Last week, many auto biggies released U.S. vehicle sales data for the month of November 2022. Among the automakers that revealed monthly sales numbers, Toyota, Mazda, Hyundai, Kia, Subaru and Volvo registered year-over-year gains, while Ford and Honda posted a decline in sales. Per Motor Intelligence, the seasonally adjusted annualized rate of sales reached 14.4 million in November, up from 12.9 million recorded in the year-ago period but down from 15.3 million in October.

On the news front,

Lithia Motors

LAD

boosted its portfolio with the acquisition of Meador CDJR dealership in Dallas-Fort Worth.

Cummins Inc.

CMI

also powered its prospects with the purchase of Siemens Commercial Vehicles business. Banking on the soaring popularity of green vehicles, legacy automakers, including

General Motors

GM

and

Ford

F

, announced the investment of additional funds in their EV facilities to boost production.

Stellantis

STLA

and Qinomic partnered for sustainable electric retrofitting solutions for LCVs. The company also announced that it would launch Ram 1500 BEV Concept and Peugeot Inception Concept at the CES event in 2023.

Last Week’s Top Stories

Lithia

bolstered its footprint in Texas with the purchase of Meador Chrysler, Dodge, Jeep, Ram (“CDJR”), the second largest CDJR dealership in the Dallas/Fort Worth area. Meador CDJR is in Fort Worth and serves the greater Dallas-Fort Worth area. Lithia expects the dealership to generate more than $200 million in annualized revenues, bringing LAD’s total expected annualized revenues acquired in 2022 to more than $3.3 billion. The acquisition is part of LAD’s nationwide network expansion initiative under the company’s 2025 plan, where it has set a target to reach $50 billion in revenues and EPS in the range of $55-$65.

Lithia’s strategic buyouts are helping the auto retailer increase its market share and boost its portfolio. The spree of acquisitions brought Lithia’s total expected annualized revenues acquired to $7 billion in 2021, keeping it ahead of schedule laid out in the five-year plan rolled out in July 2020. Its total expected annualized revenues acquired in 2022 have reached $3.3 billion.

Cummins

announced that it completed the acquisition of Siemens Commercial Vehicles business, a top supplier of high-performance electric drive systems for commercial vehicles. The acquired business will report through Cummins New Power business unit.Cummins is enthusiastic about the acquisition and looking forward to bringing innovation in its key technologies. The buyout also reflects another key milestone as it bolsters Cummins’ strategy to reach net-zero emissions by 2050.

The acquisition contributes to Cummins’ capabilities in direct drive and transmission-based remote mount electric motors, inverters, software and related services, critical for the next generation of electric powertrains. The buyout will also add nearly 200 employees, primarily in Germany, China and the United States, which will expand its scope of offering global customers with a wider range of electrified product solutions across commercial vehicle applications.

Ford

announced plans to invest an additional $180 million in its Halewood EV powertrain facility in northern England. In October, F announced an investment of $280 million to transform its Halewood transmission facility to build electric power units for future European Ford passenger and commercial EVs. Production is scheduled to begin in 2024. The current flow of fresh funds will boost annual production at the plant to 420,000 units per year, up from 250,000 previously, an increase of 70% in factory output. This, in turn, will supply powertrains to many European Ford models by 2026.

Ford’s much-celebrated Mustang Mach-E SUV reached an important milestone last week as the company produced its 150,000th order since the start of production in late 2020. The all-electric Mustang Mach-E was globally launched in 2019 and became one of the several highly anticipated EV releases and ushered in a new generation of vehicles. Since then, it has become one of the best-selling EVs in the United States and globally.

Stellantis

and Qinomic, a high-tech company specializing in innovative and sustainable solutions, are partnering for mobility to create a proof of concept. The aim is to convert internal combustion engine light commercial vehicles (LCV) to electric drivetrains while maintaining OEM quality and specifications like safety, durability and type approval.

Stellantis is set to launch Ram 1500 Revolution Battery Electric Vehicle (BEV) Concept and the Peugeot Inception Concept in early January. Equipped with advanced technology features and the BEV-by-design body-on-frame architecture, the Ram Revolution BEV Concept is a pioneering and futuristic model promising to bring a breakthrough in the pickup truck segment. The Peugeot Inception Concept brings the next generation of cockpit platforms to re-invent the whole automobile experience, redesign the interior space and reshape driving gestures around the next generation of the Peugeot i-Cockpit.

General Motors

and LG energy will invest another $275 million in the battery plant in Tennessee. In April 2021, the companies had announced an investment of $2.3 billion to build a 2.8 million sq ft facility. Production at the plant will start in late 2023.

The additional $275 million investment is likely to boost the output by more than 40%. It is expected to ramp up the capacity from 35 gigawatt-hours to 50 GWh once the plant is fully functional. Tim Herrick, GM’s vice president of EV Launch Excellence said, “By expanding battery cell output at Ultium Cells Spring Hill, this investment will help GM offer customers the broadest EV portfolio of any automaker and further solidifies our path toward U.S. EV leadership.”

GM currently carries a Zacks Rank #3 (Hold).You can see

the complete list of today’s Zacks Rank #1 (Strong) stocks here

.

Price Performance

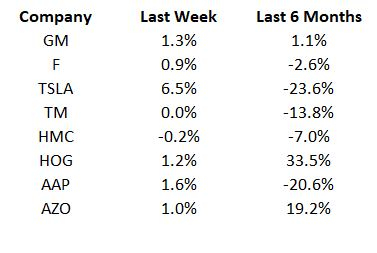

The following table shows the price movement of some of the major auto players over the last week and six-month period.

Image Source: Zacks Investment Research

What’s Next in the Auto Space?

Industry watchers will track China vehicle sales data for November 2022, which is likely to be released by the China Association of Automobile Manufacturers this week.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report