceuticals Inc.

ACAD

have plunged 33.5% in the past three months compared with the

industry

’s decrease of 7.6%.

Image Source: Zacks Investment Research

The company’s sole marketed drug, Nuplazid (pimavanserin), is approved in the United States for the treatment of hallucinations and delusions associated with Parkinson’s disease psychosis. The drug is the first and the only FDA-approved treatment for the given indication.

In June 2022, the FDA’s Psychopharmacologic Drugs Advisory Committee (“PDAC”) voted (nine-three) against the supplemental new drug application (sNDA) for Nuplazid for treating hallucinations and delusions associated with Alzheimer’s disease psychosis (“ADP”).

Earlier, the FDA had asked the committee for advice and recommendations regarding the evidence that pimavanserin is effective for the given indication. Though the FDA is not completely bound by the PDAC’s recommendations, it usually follows the same. The FDA’s decision date for the sNDA is Aug 4.

This might be a reason for ACAD’s shares to have remained down during this time frame.

We remind investors that the FDA had

issued

a complete response letter to the sNDA for Nuplazid in April 2021.

Nuplazid generated sales worth $115.5 million in the first quarter of 2022, reflecting an increase of 8% year over year. A potential label expansion is likely to boost sales of the drug in the days ahead.

This apart, Acadia has other promising pipeline candidates that are being developed for various other indications.

The company is planning to file a new drug application for trofinetide to treat Rett syndrome later in 2022. Currently, there are no approved medicines for the given indications.

In April 2022, Acadia announced top-line data from a phase II study evaluating the safety and efficacy of its investigational candidate, ACP-044, for the treatment of acute pain following bunionectomy surgery. The study failed to meet its primary endpoint. Shares of Acadia tanked on this news.

ACP-044 is also being evaluated in a phase II study for treating pain associated with osteoarthritis.

Zacks Rank & Stocks to Consider

Acadia currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the biotech sector are

Leap Therapeutics, Inc.

LPTX

,

Aeglea BioTherapeutics, Inc.

AGLE

and

Precision BioSciences, Inc.

DTIL

, all carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The Zacks Consensus Estimate for Leap Therapeutics’ loss per share has narrowed 11.1% for 2022 and 5.9% for 2023 in the past 60 days.

Earnings of Leap Therapeutics have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion. LPTX delivered an earnings surprise of 1.92%, on average.

Aeglea BioTherapeutics’ loss per share estimates narrowed 12.7% for 2022 and 25.6% for 2023 in the past 60 days.

Earnings of Aeglea BioTherapeutics have surpassed estimates in two of the trailing four quarters and missed the same on the other two occasions. AGLE delivered an earnings surprise of 9.47%, on average.

Precision BioSciences’ loss per share estimates narrowed 26.2% for 2022 and 42.6% for 2023 in the past 60 days.

Earnings of Precision BioSciences have surpassed estimates in each of the trailing four quarters. DTIL delivered an earnings surprise of 76.15%, on average.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the

Zacks Top 10 Stocks

portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report