Amryt Pharma plc

AMYT

announced that the FDA has granted Orphan Drug designation to its marketed product, Mycapssa (oral octreotide), for the treatment of carcinoid syndrome, a common functional syndrome related to neuroendocrine tumors (NETs).

The Orphan Drug designation is granted by the FDA to a drug or biologic intended to treat a rare disease or condition, which generally includes one that affects fewer than 200,000 individuals in the United States.

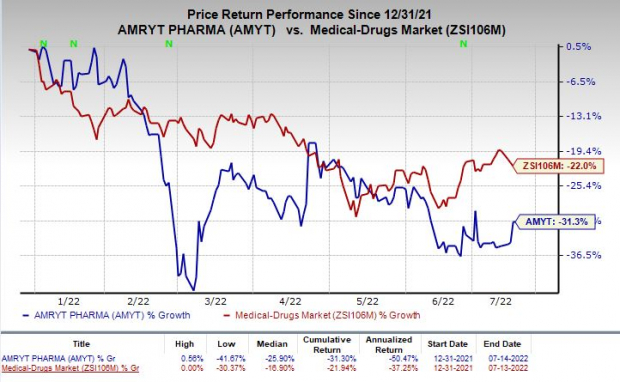

Shares of Amryt were up in pre-market trading on Thursday following the announcement of the news. The stock has plunged 31.3% so far this year compared with the

industry

’s decline of 22%.

Image Source: Zacks Investment Research

Mycapssa is currently approved by the FDA as long-term maintenance treatment for acromegaly patients who have responded to and tolerated injectable treatment with octreotide or lanreotide. The medicine is also under review in Europe.

In the first quarter of 2022, Mycapssa generated revenues of $3.4 million. Successful development and potential approval for additional indications is likely to boost sales for Mycapssa in the days ahead.

Apart from Mycapssa, AMYT’s other marketed drugs include Myalept/Myalepta, Juxtapid/Lojuxta and Filzuvez (Oleogel-S10).

Myalept is approved as replacement therapy to treat leptin deficiency in patients with congenital or acquired generalized lipodystrophy.

Juxtapid is approved for treating homozygous familial hypercholesterolaemia.

Filsuvez is approved in the EU for the treatment of partial thickness wounds associated with junctional and dystrophic epidermolysis bullosa, a rare genetic skin disorder, in patients aged six months and older.

Zacks Rank & Other Stocks to Consider

Amryt currently carries a Zacks Rank #2 (Buy). Other stocks worth considering in the biotech sector are

Leap Therapeutics, Inc.

LPTX

,

Fate Therapeutics, Inc.

FATE

and

Precision BioSciences, Inc.

DTIL

, all carrying the same Zacks Rank #2 at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The Zacks Consensus Estimate for Leap Therapeutics’ loss per share has narrowed 6.9% for 2022 and 2% for 2023 in the past 60 days.

Earnings of Leap Therapeutics have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion. LPTX delivered an earnings surprise of 1.92%, on average.

Fate Therapeutics’ loss per share estimates narrowed 0.9% for 2022 and 0.5% for 2023 in the past 60 days.

Earnings of Fate Therapeutics have surpassed estimates in two of the trailing four quarters and missed the same on the other two occasions. FATE delivered an earnings surprise of -0.72%, on average.

Precision BioSciences’ loss per share estimates narrowed 5.7% for 2022 and 16.2% for 2023 in the past 60 days.

Earnings of Precision BioSciences have surpassed estimates in each of the trailing four quarters. DTIL delivered an earnings surprise of 76.15%, on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report