On June 15, popular retail company Kroger (NYSE:$KR) saw a dramatic 18% drop in its stocks after it reported disappointing first quarter results. In response, Kroger CEO Rodney McMullen acknowledged some of the challenges Kroger — as well as other companies — have been facing in the retail industry. Mostly, he cited the major changes that the food retail industry have been experiencing, particularly in operation and competition. There is a lot of upheavals, he said.

McMullen’s remarks became an understatement just a day after — on Friday, June 16, Amazon (NASDAQ:$AMZN) announced that it was acquiring Whole Foods Market, Inc. (NASDAQ:$WFM) for $13.7 billion, or $42 per share, causing Kroger’s shares to tumble down by another 14%.

It’s not just the food retailers. Amazon’s news affected all those in the retail industry, noted Gordon Haskett’s (traded privately), Chuck Grom.

This could be the end of physical grocery stores

Thanks to rising popularity of online retailers like Amazon, brick-and-mortar stores that sell electronics, clothes, books, and other products have been suffering. The price and convenience of online retail just did not compare to those found in physical stores — why walk around malls when you can shop in the comfort of your own home?

But while online grocery retail has been available for a while now, it never did seem to affect traditional grocery stores like Kroger as much as it did other retailers that sell books or electronics. With Amazon’s purchase, however, this may no longer be true.

Still, a lot of things are up in the air, and many people have differing opinions on the future of brick-and-mortar groceries. For Needham’s (traded privately) Kerry Rice, Amazon’s acquisition points to a future where you can’t just have brick-and-mortar grocery stores — but you can’t just have online groceries either. Rice pointed out success will be largely dependant on the logistics that grocery stores are currently: getting products to consumers quickly and efficiently while building the correct network to do so.

Barclays’ (LON:$BARC) Karen Short thinks Amazon’s deal with Whole Foods is Darwinism at best.

Whole Foods, whose shares were as high as $65 per share in October 2013, fell drastically over the years. In early 2017, the grocery retailer was only worth less than $30 per share. Declining sales, along with pressure from shareholder Jana Partners — who owned 9% of the company — pushed Whole Foods to attempt a comeback through an online strategy. In a nine-point turnaround plan outlined in November 2015, Whole Foods CEO John Mackey specifically highlighted online strategies. “We will invest in digital strategies to convert the strong traffic we generate online into sales,” he explained in a conference call with the company that month. “We have integrated Instacart into our app, will soon launch a national sales flyer, and will continue to make upgrades to provide more functionality and streamline our customers’ digital experience.”

Two years later, Mackey has continued to back digital strategies and implementations. In his latest conference call with Whole Foods, a possible partnership with Instacart (traded privately) for direct grocery delivery was mentioned, along with announcements that the grocery retailer has made extra investments to open a catering and meal delivery e-store with DoorDash (traded privately).

Mackey’s attempts, however, were futile. In its 2017 first quarter report, the company announced a 2.8% fall in comparable store sales. This marks the seventh consecutive quarter of a decline in sales — just as Whole Foods had hired some new additions to its board of directors.

It’s not just groceries

Online retail has been a dark cloud looming over major retailers like Macy’s (NYSE:$M) and Nordstrom, Inc. (NYSE:$JWN). Amazon’s deal with Whole Foods — while seemingly only affecting grocery retailers — could bring in that storm other retailers have been trying to fight off for years now.

With the deal, groceries is just the surface, said Morgan Stanley’s (NYSE:$MS) Brian Nowak. Amazon can also gain a new channel for sales in other places as well.

The average U.S. consumer goes to the supermarket about 1.6 times per week, Nowak explained, and Amazon could capture this traffic flow, creating more opportunities to upsell its other categories. This could be potentially very damaging to the sales of other retailers.

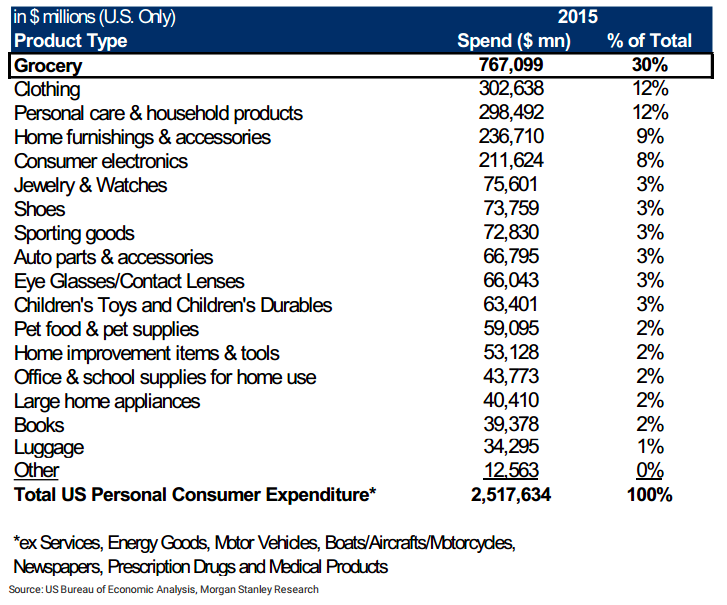

Not only is grocery shopping great for traffic flow, it also accounts for 30% of total U.S. personal spending, according to data provided by Morgan Stanley. As such, it’s a win-win situation for Amazon if it succeeds in its grocery retail takeover.

Amazon’s acquisition further confirms the company’s commitment to break into the grocery retail industry — its first attempt being Amazon Fresh, which began almost ten years ago.

Disrupt in price

Besides the disappearance of brick-and-mortar grocery stores, Amazon’s involvement with Whole Foods can also affect the pricing of groceries. This will be especially challenging, as Amazon is typically known for its low prices — a large reason why it has been able to beat out retailers in things like clothing and electronics.

For Stifel’s (NYSE:$SF) Mark Astrachan, the price transition should be an interesting one. “We anticipate Amazon’s ownership is likely to result in lower prices at Whole Foods, forcing other grocery participants to follow, negatively impacting category margins,” Astrachan said. “There is a generally strong correlation between price and comp store sales growth, and we also note Amazon has largely foregone profits in other categories in which it competes, which we believe is likely to happen with Whole Foods/grocery.”

This means that Amazon may not put profitability as a top priority with Whole Foods, creating more pressure for fellow competitors in the industry to lower the prices on their products. What’s even more concerning is the fact that Amazon’s acquisition of Whole Foods comes at a time where price competition is getting more intense within the grocery retail industry.

It is also important to note that it was Whole Foods who lead other grocery retailers to expand their organic and natural food categories. Since the success of Whole Foods, big-name retailers like Costco (NASDAQ:$COST), Target (NYSE:$TGT) and Walmart (NYSE:$WMT), as well as traditional grocery retailers like Kroger and Wegmans (traded privately) have all taken the time to focus on organic foods. Even convenience stores like Walgreens (NASDAQ:$WBA) have put in the effort to go organic. Meanwhile, specialty organic grocery retailers like Sprouts Farmers Market (NASDAQ:$SFM) and Trader Joe’s (traded privately) have been expanding rapidly.

Summary

While things may look dire in the grocery retail industry, there is still a great chance of a turnaround. Besides its acquisition of Whole Foods, Amazon did not release any other details regarding its future plans for the company. As such, a lot of the things mentioned above are just speculation. Nevertheless, it should be an interesting next few years as the consequences of Amazon’s recent deal slowly unfolds.

Featured Image: twitter