Apellis Pharmaceuticals, Inc.

’s

APLS

lead drug, Empaveli (pegcetacoplan), has been approved by the FDA as a monotherapy treatment for adult patients suffering from paroxysmal nocturnal hemoglobinuria (“PNH”). The company has seen a strong initial uptake of Empaveli since its approval in May 2021.

A rare blood disorder, PNH is associated with abnormally low hemoglobin levels as the disease destroys red blood cells.

Empaveli is approved for treatment-naïve patients as well as for those switching from Alexion’s [now part of

AstraZeneca

’s

AZN

] C5 inhibitor therapies for PNH, namely, Soliris and Ultomiris (ravulizumab).

AstraZeneca closed the acquisition of rare-disease drugmaker, Alexion, for $39 billion last July.

The Alexion buyout strengthened AstraZeneca’s immunology franchise, adding several drugs that can boost its top-line.

In December 2021, the European Commission approved Aspaveli for the treatment of adult patients with PNH who are anemic after treatment with a C5 inhibitor for at least three months. The drug is marketed under the trade name Empaveli in the United States.

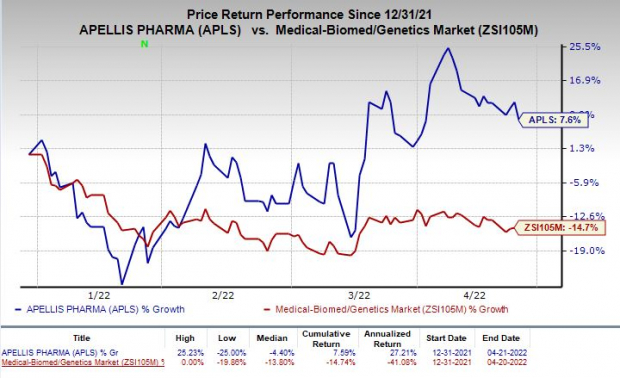

Shares of Apellis have gained 7.6% in the year so far against the

industry

’s decline of 14.7%.

Image Source: Zacks Investment Research

Apart from PNH, Apellis is developing pegcetacoplan with Sobi for other rare diseases.

Pegcetacoplan, as a monotherapy, is being evaluated in two phase III studies, namely, DERBY and OAKS, for treating patients with geographic atrophy (“GA”). Apellis is planning to submit a new drug application or NDA to the FDA for intravitreal pegcetacoplan to treat GA in the second quarter of 2022.

The company is looking to submit a marketing authorization application to the European Medicines Agency for pegcetacoplan to treat GA in the second half of 2022.

The phase II MERIDIAN study is evaluating systemic pegcetacoplan for treating amyotrophic lateral sclerosis or ALS. The company plans to complete enrollment in the study in the first half of 2022. A potential label expansion of the drug for any of the above indications will be a boost to the company’s top line.

Though Apellis has made steady progress so far with Empaveli, we are concerned about the lack of other candidates in the company’s pipeline. Due to the lack of a strong pipeline, the company is heavily dependent on Empaveli for growth. Any regulatory or developmental setback for the drug will hurt the stock. Stiff competition in the target market also remains a headwind.

Zacks Rank & Stocks to Consider

Apellis currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the biotech sector are

Vertex Pharmaceuticals Incorporated

VRTX

and

Voyager Therapeutics, Inc.

VYGR

, both carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The Zacks Consensus Estimate for Vertex’s earnings has been revised 1.7% upward for 2022 and 0.4% upward for 2023 over the past 60 days. The VRTX stock has rallied 28.2% year to date.

Earnings of Vertex surpassed estimates in each of the trailing four quarters.

Voyager Therapeutics’ loss per share estimates have narrowed 38.6% for 2022 and 29% for 2023 over the past 60 days. The VYGR stock has skyrocketed 167.5% year to date.

Earnings of Voyager Therapeutics have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report