ANSYS

ANSS

has announced the acquisition of Engineering Simulation and Scientific Software’s (ESSS) subsidiary – Rocky DEM. The acquisition of Rocky is not expected to have a significant impact on Ansys’ financial performance in 2023.

Rocky is a software package that uses the discrete element method (DEM) to simulate the behavior of discrete materials and particle-laden free-surface flows across various verticals. Rocky simulations provide valuable insights to help companies address sustainability concerns and manage their resources effectively.

The acquisition of Rocky will allow Ansys to offer its customers a broader range of engineering simulation software solutions by integrating Rocky’s DEM tools and expertise.

The current acquisition is a continuation of Ansys’s and ESSS’s collaboration in 2021 to develop DEM workflow to effectively analyze particle movement across several industrial applications.

Ansys’ acquisition of Rocky will provide customers with ongoing access to high-quality particle modeling tools seamlessly integrated with other Ansys solutions. This will enable them to solve a wider range of problems involving discrete particles.

In addition, the acquisition will allow Ansys to incorporate Rocky technology into its existing portfolio, creating long-term synergies and enabling the inclusion of Rocky into the PyAnsys framework.

ANSS is the global leader in the high-end design simulation software industry. The company offers simulation solutions for developing next-generation 5G product designs, autonomous vehicles, Internet of Things products and high-performance chips for advanced driver assistance systems.

In October 2022, the company announced that it is set to acquire orbital thermal analysis provider — Cullimore and Ring Technologies or C&R Technologies. The buyout will aid ANSS in bolstering its position in the simulation solutions market, especially in the lucrative Aerospace as well as defense and private space industry verticals.

Though acquisitions have enabled the company to expand its product portfolio, its balance sheet has been negatively impacted in the form of a high level of goodwill and intangible assets, which totaled approximately $4.27 billion or 69.3% of total assets as of Sep 30, 2022.

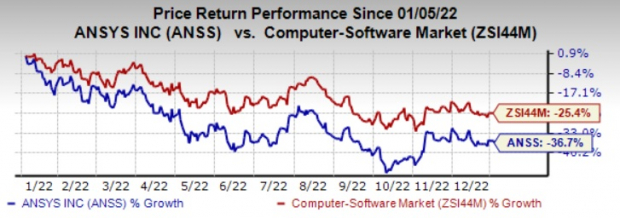

In the past year, shares of ANSYS, carrying a Zacks Rank #3 (Hold), have lost 36.7% of their value compared with the

industry’s

decline of 25.4%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are

Arista Networks

ANET

,

Jabil

JBL

and

Asure Software

ASUR

, each presently sporting a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Arista Networks 2022 earnings is pegged at $4.37 per share, up 0.5% in the past 60 days. The long-term earnings growth rate is anticipated to be 17.5%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 12.7%. Shares of ANET have declined 12.8% in the past year.

The Zacks Consensus Estimate for Jabil’s 2023 earnings is pegged at $8.31 per share, rising 1.6% in the past 60 days. The long-term earnings growth rate is anticipated to be 12%.

Jabil’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 8.9%. Shares of JBL have declined 5.7% in the past year.

The Zacks Consensus Estimate for Asure Software’s 2022 earnings is pegged at 7 cents per share, rising 75% in the past 60 days. The long-term earnings growth rate is anticipated to be 23%.

Asure Software’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 83.3%. Shares of ASUR have soared 22.2% in the past year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report