Last week, the European Automobile Manufacturers Association (“ACEA”) released data for passenger car registrations made in May 2021. New car registrations surged 53.4% year over year to 891,665 units. While Spain performed exceptionally well, registering triple-digit percentage gains in May; Italy, France and Germany also witnessed strong double-digit growth. Registrations in major markets including Spain, Germany, France and Italy soared a whopping 177.8%, 37.2%, 46.4% and 43%, respectively. However, last month’s results compared unfavorably with 1.2 million cars sold in May 2019.

On the news front, U.S. auto bigwigs

General Motors

GM

and

Ford

F

provided updates on their electric vehicle (EV) strides. While General Motors made headlines by entering into an alliance with Wabtec Corporation and boosting e-mobility investment plans, Ford’s decision to acquire Electriphi and electrify the entire Lincoln fleet by 2030 generated buzz. On the flip side, the two automakers also issued safety recalls. Ford issued recalls for select 2021 super duty vehicles over defective front axles. The recall affected 17,616, 1,779 and 231 vehicles in the United States, Canada and Mexico, respectively. General Motors will recall more than 282,000 new vehicles over an airbag warning light failure. The affected vehicles were manufactured in 2021 itself, and include the Buick Envision, Cadillac CT4 and CT5, Cadillac Escalade and Escalade ESV, Chevrolet Corvette, Suburban and Tahoe, and GMC Yukon and Yukon XL.

While General Motors currently sports a Zacks Rank #1 (Strong Buy), Ford carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Last Week’s Top Stories

General Motors

announced its decision to enter into a

partnership with Wabtec

for developing and supplying the Ultium battery technology and Hydrotec hydrogen fuel cell systems for Wabtec freight locomotives. The U.S. auto giant — which is

pulling out all the stops to demonstrate its EV prowess

— also boosted electric and driverless investment to $35 billion through 2025, up from $27 billion proposed in November 2020. Part of the additional investment would be allocated toward the establishment of two new battery plants. General Motors plans to set up two new battery cell manufacturing plants in the United States by mid-decade, in addition to facilities in Ohio and Tennessee.

Ford

announced that it is

set to acquire Electriphi

, a California-based start-up providing battery management and fleet monitoring software for EVs. The acquisition is likely to conclude this month. With the takeover, Electriphi will be integrated into the newly-established Ford Pro global business unit, which is committed to redefining the market for commercial vehicles and services. Meanwhile, the automaker projects second-quarter 2021 adjusted EBIT to surpass expectation and be significantly better than the year-ago period. In a separate development, Lincoln — Ford’s luxury marque — announced plans to transit half of its sales to carbon-free vehicles by mid-decade and

electrify the entire portfolio

of vehicles by 2030.

Lordstown

’s

RIDE

founder, chairman and chief executive officer Steve Burns and chief financial officer Julio Rodriguez voluntarily resigned in the

latest setback for the electric truck maker

. The firm failed to provide a plausible explanation for the departure of Burns and Rodriguez. Meanwhile, Angela Strand — Lordstown’s lead independent director — has been appointed as the executive chairwoman and would oversee the firm’s transition until a permanent replacement is found. Becky Roof would take up the role of interim CFO, effective immediately. Also, the company named John R. Whitcomb as Vice President, Global Commercial Operations, effective Jun 21, 2021.

Lithia Motors

LAD

reported record revenues

of $2.1 billion for the month of May 2021. Total revenues for May 2021 surged 89% and same-store sales increased 26% from the pre-pandemic 2019 levels. The top line skyrocketed 104% and total same-store sales jumped 42% from the same period last year. The auto retailer also announced the acquisition of five dealership locations across Texas. The buyout is anticipated to add $350 million in combined annualized revenues. The takeover also raises the automotive retailer’s total revenues acquired to a whopping $7.5 billion annually, since the rollout of its five-year plan.

Price Performance

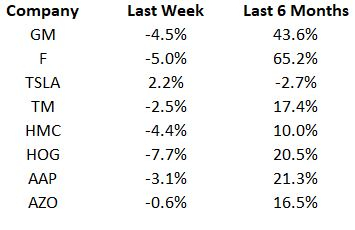

The following table shows the price movement of some of the major auto players over the past week and six-month period.

Image Source: Zacks Investment Research

In the past six months, all stocks but

Tesla

TSLA

have increased, with Ford being the maximum gainer. Over the past week, all stocks but Tesla decreased, with Harley-Davidson losing the most.

What’s Next in the Auto Space?

Industry watchers will keep a tab on May commercial vehicle registrations, to be released by the ACEA this week. Also, investors are awaiting the quarterly results of

Winnebago

WGO

and

CarMax

KMX

, which are scheduled to report this week.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report