Investing in technology stocks will take patience and higher risk tolerance at the moment but the sector’s broader 2022 decline may present great long-term buying opportunities.

Apple

AAPL

and Microsoft

MSFT

, in particular, draw a lot of interest as historically dominant tech companies whose stocks could soar whenever inflationary and recessionary concerns are behind us and interest rates stop climbing.

It will take some time for these risks to subside, but buying AAPL or MSFT stock as we head into 2023 is a worthy conversation.

Recent Developments

Despite beating earnings estimates in four consecutive quarters, Apple stock is now trading near its 52-week lows seen in June. Still, Apple stock has held up better than other big tech peers like Meta Platforms

META

and Amazon

AMZN

this year.

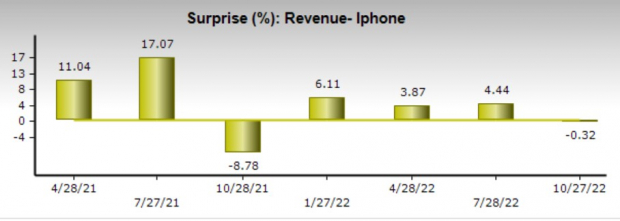

With that being said, as we can see from the nearby chart AAPL’s fiscal fourth-quarter report in October has been a weak period of the year in terms of beating iPhone revenue expectations. This could be compounded by its current fiscal first quarter iPhone production being affected by shutdowns in Foxconn’s Shenzhen City, China Factory.

Image Source: Zacks Investment Research

Foxconn is Apple’s largest iPhone maker and this has led to short-term weakness in the stock as it comes at a critical time during the holiday season. iPhone production is thought to have dropped 30% after Foxconn workers in Shenzhen fled the facility in late October due to Covid-19 outbreaks. Foxconn expects the facility to resume full production in late December or early January and is working to boost production at a nearby facility.

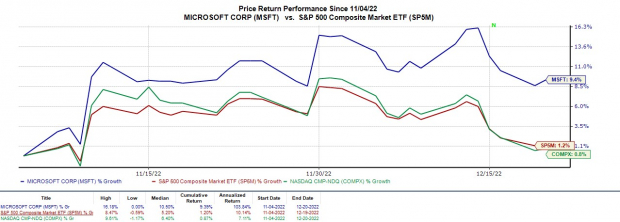

As for Microsoft, MSFT shares have bounced back nicely after reaching a low of $213.43 a share on November 4

th

as shown in the chart below. Like Apple, Microsoft stock has also held up better than the likes of Amazon and Meta Platforms. In regards to the latter, Microsoft has made its push into the metaverse as well. Microsoft’s planned acquisition of Activision Blizzard

ATVI

will help accelerate the growth of its gaming business and provide building blocks for the metaverse.

Image Source: Zacks Investment Research

However, an antitrust lawsuit was filed in early December by the Federal Trade Commission to block the Activision Blizzard acquisition, which was expected to be completed in June of 2023. Microsoft will of course fight the lawsuit.

Performance & Valuation

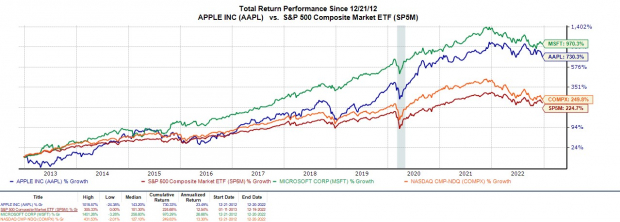

Apple is now down -26% year to date Vs. Microsoft’s -28%. Both APPL and MSFT have outperformed the Nasdaq’s -32% YTD performance but lagged the S&P 500’s -21%. Still, over the last decade, Microsoft and Apple’s total return including dividends has crushed the broader indexes, with MSFT having the edge at +970%.

Image Source: Zacks Investment Research

Trading around $242 per share and roughly 30% from its highs, MSFT has a forward P/E of 25.2X. In comparison, AAPL is 27% from its high and trades at $132 a share and 21.3X forward earnings.

Both stocks are starting to trade attractively relative to their past. Microsoft’s stock trades 33% below its decade high of 37.4X and only 6% above its decade median of 23.7X. When comparing this period, AAPL is 44% off its decade-high of 38.6X but still 36% above its median of 15.6X.

Image Source: Zacks Investment Research

Growth & Outlook

Microsoft earnings are now projected to be up 3% in its current fiscal 2023 and climb another 14% in FY24 at $10.92 per share. It is important to note that earnings estimate revisions have trended down for both FY23 and FY24 over the last 90 days.

Image Source: Zacks Investment Research

On the top line, Microsoft’s sales are anticipated to rise 7% in FY23 and jump 13% in FY24 to $239.40 billion. FY24 would represent a 90% increase from pre-pandemic levels with 2019 sales at $125.84 billion. This is especially impressive for a mature company of Microsoft’s size.

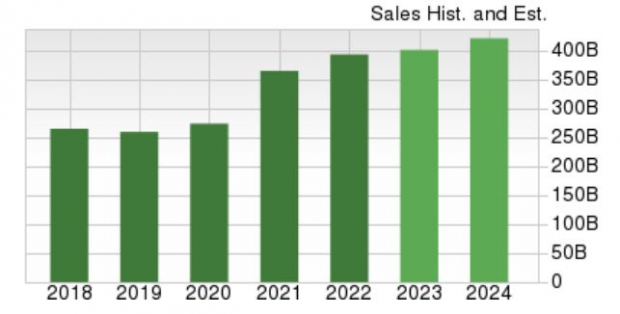

Pivoting to Apple, earnings are expected to rise 1% in its current fiscal 2023 and jump 8% in FY24 at $6.70 a share. Earnings estimates have also trended lower for Apple’s FY23 and FY24 over the last quarter.

Image Source: Zacks Investment Research

Sales are forecasted to be up 2% in FY23 and rise another 6% in FY24 at $427.22 billion. FY24 would represent 64% growth from pre-pandemic levels with 2019 sales at $260.17 billion.

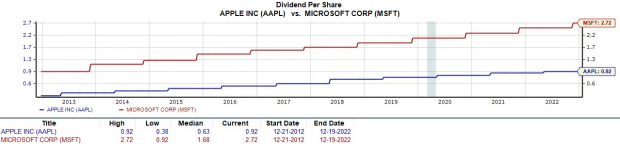

Dividends

Microsoft’s stock appears to be sticking out to this point, and in regard to portfolio income, the trend continues with MSFT’s 1.13% annual dividend yield topping Apple’s 0.70%.

Image Source: Zacks Investment Research

Bottom Line

Apple (AAPL) and Microsoft (MSFT) stock both currently land a Zacks Rank #3 (Hold). Although more short-term weaknesses may be ahead for both companies they are starting to look attractive at their current levels. Microsoft especially stands out from a valuation standpoint. But with these being two unique tech firms and two of the biggest companies on the planet, holding on to or buying both stocks could be rewarding going into 2023.

From a historical performance perspective, holding on to shares of Apple and Microsoft also makes sense after this year’s drop. There might be better buying opportunities ahead but both AAPL and MSFT have crushed the return of broader indexes over the last decade and this could continue considering their long-term growth is still intact.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report