Badger Meter, Inc

.

BMI

reported earnings of 57 cents per share for second-quarter 2022, beating the Zacks Consensus Estimate of 53 cents. Also, the bottom line compares favorably with the year-ago quarter’s earnings of 48 cents.

Net earnings in the reported quarter were $16.7 million compared with $14 million in the year-ago quarter. The year-over-year improvement can be primarily attributed to higher revenues.

Revenues

Quarterly net sales increased to $137.8 million from $122.9 million in the year-ago quarter. The 12.2% rise was primarily due to record order rates, driven by robust customer demand, effective supply chain management and continued price realization, partly offset by inflationary cost pressure and supply-chain challenges.

Also, the top line beat the consensus mark of $135.5 million.

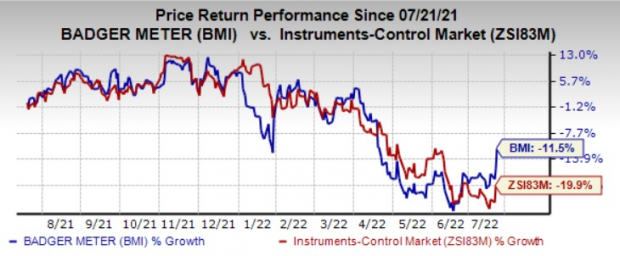

Following the announcement, shares of the company jumped 5.5% on Jul 20, 2022 and closed the session at $87.26. In the past year, shares are down 11.5% compared with the Zacks

sub-industry’s

decline of 19.9%.

Image Source: Zacks Investment Research

Segmental Performance

In the quarter under review, utility water sales soared 14%, owing to strong order momentum. Also, strength in ultrasonic meters, ORION Cellular endpoint sales and higher BEACON Software-as-a-Service revenues acted as major tailwinds. Supply chain disruptions partly offset this.

Flow instrumentation sales increased 4% year over year, driven by continued strong order trends across the majority of end-market applications globally. However, it was partly offset by supply chain woes, which impacted manufacturing output.

Other Details

During the June quarter, gross profit was $54.8 million, up 9.3% from $50.1 million in the year-earlier quarter. The gross margin was 39.7%, down from 40.8% recorded in the prior-year quarter. This downside in the margin was primarily due to rising material, logistics and other costs. Operating earnings were $22.1 million or 16% of sales compared with respective tallies of $18.7 million and 15.2% in the year-earlier quarter.

Selling, engineering, and administration (SEA) expenses were $32.7 million or 23.7% of sales compared with $31.4 million or 25.6% in the prior-year quarter. Effective spending controls and higher sales mainly drove the year-over-year improvement in SEA expense leverage.

Cash Flow & Liquidity

During the second quarter of 2022, Badger Meter generated $19.7 million of net cash from operating activities compared with $14.5 million a year ago. As of Jun 30, 2022, the company had $100.2 million of cash and cash equivalents and $97.3 million of total current liabilities compared with the respective tallies of $87.2 million and $82.1 million, as of Dec 31, 2022.

Zacks Rank & Stocks to Consider

Badger Meter currently has a Zacks Rank #3 (Hold)

Some better-ranked stocks from the broader technology space are

Aspen Technology

AZPN

,

Synopsys

SNPS

and

Broadcom

AVGO

. Broadcom sports a Zacks Rank #1 (Strong Buy) whereas Aspen Technology and Synopsys carry a Zacks Rank #2 (Buy).You can see

the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Aspen Technology’s 2022 earnings is pegged at $5.49 per share, increasing 0.4% in the past 60 days. The long-term earnings growth rate is anticipated to be 16.3%.

Aspen Technology’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 4.1%. Shares of AZPN have soared 25.1% in the past year.

The Zacks Consensus Estimate for Synopsys 2022 earnings is pegged at $8.67 per share, unchanged in the past 60 days. The long-term earnings growth rate is anticipated to be 19.6%.

Synopsys earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 2.7%. Shares of SNPS have jumped 18.8% in the past year.

The Zacks Consensus Estimate for Broadcom’s fiscal 2022 earnings is pegged at $37.06 per share, up 3.9% in the past 60 days. AVGO’s expected long-term earnings growth rate is 14.5%.

Broadcom’s earnings beat the Zacks Consensus Estimate in all the preceding four quarters, with the average being 2.2%. Shares of AVGO have gained 6.9% in the past year.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report