AstraZeneca PLC

AZN

announced that the UK Competition and Markets Authority has allowed the company to close its impending merger with

Alexion Pharmaceuticals, Inc.

ALXN

. The deal is expected to close on Jul 21, 2021.

Last week, AstraZeneca received the European Commission’s permission for the acquisition of Alexion. Back then, the company stated that regulatory clearance in the United Kingdom remains critical to close the deal.

On receipt of the UK approval, AstraZeneca has cleared the final hurdle for the acquisition of Alexion.

The company has already received competition clearances for the above acquisition in the United States, Canada, Japan and several other countries.

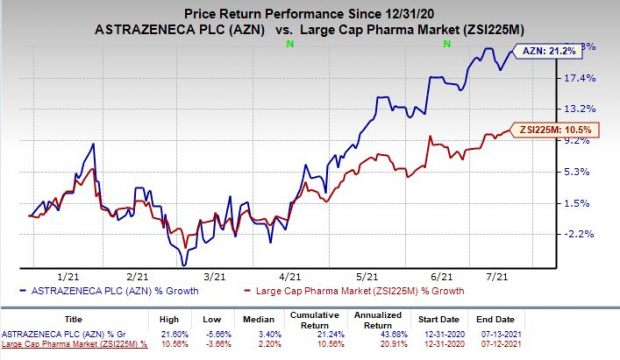

Shares of AstraZeneca have rallied 21.2% so far this year compared with its

industry

’s growth of 10.5%.

Image Source: Zacks Investment Research

AstraZeneca entered into an agreement to acquire Alexion for $39 billion in December 2020. The acquisition will enable AstraZeneca to strengthen its position in immunology. It already has a strong presence in the markets of oncology, cardiovascular, renal and metabolism, and respiratory diseases.

Upon successful completion of the merger, a dedicated business unit will be formed, which will be known as Alexion, AstraZeneca Rare Disease, and will have its headquarters in Boston, MA.

The new AstraZeneca American Depositary Shares will be admitted on the Nasdaq stock market.

We remind investors that Alexion currently markets blockbuster drug Soliris (eculizumab) – a first-in-class anti-complement component 5 (C5) monoclonal antibody – approved for the treatment of patients with paroxysmal nocturnal haemoglobinuria, generalized myasthenia gravis and neuromyelitis optica spectrum disorder. The franchise was further strengthened when Alexion launched Ultomiris (ravulizumab), a second-generation C5 monoclonal antibody with a more convenient dosing regimen.

Rare diseases represent a high-growth disease area with a high unmet medical need. Hence, the acquisition will help AstraZeneca have a broad coverage in highly specialized care and become a leader in immunology and precision medicines.

Zacks Rank & Stocks to Consider

AstraZeneca currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the large-cap pharma sector include

Roche Holding AG

RHHBY

and

Bayer Aktiengesellschaft

BAYRY

, both carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Roche’s earnings estimates have been revised 2.2% upward for 2021 and 1.1% upward for 2022 over the past 60 days. The stock has rallied 10.1% year to date.

Bayer’s earnings estimates have been revised 1.6% upward for 2021 and 3.6% upward for 2022 over the past 60 days. The stock has inched up 1.2% year to date.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report