Amgen has a diverse and growing portfolio of medicines in large therapeutic categories that it expects will help it drive growth through the end of the decade despite a declining pricing environment.

Amgen

AMGN

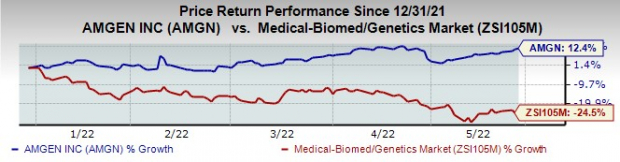

stock has risen 12.4% this year so far against a decrease of 24.5% for the

industry

.

Image Source: Zacks Investment Research

Amgen’s key drugs like Prolia, Repatha, Xgeva and biosimilars are aiding sales, driven by volume growth as these key drugs are gaining consistent approvals for label expansions.

Moreover, Amgen is evaluating Prolia/Xgeva, Vectibix, Enbrel, Aranesp, Kyprolis, Nplate and Blincyto for additional indications. Kyprolis is being investigated for weekly dosing in combinations with lenalidomide and dexamethasone for relapsed multiple myeloma while Repatha is being investigated for hypercholesterolemia as well as in a cardiovascular outcomes study (VESALIUS-CV) in patients with high cardiovascular risk without prior heart attack or stroke in phase III. Nplate is being studied in phase III for chemotherapy-induced thrombocytopenia. Otezla was approved to treat plaque psoriasis in December 2021 while it is in phase III for moderate-to-severe genital psoriasis. Amgen expects worldwide Otezla sales to grow by low double-digits annually, on average, before its U.S. loss of exclusivity.

Amgen acquired global commercial rights to Otezla from Celgene, which is now part of

Bristol-Myers

BMY

. The acquisition of Otezla from Bristol-Myers significantly strengthened its inflammation portfolio, which should boost long-term growth.

Repatha surpassed $1 billion of sales in 2021 and is expected to grow into a multi-billion-dollar franchise through 2030.

Amgen is also rapidly advancing its robust pipeline of early and late-stage assets. Several phase III readouts are due in 2022, which could act as catalysts for the stock.

A key drug, Lumakras (sotorasib) was approved for advanced non-small cell lung cancer (NSCLC) in the United States in May 2021 and EU in January 2022. It is now approved in 40 countries. Lumakras is off to an excellent start while its label expansion studies, which have the potential to significantly expand the currently addressable patient population, are progressing rapidly.

Amgen also boasts a strong biosimilars portfolio, which is an important long-term growth driver. Amgen markets Kanjinti (a biosimilar of

Roche

’s [

RHHBY

] Herceptin) and Mvasi (a biosimilar of Roche’s Avastin) in the United States and Amgevita (a biosimilar of

AbbVie

’s [

ABBV

] Humira), Kanjinti and Mvasi outside the United States. In 2020, Amgen launched Avsola, a biosimilar of J&J/Merck’s blockbuster immunology medicine Remicade and in January 2021, the company launched Riabni, a biosimilar of Roche’s Rituxan. In the United States, AbbVie’s Humira biosimilar, Amjevita is expected to be launched in 2023.

In 2022, the volume growth of biosimilars is expected to be offset by lower pricing due to increased competition and average sales price erosion. However, biosimilar revenues are expected to return to growth with the launch of Amjevita (AbbVie’s Humira biosimilar) in 2023.

Amgen faces its share of challenges. Pricing and competitive pressure are impacting many of Amgen’s products and franchises. Several of Amgen’s marketed drugs are facing increased pricing headwinds.

In April 2022, The Internal Revenue Service (IRS) issued a deficiency notice to Amgen proposing some adjustments for the 2010-15 period, primarily related to the allocation of profits between U.S. entities and Puerto Rico. The notice aims to increase Amgen’s taxable income for the 2013-2015 period, resulting in an additional federal tax of approximately $5.1 billion-plus interest. The IRS additionally proposed penalties of approximately $2 billion for the period 2013 to 2015.

Earlier Amgen received a similar notice of deficiency for the period of 2010 to 2012 from IRS, which proposed increasing Amgen’s taxable income by $3.6 billion for that period. The IRS is also currently auditing the 2016 to 2018 period, which could add more deficiencies or penalties.

Amgen believes the adjustments and penalties proposed by IRS are without merit and said that it would vigorously contest them. However, the litigation will remain an overhang on Amgen shares for some time now as the timing for a resolution is uncertain. Sometimes these issues take years to resolve.

Nonetheless, continued strong growth of key drugs, higher sales from ex-U.S. markets, increased contribution from its high-quality biosimilars and costs savings should keep the stock afloat in 2022.

Zacks Rank

Amgen currently has a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top buy-and-hold tickers for the entirety of 2022?

Last year’s 2021

Zacks Top 10 Stocks

portfolio returned gains as high as +147.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys

Access Zacks Top 10 Stocks for 2022 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report