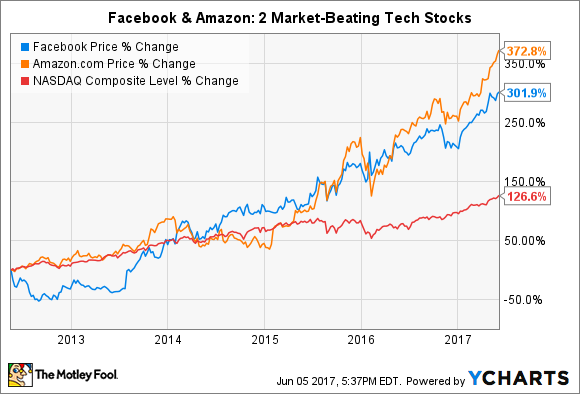

Both Facebook (NASDAQ:$FB) and Amazon.com (NASDAQ:$AMZN) — being tech giants — have consistently out-performed their market averages over the past few years. With both companies doing so well, investors may have a hard time gauging over which company’s shares to invest in.

Below, the companies are examined in three parts to help determine for investors which company’s share is a better technology investment today.

Financial Strength

Amazon has about $21.5 billion in cash and investments and $16.8 billion in cash from operations. However, the company is also about $7.7 billion in debt. Facebook, on the other hand, has no debt while holding $32.3 billion in cash and investments and $17.7 billion in cash from operations. The near-term liquidity of both companies — captured by current ratio — is 1.1 for Amazon and 12.6 for Facebook.

While money clearly isn’t an issue for both the largely successful companies, Facebook’s net-cash balance (cash and investments minus debt) is about $18 billion more than Amazon. As well, based on the numbers above, Facebook comes out on top across all four considerations (cash and investments, debt, cash from operations, and current ratio).

When it comes to finance, Facebook currently has the upper-hand.

Hefty Competitive Gain

Facebook and Amazon are both considered to be the top companies when it comes to their respective fields.

Since its establishment several years ago, Facebook has continued to dominate the social-media hemisphere. According to its recent earnings report, the social media tycoon had 1.9 billion monthly active users (MAUs) and 1.2 billion daily active users (DAUs) on its core platform. Its subsidiary company, Instagram, recently reported a rise above 700 MAUs. As well, messaging apps owned and operated by Facebook like Messenger and WhatsApp each has about 1.2 billion MAUs.

Facebook’s main competitors, Twitter (NYSE:$TWTR) and Snap (NYSE:$SNAP), seems to pale in comparison when it comes to MAUs and DAUs. Twitter saw about 328 million MAUs according to its recent earning reports, while Snapchat saw 166 million DAUs. Neither companies come close to Facebook’s billion counts.

Facebook has also been keeping up with its competitors — clearly seen with Facebook’s recent implementation of Messenger’s Story of the Day, which makes use of features that are similar to Snapchat’s. As well, Instagram Stories — another implementation made to Instagram that holds similar use to Snapchat — is growing quite rapidly. In fact, Instagram Stories alone has been reported to have surpassed Snap’s 166 million DAUs.

Similar to Facebook’s dominance over social media, Amazon dominates in the e-commerce field. According to Slice Analytics, Amazon alone has captured 43% — almost half — of all e-commerce sales last year in the United States. Long pass its $100 billion in revenue to years ago, the company continues to grow with plans to expand further in e-commerce as well as other aspects of tech, such as cloud computing.

Amazon continues to improve upon its services and look for expansion. Besides expansions in cloud computing and impressive products such as voice-controlled speakers, it is also looking to provide logistics and fulfillment services to its third party providers in order to up its efficiency in e-commerce. The move allows for the company to have better control of its own fulfillment while negotiating better terms with third party providers such as UPS (NYSE:$UPS) and FedEx (NYSE:$FDX). It also lets Amazon to continue to offer lower prices within its e-commerce business.

With both company dominating their respective fields, and despite that continue to look for ways to expand and better their services, Amazon and Facebook are tied in its competitive advantages.

Valuation

With both the companies’ growth rates and long-term potential in future outlook, their shares are typically more expensive to buy. However, Facebook has Amazon beat when it comes to price-earnings ratio (P/E), forward price-earnings ratio (forward P/E), and price-to-cash-flow ratio (P/Cash Flow).

Facebook’s P/E is 39.0 compared to Amazon’s 189.5, and its forward P/E is 25.6 compared to Amazon’s 89.1. For P/Cash Flow, while Amazon came a little close to Facebook, the social media company still came out on top with a 31.2 compared to Amazon’s 42.2.

It is worth noting, however, to those investing in technology, that Amazon has been known to keep its profitability as close to zero as its investors will tolerate. This is because Amazon offer low prices in order to get market share — leading to a cycle known as the Flywheel Effect, which allows Amazon to offer lower and lower prices which attracts more market shares. That being said, Amazon’s cash flows has also been known to outstrip its small profits.

As such, when it comes to valuation, Facebook wins over Amazon.

And the winner is …

The margin was small, but Facebook’s finance and valuation has won over Amazon. However, both companies are worth looking into if you are just getting into technology investments — after all, these two companies have been consistently performing well in its sectors. In long-term technology investing, an investment in either of these companies is sure to reap some rewards.

Featured Image: twitter