A strategy that’s gained rapid traction over the last several years in the market is stock splits. It’s an exciting announcement that investors can receive that comes with significant benefits.

Earlier in June, the mega-popular EV manufacturer Tesla

TSLA

announced that its board approved a three-for-one stock split, subject to shareholder approval at the company’s annual meeting on August 4

th

.

When Tesla last split its stock in August 2020, shares skyrocketed thanks to an influx of new buyers and increased liquidity. Noting the steep price tag of Tesla shares, the company has decided to split its stock again, making its shares more affordable.

In addition, several other market titans have split their stock in 2022, such as Alphabet

GOOGL

and Amazon

AMZN

. The year-to-date chart below illustrates the share performance of all three companies.

Image Source: Zacks Investment Research

As we can see, it’s been a rough stretch for all three companies.

However, upon shrinking the timeframe to encompass just the last month of price action, we can see that all three companies’ shares have rallied quite notably, signaling buyers have finally started to arrive.

Image Source: Zacks Investment Research

It raises a valid question – are Tesla shares a buy pre-split? Let’s take a closer look to find out.

Tesla

Tesla has repeatedly reported top and bottom-line results above expectations, exceeding both revenue and EPS estimates in nine of its previous ten quarterly reports.

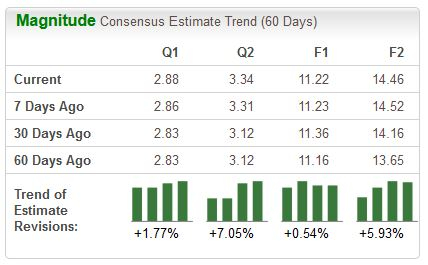

Simply put, the company has been firing on all cylinders, and analysts have taken note – over the last 60 days, analysts have raised their earnings outlook across all timeframes.

Image Source: Zacks Investment Research

In the quarterly report that dropped on July 21

st

, the EV titan recorded a sizable double-digit 25% bottom-line beat in the face of harsh business conditions. Quarterly sales fell just short of expectations by a marginal 0.9% – the company’s only top-line miss over its last ten quarters.

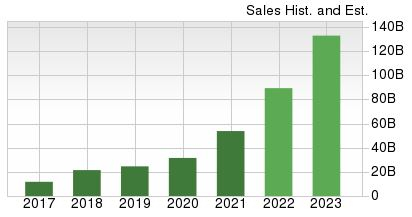

The company has had zero issues with generating serious revenue growth – since 2016, Tesla’s annual revenue has soared by a triple-digit 660%.

In addition, Tesla has grown its annual revenue by double-digit percentages each year since 2012.

Image Source: Zacks Investment Research

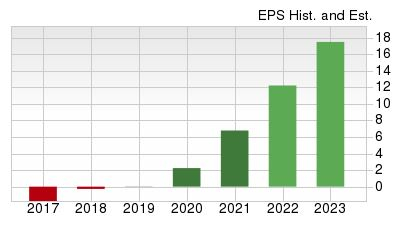

Furthermore, growth estimates are stellar for both the top and bottom-line.

For the current fiscal year (FY22), the EV titan is projected to generate a mighty $85 billion in revenue, notching a double-digit uptick of nearly 60% year-over-year. In FY23, the top-line is forecasted to tack on an additional 35%.

Image Source: Zacks Investment Research

The Zacks Consensus EPS Estimate for FY22 resides at $11.22, penciling in a massive 65% growth in earnings year-over-year. Additionally, the bottom-line is projected to tack on an additional 28% in FY23.

Image Source: Zacks Investment Research

Amazon & Alphabet Splits

Alphabet and Amazon simply announcing their plans for a stock split was enough to send both companies’ shares flying.

On March 9

th

, when the news broke that AMZN would split, shares jumped nearly 6% the next day. GOOGL announced its split during its quarterly earnings in February; shares surged 7.5% the following day.

Simply put, stock splits are bullish catalysts, causing buyers to come in wave after wave.

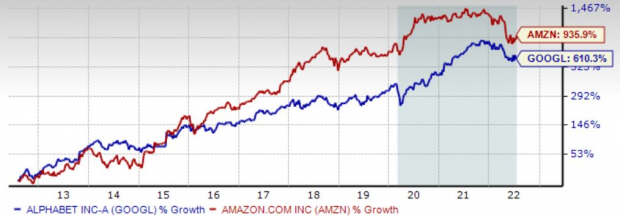

After all, it’s easy to understand why AMZN and GOOGL performed stock splits – look at the chart below. AMZN and GOOGL shares have appreciated immensely over the last ten years, causing the higher share price to limit overall trading volume.

Image Source: Zacks Investment Research

Bottom Line

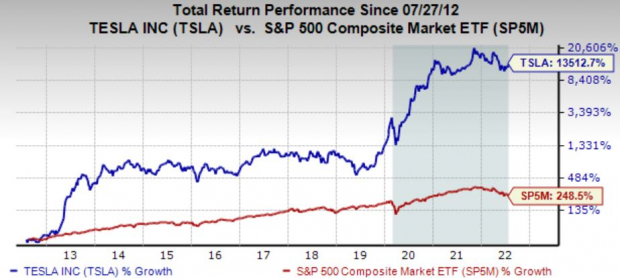

Tesla shares have been among the most rewarding investments over the last decade. If an investor has held TSLA shares for the past decade, they’ve been rewarded with a mind-boggling 13500% gain with an average annualized return of more than 60%.

The return doesn’t even compare to the S&P 500.

Image Source: Zacks Investment Research

Now that TSLA is planning on performing a three-for-one stock split, shares appear even more appealing.

The company has repeatedly reported quarterly results above expectations, enjoys supercharged revenue growth, and the company sports a Zacks Rank #2 (Buy).

For investors that can swallow elevated valuation levels and are looking for a company with serious growth prospects and great momentum, Tesla shares should be at the top of your list.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report