Amicus Therapeutics

FOLD

is focused on developing a diverse set of novel treatments for patients living with rare metabolic diseases.

Currently, FOLD has only one marketed medicine in its portfolio called Galafold (migalastat), an oral precision medicine for patients living with Fabry disease, having amenable genetic variants.

A rare genetic disorder, Fabry disease is caused by various mutations of the enzyme alpha-galactosidase A (alpha-Gal A). Migalastat is a potent, orally available inhibitor of alpha-Gal A.

Galafold has shown a solid uptake since its launch. The product is approved in more than 40 countries, including the United States, Europe and Japan. The drug’s sales have been rising consistently year over year. Amicus recorded sales worth $305 million in 2021. For 2022, Galafold sales are estimated in the range of at least $350-$365 million, suggesting growth of around 20% from the year-ago reported figure.

Last August, Galafold received approval for label expansion in the European Union (EU) for the long treatment of adolescents with Fabry disease. The drug also has a strong IP portfolio in the United States, providing it protection through 2038.

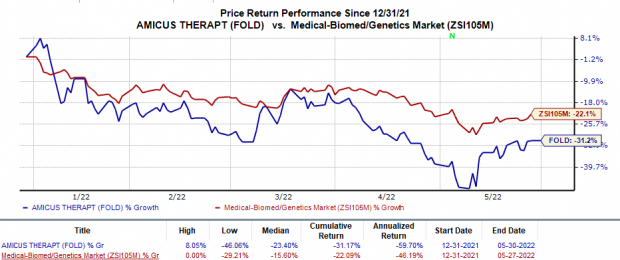

Shares of Amicus have plunged 31.2% so far this year compared with the

industry

’s 22.1% decline.

Image Source: Zacks Investment Research

Amicus also developed its lead pipeline candidate, AT-GAA, as a potential treatment for Pompe disease. The candidate consists of two components, such as cipaglucosidase alfa, an engineered enzyme to enhance lysosomal uptake into cells, and miglustat, a stabilizer of the engineered enzyme. AT-GAA was granted a Breakthrough Therapy designation (BTD) by the FDA in 2019, the first ever such tag granted to an investigational product for Pompe disease.

Amicus has already filed regulatory applications for AT-GAA, comprising a biologics license application (BLA) for cipaglucosidase alfa and a new drug application (NDA) for miglustat, to treat Pompe disease. The filings in both the United States and the EU are based on data from the phase I/II and phase III PROPEL studies as well as the long-term open-label extension study evaluating AT-GAA to address Pompe disease.

Although initially, the FDA decisions on both regulatory filings were expected by mid-2022, the FDA extended the review periods by three months after FOLD submitted additional clinical data on the candidate. The FDA’s decision on the NDA is expected later this year in August while a decision on the BLA is expected by October.Amicus expects the extension to provide it with additional time to allow completion of the pre-license approval inspections required at the WuXi Biologics manufacturing site in China.

As part of Amicus’ long-term commitment toward providing multiple solutions to address the significant unmet needs of the Pompe disease community, it is advancing a next-generation gene therapy as a potential cure for Pompe disease.

Other than AT-GAA, Amicus is developing several gene-therapy programs. While many of these programs are currently being evaluated in preclinical studies, a clinical gene-therapy program is being developed for CLN3, a form of Batten disease, in a phase I/II study. The program is advancing well. In first-quarter 2020, the FDA granted a Fast Track designation to the CLN3 Batten disease gene therapy AT-GTX-502 to treat pediatric patients below the age of 18 years.

Both Fabry disease and Pompe disease are rare indications with high market potential. The incidence of Fabry disease increased tenfold in recent years. Many types of genetic mutations may result in misfolded alpha-Gal A and therefore, may also respond to treatment with monotherapy Galafold. Thus, approximately 35-50% of the Fabry disease patient population may benefit from Galafold as a standalone treatment. However, the entire Fabry disease patient population has potential to gain from Galafold in combination with ERT.

Like Fabry disease, Pompe is a lysosomal disorder, stemming from a deficiency in an enzyme called GAA. Per reported estimates of the Acid Maltase Deficiency Association, the United Pompe Foundation and the Lysosomal Disease Program at Massachusetts General Hospital, there are 5,000-10,000 patients with Pompe disease worldwide.

Amicus also suffered its fair share of setbacks. In first-quarter 2022, FOLD decided to discontinue the CLN6 Batten Disease gene-therapy program development. The decision was based on the review of a long-term extension study data, which determined that any initial stabilization of disease progression at the two-year time point was not maintained. Such setbacks do not bode well for the stock.

Zacks Rank & Key Picks

Amicus currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the same sector are

Abeona Therapeutics

ABEO

,

Alkermes

ALKS

and

Sesen Bio

SESN

. While Sesen Bio currently sports a Zacks Rank #1 (Strong Buy), both Alkermes and Abeo Therapeutics carry a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Sesen Bio’s loss per share estimates for 2022 have declined from 33 cents to 32 cents in the past 30 days. Shares of SESN have declined 35.6% in the year-to-date period.

Earnings of Sesen Bio beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 69.9%. In the last reported quarter, Sesen Bio delivered an earnings surprise of 100%.

Alkermes’ loss per share estimates for 2022 have narrowed from 6 cents to 3 cents in the past 30 days. Shares of ALKS have risen 31.3% year to date.

Earnings of Alkermes beat estimates in each of the last four quarters, the average being 350.5%. In the last reported quarter, Alkermes delivered an earnings surprise of 1,100%.

Abeona Therapeutics’ loss per share estimates for 2022 have narrowed from 33 cents to 31 cents in the past 30 days. The same for 2023 has narrowed from 15 cents to 13 cents in the past 30 days. Shares of ABEO have declined 50.2% in the year-to-date period.

Earnings of Abeona Therapeutics missed estimates in two of the trailing four quarters and met the same on the remaining two occasions, the average negative surprise being 8.2%. In the last reported quarter, Abeona Therapeutics missed on earnings by 25%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report