AstraZeneca PLC

AZN

announced that the Japanese Ministry of Health, Labour, and Welfare (“MHLW”) has approved its PD-L1 inhibitor Imfinzi (durvalumab) in combination with CTLA-4 antibody Imjudo (tremelimumab) for two cancer types – advanced liver and lung cancer in Japan.

The regulatory body approved Imfinzi in combination with Imjudo for treating adult patients with unresectable hepatocellular carcinoma (HCC), the most common type of liver cancer, and in combination with chemotherapy for treating adult patients with unresectable, advanced/recurrent non-small cell lung cancer.

The Japanese regulatory authorities also approved Imfinzi as monotherapy for unresectable HCC and curatively unresectable biliary tract cancer in combination with chemotherapy (gemcitabine plus cisplatin).

The latest approvals in Japan were based on significant survival benefits observed in the three phase III studies – HIMALAYA, TOPAZ-1 and POSEIDON.

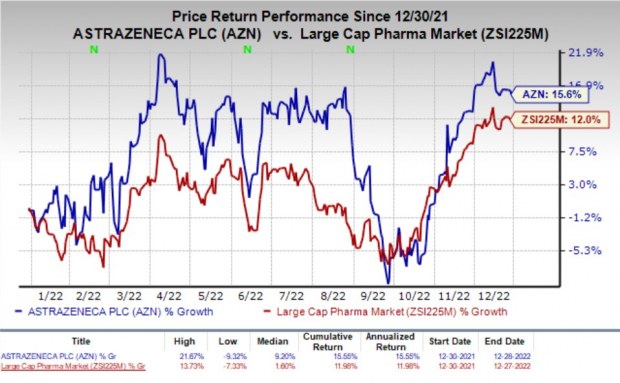

Shares of AstraZeneca have rallied 15.6% in the past year compared with the

industry

’s increase of 12%.

Image Source: Zacks Investment Research

In a separate press release, AZN announced that the MHLW has approved its selective BTK inhibitor, Calquence (acalabrutinib) for the treatment of adult patients with treatment-naïve chronic lymphocytic leukaemia (CLL) (including small lymphocytic lymphoma [SLL]) in Japan.

Calquence is currently approved in Japan for treating adults with relapsed/refractory CLL.

The latest approval for the expanded use of Calquence in Japan was based on positive data from two studies, including the phase III ELEVATE-TN study, which evaluated Calquence for treating adults with treatment-naïve CLL.

Data from the ELEVATE-TN study showed that treatment with Calquence in combination with obinutuzumab or as monotherapy led to a significantly improved progression-free survival versus the chemotherapy-based combination of chlorambucil and obinutuzumab.

Updated data from the study showed that Calquence plus obinutuzumab reduced the risk of disease progression or death by 89% and as a monotherapy by 79% versus chlorambucil plus obinutuzumab.

Please note that Calquence is approved in the United States for the treatment of CLL and SLL and in the EU for treating CLL. The drug is also approved for treating adult patients with mantle cell lymphoma (“MCL”) who have received at least one prior therapy in the United States and other countries worldwide.

Calquence is presently not approved for the treatment of MCL in Japan or the EU.

Zacks Rank & Stocks to Consider

AstraZeneca currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the biotech sector are

Syndax Pharmaceuticals, Inc.

SNDX

,

Celularity Inc.

CELU

and

Repare Therapeutics Inc.

RPTX

, all sporting a Zacks Rank #1 (Strong Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Loss per share estimates for Syndax Pharmaceuticals have narrowed 5.9% for 2022 and 14.5% for 2023 in the past 60 days.

Earnings of Syndax Pharmaceuticals surpassed estimates in three of the trailing four quarters and met the same on the other occasion. SNDX witnessed an earnings surprise of 95.39% on average.

Loss per share estimates for Celularity have narrowed 57.1% for 2022 and 7.7% for 2023 in the past 60 days.

Earnings of Celularity surpassed estimates in three of the trailing four quarters and missed on the remaining occasion. CELU witnessed an earnings surprise of 51.01% on average.

Loss per share estimates for Repare Therapeutics have narrowed 76.1% for 2022 and 0.3% for 2023 in the past 60 days.

Earnings of Repare Therapeutics surpassed estimates in each of the trailing four quarters. RPTX witnessed an earnings surprise of 240.65% on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report