AT&T Inc. (NYSE:T) was the best stock pick for investors in terms of dividend growth a few years ago when the telecom industry was at its full bloom. However, the sentiments of dividend growth investors have now changed for the biggest telecom giant.

The change in sentiment was due to the sluggish growth in AT&T’s dividend. The average dividend growth of 2% from AT&T doesn’t look attractive, especially when there are several other companies offering bigger dividend growth – with steady share price appreciation.

A 14% decline in AT&T’s stock price over the last twelve months has pushed the company’s yield to 6%. AT&T share price is down 5% in the previous three years.

Though AT&T’s 6% dividend yield stands at the higher end of the industry average, this increase wasn’t getting major support from dividend increases. Indeed, the increase in dividend yield was driven by a steady decline in its share price.

Why AT&T’s Dividends and Stock Price are Under Pressure

The lack of support from organic growth has reduced AT&T’s potential to offer significant increases in its dividends over the last couple of years. The company will have to invest a considerable portion of its cash flows for acquisition to sustain its revenue growth.

On the other hand, At&T Inc. has completed several acquisitions over the last three years to support its revenue base. The $80 billion buyout of Time Warner (NYSE:TWX) is the latest on the list.

Despite all these activities, however, the company is facing difficulties in expanding its revenue base.

Free Cash Flows Doesn’t Offer Cover to Dividend Payments

AT&T’s dividend payments are exceeding its free cash flows – which isn’t a good sign for its dividends when the company has to pay $133 billion of debt.

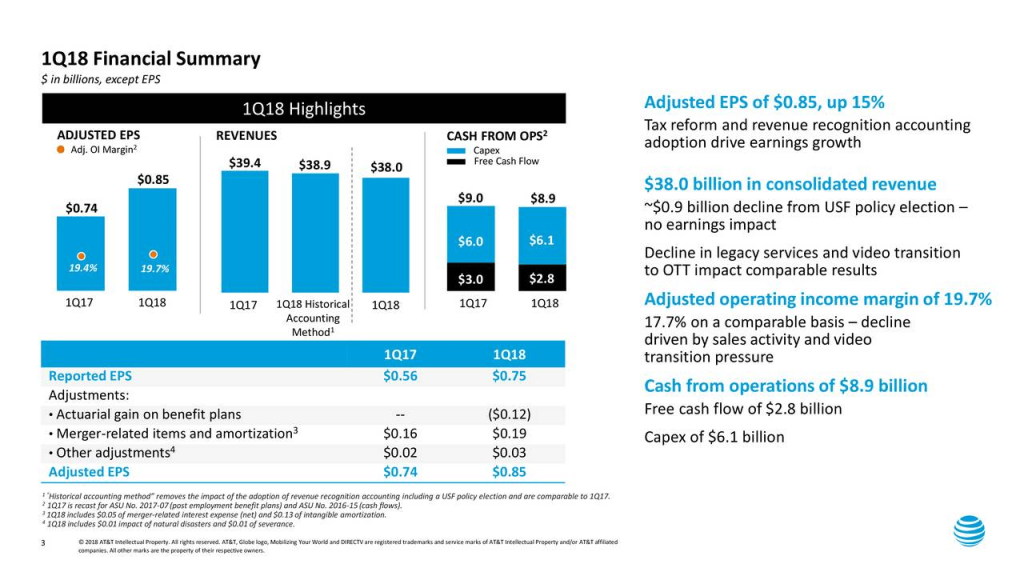

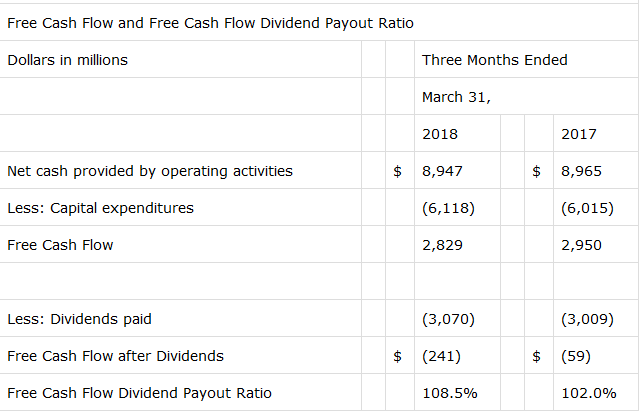

In the first quarter of this year, AT&T generated $2.8 billion in free cash flows, while its dividend payments were standing around $3 billion. The company’s dividend payout ratio based on free cash flows hovers at around 108%, meaning the company isn’t in a position to fund any dividend payments from internal cash generation.

>> Cisco System Inc. Shares are Steadily Moving Higher – Here’s Why

Featured Image: Depositphotos/© pinkblue