Throughout history, silver has been noted as one of the most important metals for monetary exchange as well as ornamentation purposes. While there are no current currencies today that is using silver as its precious metal backed currency, demand for silver has recently rose. As a result, silver investing is now gaining traction. The rise in demand for silver is due to a variety of factors.

Silver as an investment is looking like a smart move among investors as people begin to lose confidence in flat currencies — especially the U.S. dollar. As fiat currencies continue to fall in value, demand in silver could rise, because like gold, it has a rather stable monetary value. The precious metal is also used by investors to protect their portfolios from fiat currency falls. Furthermore, silver is an attractive option due to its cheaper price when compared to other precious metals, on a per ounce price basis. Unlike gold, silver can be bought by the average investor.

As well, silver has various industrial used. Unlike gold, the metal has seen increased uses in a number of applications from batteries and other electronics to medical and photographic materials. This means that even if currencies remain stable, the demand for silver still have the potential to remain high.

If you are an investor seeking to learn more about silver investing or how you can make silver as an investment, below are some ways one can invest in silver.

Silver ETFs

ETF stands for exchange-traded funds, and is quite a popular option for silver investing. This is because silver ETFs have low expenses and do not include all the complexities that goes into finding physical storage for actual silver.

Make sure you get proper silver investing advice before investing in an ETF, as there are many silver ETFs available. Some ETFs use physically-backed funds, while others have more of a focus on silver futures contracts. For U.S. investors, a couple silver ETFs you can choose from include ISE Junior Silver ETF, iShares Silver Trust, Physical Silver Shares, and PowerShares DB Silver.

There are also a number of inverse and leveraged silver ETFs available for investors, including AGQ (2x daily long) and ZSL (2x daily short). Additionally, Global X Silver Miners ETF is an ETF that is moreso focused on stocks of companies that are engaged in the extraction and/or production of silver.

Silver Futures

If you have had long-term experience in investing in stocks as well as some exposure to futures trading, perhaps silver futures is you first step into silver investing. SIlver futures are traded under the ticker SI, on the COMEX division of the NYMEX. The futures contracts traded on the NYMEX are typically priced in U.S. dollar and cents per troy ounce, and the contract size is around 5,000 troy ounce of silver.

Trading is done for delivery during the current calendar month, the next two calendar months, any January, March, May, and September falling within a 23-month period beginning with the current month, and/or any July and December falling within a 60-month period beginning with the current month.

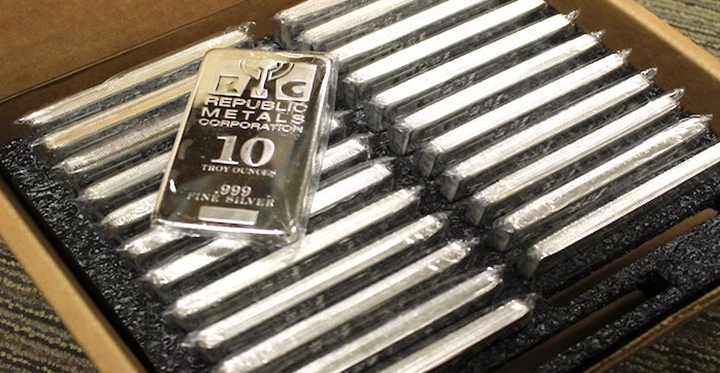

Physical Silver

Although it is generally cheaper than gold, silver holds a relatively high monetary value per kilogram or pound. This makes physical silver as an investment to be quite practical. Web-based bullion dealers and trade shows are just some of the ways one can buy physical silver bars and/or silver coins.

Investing in physical silver can also be done through certain ETFs. Underlying holdings of products like SLV and SIVR are silver bars stored in vaults.

Silver Stocks

Silver as an investment can also be achieved through stocks of companies that have a hand in the extraction and production of the precious metal. Keep in mind, though, that many of these mining companies also extract other metals besides silver, thus stock prices can be impacted by the price of other precious and/or industrial metals.

However, a handful of publicly-traded companies that exclusively focus on silver do exist, and they include, but are not limited to:

- Silver Wheaton Corporation ($SLW)

- Pan American Silver Corp. ($PAAS)

- Silvercorp Metals ($SVM)

- Silver Standard Resources ($SSRI)

- First Majestic Silver Corp ($AG)

If you wish to have silver investing that is not affected by other prices, these are some of the companies to consider investing in.

Featured Image: twitter