Alkermes plc

ALKS

reported first-quarter 2022 adjusted earnings of 12 cents per share, which beat the Zacks Consensus Estimate of 1 cent. The company had reported adjusted earnings of 11 cents per share in the year-ago quarter.

The company’s revenues of $278.5 million increased 10.8% from the year-ago quarter. The top line also beat the Zacks Consensus Estimate of $262 million.

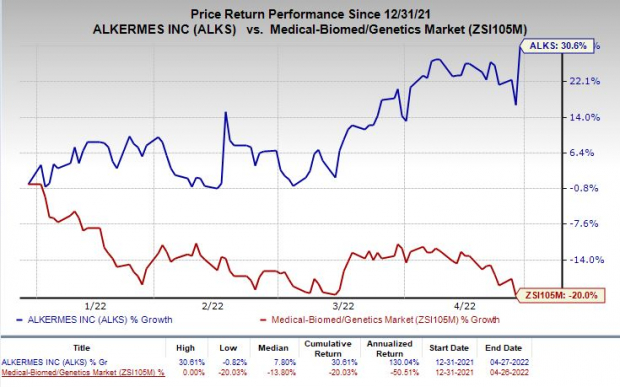

Shares of Alkermes were up 11.9% on Wednesday, owing to better-than-expected first-quarter results. The stock has rallied 30.6% in the year so far against the

industry

’s decline of 20%.

Image Source: Zacks Investment Research

Quarter in Detail

Total manufacturing and royalty revenues were down 12.2% year over year to $105.2 million due to partial termination of the license agreement related to sales of long-acting Invega products in the United States by Janssen, a subsidiary of J&J.

Sales of proprietary drug, Vivitrol (for alcohol and opioid dependence), increased approximately 14% year over year to $84.9 million, while the same for Aristada (for schizophrenia) increased approximately 31% year over year to $72.5 million. These increases were driven by the underlying unit growth and volume growth.

Vumerity revenues increased around 128% to $30.6 million.

Research and development (R&D) expenses were $96 million, up 4% year over year.

Selling, general and administrative (SG&A) expenses were $145.1 million, up 15.9% year over year.

Newly approved medicine, Lybalvi (olanzapine and samidorphan), generated sales worth $13.9 million following its launch in October 2021. Sales of the drug increased 69.5% sequentially.

In June 2021, the FDA had

approved

Lybalvi for the treatment of adults suffering from schizophrenia or bipolar I disorder.

As of Mar 31, 2022, Alkermes had cash and cash equivalents worth $758.7 million compared with $765.7 million on Dec 31, 2021. Total outstanding debt was $295.2 million as of Mar 31, 2022.

2022 Guidance

Alkermes has reiterated the financial guidance it provided earlier this year.

Pipeline Updates

Alkermes is conducting the phase III ARTISTRY-7 study, which is evaluating the anti-tumor activity and safety of its pipeline candidate, nemvaleukin alfa, in combination with

Merck

’s

MRK

Keytruda (pembrolizumab), an anti-PD-1 antibody, for treating patients with platinum-resistant ovarian cancer.

Merck’s biggest revenue generator, Keytruda, is approved for treating several types of cancer indications. Merck is also studying Keytruda for addressing yet more cancer indications.

Zacks Rank & Other Stocks to Consider

Alkermes currently carries a Zacks Rank #1 (Strong Buy). Other stocks worth considering in the biotech sector include

AngionBiomedica Corp.

ANGN

and

BioMarin Pharmaceutical Inc.

BMRN

, both sporting the same Zacks Rank #1 at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Angion Biomedica’s loss per share estimates have narrowed 28.9% for 2022 and 29.5% for 2023 over the past 60 days.

Earnings of ANGN have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion.

BioMarin’s earnings estimates have been revised 1% upward for 2022 and 1.8% for 2023 over the past 60 days.

Earnings of BMRN surpassed estimates in each of the trailing four quarters.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report