AstraZeneca

AZN

announced that it has inked a licensing deal with London-based RQ Biotechnology (RQ Bio) for the latter’s portfolio of early-stage monoclonal antibodies (mAbs), which target the SARS-CoV-2, the virus responsible for causing COVID-19 infection.

Per the terms of the agreement, AstraZeneca will acquire a global exclusive license from RQ Bio’s portfolio to develop, manufacture and commercialize mAbs against the SARS-CoV-2 virus. In exchange for these rights, RQ Bio will receive upfront and milestone payments of up to $157 million. In addition, RQ Bio will be eligible to receive single-digit royalties on the future sales of mAbs.

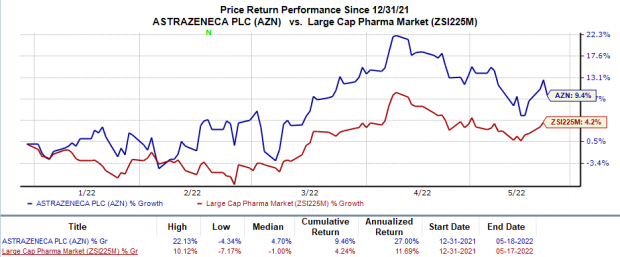

Shares of AstraZeneca have risen 9.5% this year so far compared with the

industry

’s 4.2% increase.

Image Source: Zacks Investment Research

Currently, AstraZeneca markets its own mAb Evusheld, a combination of two long-acting antibodies, namely tixagevimab and cilgavimab, for treating COVID-19 infections. Evusheld is authorized for use in the United States and Europe as pre-exposure prophylaxis (prevention) for COVID-19.

In the present scenario, we note that the fate of antibody treatments in the United States is quite uncertain. Ever since the year began, a number of antibodies that were earlier granted authorization for emergency use by the FDA, later got their status revoked. The FDA reiterated that these antibody treatments lack efficacy against the predominant Omicron variant.

The antibodies with a repealed status by the FDA include

GalxoSmithKline

GSK

/

Vir Biotechnology

’s

VIR

mAb sotrovimab and two separate antibody cocktails developed by

Eli Lilly

LLY

and Regeneron Pharmaceuticals.

Last month, Vir Biotechnology and partner Glaxo

faced a major setback

when the FDA determined that sotrovimab is no longer authorized to treat COVID-19, given its lack of efficacy against the Omicron variant. The news was a big blow to both Vir Biotechnology and Glaxo as the revision will affect the sales of the antibody treatment. In first-quarter 2022, Vir Biotechnology reported collaboration revenues of $1.2 billion from the sale of sotrovimab, per its 2020 partnership agreement with Glaxo.

Both Eli Lilly and Regeneron also faced a similar obstacle in January this year when the FDA

revised

the EUA granted to their respective antibody cocktails. The regulatory agency cited that the antibody cocktails of Eli Lilly and Regeneron are unlikely to be effective against the Omicron variant, the then dominating variant in the country.

In February this year, the FDA had

granted

an EUA to Eli Lilly’s bebtelovimab, another antibody that demonstrated neutralization against the Omicron variant. The antibody treatment is currently authorized by the FDA for treating mild-to-moderate COVID-19 patients at a high risk of disease progression.

Zacks Rank

AstraZeneca currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report