AstraZeneca

AZN

announced that the European Medicines Agency’s (EMA) Committee for Medicinal Products for Human Use (“CHMP”) has recommended the use of Lynparza and Enhertu in certain patients with breast cancer.

The CHMP has recommended the label expansion of AstraZeneca and partner

Merck

’s

MRK

Lynparza for use as a monotherapy or in combination with endocrine therapy as an adjuvant treatment of adult patients with germline BRCA1/2 mutations (gBRCAm) HER2-negative high-risk early breast cancer previously treated with chemotherapy either before or after surgery.

The CHMP recommendation for AstraZeneca and Merck’s Lynparza was based on data from the phase III OlympiA study, which showed that treatment with the drug reduced the risk of cancer recurrence, or death, by 42% in the adjuvant treatment of patients with gBRCAm who have HER2-negative high-risk early breast cancer. The results also show clinically meaningful improvement in overall survival, wherein patients treated with Lynparza treatment demonstrated a statistically significant and clinically meaningful improvement in overall survival. Treatment with the drug reduced risk of death by 32% compared to participants who were treated with a placebo.

Lynparza was approved for a similar indication in the United States in March.

Lynparza is already approved in Europe for the treatment of germline BRCAm, HER2-negative, metastatic breast cancer previously treated with chemotherapy based on results from the phase III OlympiAD study.

Apart from this indication, Lynparza is also approved in Europe for three different cancer types — ovarian, prostate and pancreatic — in various patient populations. Both Merck and AstraZeneca are also evaluating Lynparza in a range of tumor types. In first-quarter 2022, Lynparza generated product sales of $617 million for AstraZeneca and alliance revenues of $266 million for Merck.

In a separate press release, AstraZeneca also announced that the CHMP has recommended the label expansion of its and partner Daiichii Sankyo’s Enhertu for use as a monotherapy for the treatment of adult patients with unresectable or metastatic HER2-positive breast cancer previously treated with an anti-HER2-based regimen. Enhertu was approved for a similar indication in the United States last month.

The positive recommendation for Enhertu is based on data from the phase III DESTINY-Breast04 study, which showed that treatment with the drug reduced the risk of disease progression or death by 72% compared to those who were administered

Roche

’s

RHHBY

Kadcyla (trastuzumab emtansine).

Roche’s Kadcyla is approved in the EU to treat metastatic breast cancer HER2-positive breast cancer in adult patients who have been treated with trastuzumab and a taxane. During first-quarter 2022, sales of Roche’s Kadcyla drug grew 9% year over year driven by new patients switching to the drug for treatment.

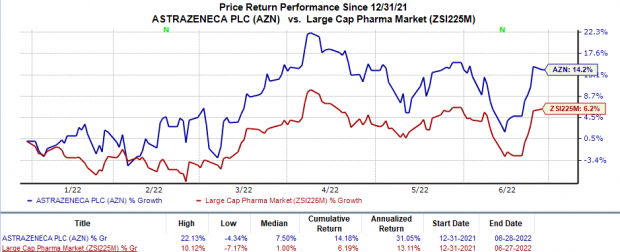

In the year so far, shares of AstraZeneca have risen 14.2% compared with the

industry

’s 6.2% increase.

Image Source: Zacks Investment Research

AstraZeneca expects that a potential approval for Enhertu in the EU will give an opportunity to patients to benefit from using the drug. Based on results from the DESTINY-Breast04 study, AZN believes that Enhertu can become a new standard of care for treating HER2-positive metastatic breast cancer.

AstraZeneca and Daiichii Sankyohave also filed a regulatory application, which is also seeking approval for Enhertu as a treatment for adult patients with locally advanced or metastatic HER2-positive gastric or gastroesophageal junction adenocarcinomawho have been previously treated with an anti-HER2-based regimen. A decision on the same is expected later this year. Both companies are also exploring the potential of Enhertu in earlier lines of treatment as well as in new breast cancer settings.

Zacks Rank & Stock to Consider

AstraZeneca currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the overall healthcare sector is

Sesen Bio

SESN

, which sports a Zacks Rank #1 (Strong Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Estimates for Sesen Bio’s 2022 bottom line have declined from a loss of 46 cents to 44 cents in the past 60 days. Share prices of Sesen Bio have dropped 0.1% in the year-to-date period.

Earnings of Sesen Bio beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 69.9%. In the last reported quarter, Sesen Bio delivered an earnings surprise of 100%.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report