Axsome Therapeutics, Inc.

AXSM

received a big boost when the FDA approved its lead pipeline candidate AXS-05, under the trade name Auvelity, for treating adults with major depressive disorder (MDD) in August, making it the first approved drug in its portfolio.

Post approval, Auvelity became the first and only oral rapid-acting drug approved for the treatment of MDD, exhibiting statistically significant antidepressant efficacy against placebo, starting at week one.

Auvelity was commercially launched in October 2022. Axsome is expected to announce the first sales of Auvelity at its fourth quarter conference call in February/March 2023.

The company is also developing AXS-05 for various central nervous system disorders.

In November 2022, AXSM announced positive data from the phase III ACCORD study evaluating AXS-05 for treating Alzheimer’s disease (AD) agitation.

Data from the same showed that treatment with AXS-05 led to statistically significant delayed time for the relapsing of AD agitation compared to placebo – the study’s primary endpoint. Treatment with AXS-05 also statistically significantly prevented relapse of AD agitation versus placebo – the secondary endpoint of the study.

The target market represents a massive opportunity. If the study progresses well, a potential label expansion of AXS-05 will majorly boost the drug’s sales.

AXS-05 is also being investigated in the phase II MERIT study to address patients with treatment-resistant depression and a candidate for smoking cessation.

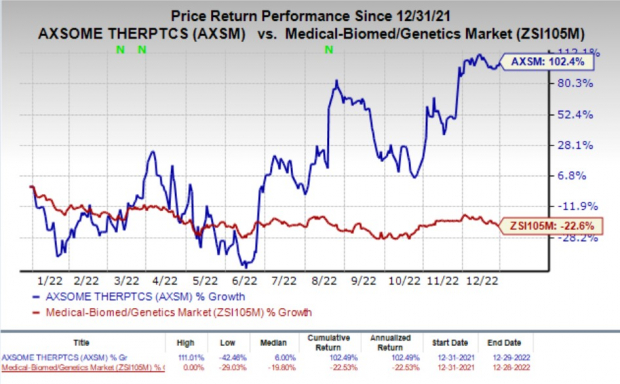

Shares of Axsome have soared 102.4% in the past year against the

industry

’s decline of 22.6%.

Image Source: Zacks Investment Research

Axsome’s other lead candidate, AXS-07, is being developed for the acute treatment of migraine.

The company received a complete response letter from the FDA for the NDA, seeking approval for AXS-07 for the migraine indication in May. The company held a Type A meeting with the FDA to discuss Axsome’s approach to its planned resubmission of the NDA. Following the meeting, the company intends to resubmit its NDA in the third quarter of 2023. The FDA has not requested any additional safety or efficacy data for the candidate in light of the NDA resubmission.

Axsome’s other central nervous system (CNS) pipeline candidates are also progressing well.

Meanwhile, AXSM acquired Sunosi (solriamfetol) from

Jazz Pharmaceuticals

JAZZ

in May 2022. The acquisition strengthened Axsome’s neuro portfolio and transformed the company into a revenue-generating entity before the approval of Auvelity.

JAZZ’s Sunosi is approved as a treatment to improve wakefulness and reduce excessive daytime sleepiness in adults with narcolepsy or obstructive sleep apnea. Sunosi is currently marketed in the United States, Europe and several other countries.

Though Axsome is riding on the successful acquisition of Sunosi and the FDA’s approval for Auvelity, competition looms large on the company in the target market as many companies are developing treatments to address various CNS disorders. One such company is

Acadia Pharmaceuticals

ACAD

, which is currently developing Nuplazid (pimavanserin) in several studies targeting different CNS indications.

ACAD’s Nuplazid is already approved for hallucinations and delusions associated with Parkinson’s disease psychosis. Acadia is also studying pimavanserin for the treatment of other CNS disorders,

Zacks Rank & Stocks to Consider

Axsome currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the biotech sector is

Syndax Pharmaceuticals, Inc.

SNDX

, which has a Zacks Rank #1 (Strong Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Loss per share estimates for Syndax Pharmaceuticals have narrowed 5.9% for 2022 and 14.5% for 2023 in the past 60 days.

Earnings of Syndax Pharmaceuticals surpassed estimates in three of the trailing four quarters and met the same on the other occasion. SNDX witnessed an earnings surprise of 95.39% on average.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the

Zacks Top 10 Stocks

portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report