Acadia Pharmaceuticals Inc.

ACAD

reported first-quarter 2022 loss of 70 cents per share, wider than the Zacks Consensus Estimate of a loss of 49 cents. In the year-ago quarter, the company had incurred a loss of 42 cents per share.

Total revenues, comprising net sales of Acadia’s only marketed drug, Nuplazid (pimavanserin), increased 8% year over year to $115.5 million in the first quarter, driven by Nuplazid demand growth. The top line, however, missed the Zacks Consensus Estimate of $124 million. Nuplazid sales declined 11.7% sequentially in the reported quarter.

Nuplazid is the first and the only FDA-approved treatment for hallucinations and delusions associated with Parkinson’s disease psychosis.

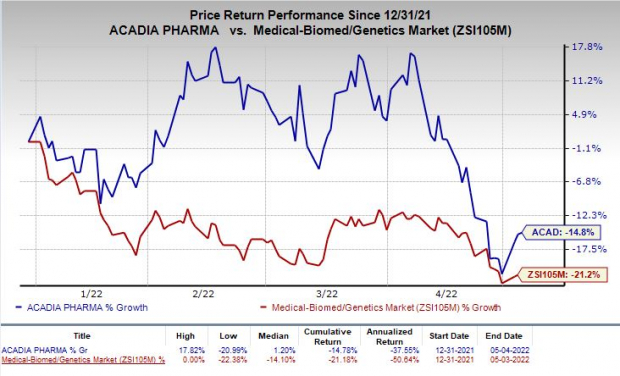

Shares of Acadia were up 3% in after-market trading on Wednesday, despite the weaker-than-expected earnings announcement. The stock has plunged 14.8% in the year so far compared with the

industry

’s 21.2% decline.

Image Source: Zacks Investment Research

Quarter in Detail

Research and development (R&D) expenses were $128.9 million for the quarter, significantly up from the year-ago quarter. This was due to an upfront payment of $60 million made to

Stoke Therapeutics

STOK

under the collaboration agreement.

In January 2022, Acadia entered into a license and collaboration agreement with Stoke Therapeutics to discover, develop and commercialize novel RNA-based medicines for treating neurodevelopmental diseases of the central nervous system.

Acadia and Stoke will share all costs and profits equally for the SYNGAP1 program worldwide.

Selling, general and administrative (SG&A) expenses were $96.7 million, down 13.4% year over year, owing to reduced advertising and promotional costs as well as lower personnel expenses.

As of Mar 31, 2022, Acadia had cash, cash equivalents and investments worth $446 million compared with $520.7 million as of Dec 31, 2021.

2022 Guidance

Acadia reiterated the financial guidance for 2022 it had provided earlier this year.

The company expects Nuplazid net sales of $510-$560 million for 2022. The Zacks Consensus Estimate for the metric is pegged at $542.4 million.

The company expects R&D expenses of $355-$375 million while SG&A expenses are expected to be $360-$380 million in 2022.

Pipeline Updates

In March 2022, Acadia received the action date from the FDA related to its resubmitted supplemental new drug application (sNDA) for pimavanserin to treat hallucinations and delusions associated with Alzheimer’s disease psychosis.

The regulatory body has set a target action date of Aug 4, 2022.

Earlier this month, Acadia announced that the FDA’s Advisory Committee meeting to review the resubmission of the sNDA for pimavanserin is scheduled take place on Jun 17, 2022.

The FDA had

issued

a complete response letter to the sNDA for Nuplazid in April 2021.

Acadia has other promising pipeline candidates that are progressing well.

Last month, the company announced top-line data from a phase II study evaluating the safety and efficacy of its investigational candidate, ACP-044, for the treatment of acute pain following bunionectomy surgery. The study failed to meet its primary endpoint. Shares of Acadia tanked on this news.

Acadia is planning to file a new drug application for trofinetide to treat Rett syndrome around mid-2022.

Zacks Rank & Stocks to Consider

Acadia currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the biotech sector are

Vertex Pharmaceuticals Incorporated

VRTX

and

Voyager Therapeutics, Inc.

VYGR

, both carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Vertex’s earnings estimates have been revised 0.3% upward for 2022 and 0.2% upward for 2023 over the past 60 days. The VRTX stock has rallied 24.6% year to date.

Earnings of Vertex surpassed estimates in each of the trailing four quarters.

Voyager Therapeutics’ loss per share estimates have narrowed 38.6% for 2022 and 29% for 2023 over the past 60 days. The VYGR stock has skyrocketed 214.4% year to date.

Earnings of Voyager Therapeutics have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report