Last week, the European Automobile Manufacturers Association released data for commercial car registrations for December and full-year 2021. The European Union (EU) commercial vehicle market contracted 8.4% in December to 155,963 units, representing the sixth straight month of decline. For the full year, however, commercial vehicle registrations in the EU increased 9.6% to 1,880,682 units. In 2021, while registrations in Spain inched down 2.8% year over year, the three other key EU markets, i.e., Italy, Germany, and France, witnessed yearly growth of 15.5%, 0.6%, and 7.8%, respectively.

Meanwhile, fourth-quarter 2021 earnings for the auto sector kicked off last week. Trucking giant

PACCAR Inc.

PCAR

and electric vehicle behemoth

Tesla

TSLA

delivered a comprehensive beat and recorded a year-over-year surge in their earnings and revenues. Meanwhile,

Oshkosh Corporation

’s

OSK

earnings for the three months ended Dec 31, 2021 missed expectations and decreased from the year-ago period.

Autoliv

’s

ALV

fourth-quarter earnings met estimates, while

Gentex Corporation

’s

GNTX

EPS surpassed estimates by a whisker.

Inside the Headlines

1.

PACCAR

reported earnings of $1.47 per share for fourth-quarter 2021, topping the Zacks Consensus Estimate of $1.31 and rising from the year-ago figure of $1.17. Higher-than-expected pre-tax profits across all segments resulted in the outperformance. Consolidated revenues (including trucks and financial services) came in at $6,686.1 million, up from $5,568.6 million recorded in the corresponding quarter of 2020. Sales from Trucks, Parts and Others came in at $6,295.7 million, beating the consensus mark of $5,383.4 million.

PACCAR’s cash and marketable debt securities amounted to $4,813 million as of Dec 31, 2021, compared with $4,834 million on Dec 31, 2020. For 2022, capex is projected at $425-$475 million, while R&D expenses are estimated in the $350-$400 million band. (

PACCAR Q4 Earnings & Revenues Top Estimates, Rise Y/Y

)

2.

Tesla

reported fourth-quarter 2021 earnings of $2.54, which surpassed the Zacks Consensus Estimate of $2.11. A higher-than-expected automotive gross profit resulted in this outperformance. Precisely, automotive gross profit came in at $4,882 million, topping the consensus mark of $4,254 million. The bottom line also compared favorably with the year-ago earnings of 80 cents a share. Total revenues came in at $17,719 million, beating the consensus mark of $16,070 million. The top line also witnessed year-over-year growth of 65%.

Tesla had cash and cash equivalents of $17,576 million as of Dec 31, 2021 compared with $16,065 million on Sep 30, 2021. Long-term debt and finance leases — net of current portion on Dec 31, 2021 — totaled $5,245 million, down from $6,438 million on Sep 30, 2021. Tesla generated free cash flow of $2,775 million during the quarter, up 48.5% year on year. (

Tesla Q4 Earnings & Sales Beat, FCF Jumps 49% Y/Y

).

3.

Oshkosh

reported adjusted earnings of 9 cents per share for the three months ended Dec 31, 2021. The metric missed the Zacks Consensus Estimate of 19 cents. Higher material and logistics costs and an adverse product mix affected the company’s income. The bottom line also decreased from $1.01 recorded in the three months ended Dec 31, 2020.

In the quarter under review, consolidated net sales jumped 13.7% year over year to $1,791.7 million on the back of a rebound in demand in the Access Equipment segment in North America. The top line outpaced the Zacks Consensus Estimate of $1,757 million. Steered by robust customer demand, significant backlog price realization and improved input costs, Oshkosh laid down fiscal 2022 earnings per share expectation in the range of $5.75-$6.75 and net sales projection within $8.0-$8.5 billion.

Oshkosh Q4 Earnings Fall Short of Estimates, Sales Beat (Revised)

4.

Gentex

reported fourth-quarter 2021 earnings of 35 cents per share, marginally topping the Zacks Consensus Estimate of 34 cents. Higher-than-expected auto-dimming mirror shipments in North America and international markets resulted in the outperformance. The reported figure compares unfavorably with the prior-year quarter’s earnings of 58 cents. This Zeeland-based automotive products supplier reported net sales of $420 million, on par with the Zacks Consensus Estimate. The top line fell 20.8% year over year.

Light vehicle production in Gentex’s primary markets is expected to increase 8% for 2022 from the year-ago period. Gentex envisions 2022 net sales in the band of $1.87-$2.02 billion. Capital expenditure is envisioned in the band of $150-$175 million. Operating expenses are estimated within $230-$240 million. For 2023, GNTX expects sales growth of 15-20% year over year. (

Gentex’s Q4 Earnings Surpass Estimates, Revenues Meet

)

5.

Autoliv

reported fourth-quarter 2021 adjusted earnings of $1.30 per share, on par with the Zacks Consensus Estimate. The bottom line fell 40.6% from $2.19 per share recorded in the year-ago quarter. The company reported net sales of $2,119 million in the quarter, which missed the Zacks Consensus Estimate of $2,249.7 million. The top line also declined 15.8% from the prior-year’s $2,516.8 million.

Autoliv had cash and cash equivalents of $969 million as of Dec 31, 2021, down 17.7% year over year. Long-term debt totaled $1,662 million, decreasing 21.2% from $2,110 million as of Dec 31, 2020. With a forecast of 9% growth in light vehicle production aided by a positive regional mix and product launches, ALV expects to grow organically by around 20% in 2022, generating an adjusted operating margin of 9.5% for full-year 2022. (

Autoliv Meets Q4 Earnings Estimates, Hikes Dividend

)

Price Performance

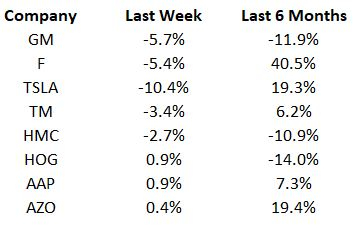

The following table shows the price movement of some of the major auto players over the past week and six-month period.

Image Source: Zacks Investment Research

What’s Next in the Auto Space?

Industry watchers will keep a tab on U.S. vehicle sales for the month of January. Investors are also awaiting the quarterly releases of a host of auto biggies that are slated to report this week. Meanwhile, stay tuned for any update on how automakers will tackle the semiconductor shortage and make changes in business operations.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

As one investor put it, “curing and preventing hundreds of diseases…what should that market be worth?” This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report