Alnylam Pharmaceuticals, Inc.

ALNY

announced positive top-line data from a phase II study evaluating its investigational pipeline candidate, cemdisiran, for the treatment of immunoglobulin A nephropathy (“IgAN”).

Alnylam is developing cemdisiran, an investigational RNAi therapeutic targeting the C5 component of the complement pathway, in collaboration with

Regeneron Pharmaceuticals

REGN

.

Data from the above-mentioned study showed that treatment with cemdisiran led to a 37% mean reduction from base line in the 24-hour urine protein to creatinine ratio relative to placebo — the primary endpoint of the study.

The study data of secondary endpoints were similar to a therapeutic benefit of cemdisiran in IgAN. There were no significant drug-related safety signals.

Alnylam and Regeneron are planning for the phase III development of cemdisiran in IgAN.

Per the company, the data on cemdisiran demonstrates what is believed to be clinically meaningful reductions in proteinuria — which is an important prognostic factor in IgA nephropathy.

Though the overall safety and tolerability profile supports the clinical development of cemdisiran monotherapy in patients with IgAN, one death was reported in the cemdisiran arm related to a post-surgical complication. However, it was not related to the study drug.

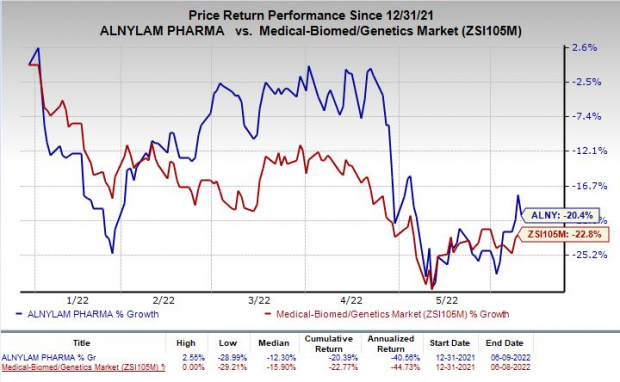

Shares of Alnylam were down 3.2% on Thursday following the announcement of the news. The stock has plunged 20.4% so far this year compared with the

industry

’s decrease of 22.8%.

Image Source: Zacks Investment Research

Alnylam, in collaboration with Regeneron, is advancing cemdisiran for the treatment of complement-mediated diseases.

Regeneron is advancing a phase III study of cemdisiran and pozelimab combination for treating myasthenia gravis.

Alnylam records collaboration revenues from its collaboration with REGN.

Zacks Rank & Stocks to Consider

Alnylam currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the biotech sector are

Leap Therapeutics, Inc.

LPTX

and

Precision BioSciences, Inc.

DTIL

, both carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The Zacks Consensus Estimate for Leap Therapeutics’ loss per share has narrowed 11.1% for 2022 and 5.9% for 2023 in the past 60 days.

Earnings of Leap Therapeutics have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion. LPTX delivered an earnings surprise of 1.92%, on average.

Precision BioSciences’ loss per share estimates have narrowed 21.7% for 2022 and 31.4% for 2023 in the past 60 days.

Earnings of Precision BioSciences have surpassed estimates in each of the trailing four quarters. DTIL delivered an earnings surprise of 76.15%, on average.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the

Zacks Top 10 Stocks

portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report