Mr. Keith Neumeyer has made a name for himself since the early 1980s. Nicknamed “Mr. Silver” for his experience in the industry, Mr. Neumeyer is now turning to zinc as his next big bet.

In a conversation with Lior Gantz, editor at the Wealth Research Group, Mr. Neumeyer mentioned that the zinc-focused company he was following “could gain more than 250% in a year’s time.” As a sizable shareholder, Mr. Neumeyer continues to increase his investment position in the open market, as well as through the company’s recent private placement financing.

High potential upside of Zinc One (TSX-V:Z & OTCMKTS:ZZZOF)

1. Heavy Interest In the Industry

Mr. Keith Neumeyer, sees Zinc One as an undervalued stock. As such, Mr. Neumeyer is aggressively adding to their position as the shares currently trade under CAD $0.45.

2. Project Funding

Zinc One just announced the completion of private placement financing worth CAD $10 million. This provides the company with funds to advance their flagship project Bongara, which is a high-grade zinc field recently acquired through their acquisition of Forrester Metals. The plans in place are to expand Bongara into a producing mine in 2-3 years time. All of this is ideal, as stocks that are in late stage project development tend to garner attention from investors.

3. Management and Strategy

As a seasoned miner, CEO, Jim Walchuck brings a wealth of experience to the table. Mr. Walchuck has not only managed mining for Barrick Gold in Tanzania, but has also supervised the construction of a multi million-ounce underground mine. Additionally, Zinc One’s strategy means quick value, as their goal is to purchase high grade “close to complete” assets, and turn them into commercial producers in a short period of time. Both of these bode well with investors, as strong management is essential to the success of a company, while a quick return on investment signifies strong financial performance.

Mr. Walchuck stated, “We believe that this transaction is a tremendous step in moving Zinc One towards becoming a zinc producer. Although there are other quality assets in Forrester, it is the high-grade zinc Bongara and Charlotte Bongara properties which will become the flagship project of Zinc One. This is an exciting opportunity for Zinc One and all its shareholders.” In relation to other zinc deposits slated for production, it could take multiples of the current 3-year timeline that the CEO has devised for Zinc One’s operations.

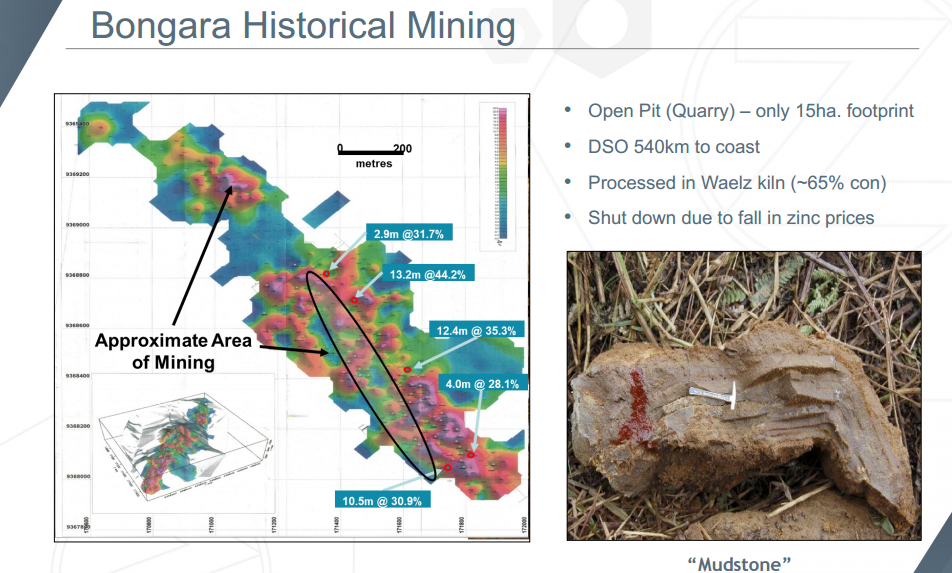

Although shutdown in August of 2008 due to falling zinc prices, the Bongara Zinc Mine was previously mined in 2007 and 2008. The product, which was extracted by an open-pit method was dried on the site, and then shipped 540 kilometres to the west coast where it was processed through a Waelz kiln, which is a processing technology typically applied to flue dust from steel mills in order to recover zinc. Through this method, Zn Calcine with concentrations of 60% or more were made, and then sold to various smelters and refineries across the United States and Peru.

Solitario Exploration’s Florida Canyon deposit, which Bonagara sits down strike of, hosts an N.I. 43-101 compliant mineral resource of 12.9 million tonnes grading a sizeable 13% zinc equivalent.

As previous operators completed an impressive amount of work on the site, a historic resource estimate (non 43-101 compliant) was finished in 2008 on the Bongara Mine that outlined 1 million tonnes grading 21.61% zinc.

Such information provides Zinc One with immediate knowledge of the Bongara Zinc Mine, the Charlotte Bongara project and Azulcocha West. This also supplies Zinc One with a healthy pipeline of exploration projects on top of actual development work located in safe jurisdiction with a mining heritage.

4. Zinc’s Faltering Supply

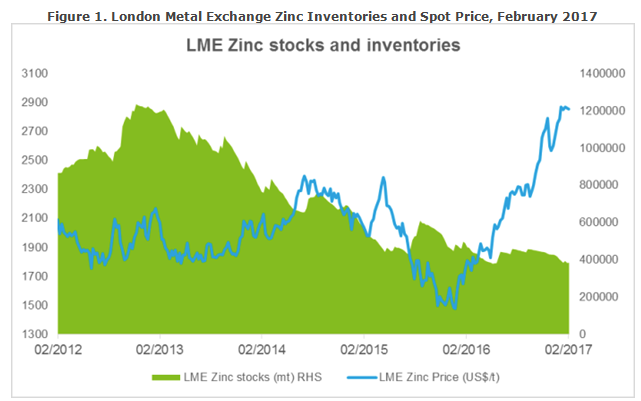

Although zinc is the third leading metal in the world in terms of demand, supply has not kept up, leading to industry professionals estimating a significant Zinc shortage in 2017. It’s the lowest it’s been since 2008 and with the current rate of usage, Zinc warehouse levels may be completed depleted within the next seven months.

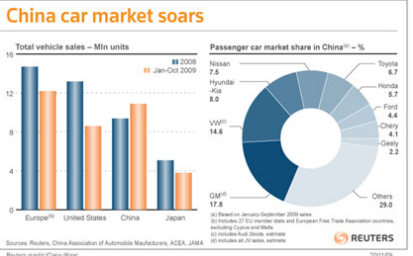

China, who is already responsible for about 47% of global zinc consumption, has announced plans for a $2 Trillion infrastructure investment and their overall trend is to Westernize. Megacities need to house millions of inhabitants and road systems need to be built that span the length of Eurasia. This increase in consumption only means an increased demand for zinc, a necessary component in infrastructure development.

Additionally, cars in both China and India are becoming vastly outdated. As such, new vehicles being manufactured and sold to the emerging middle class could require zinc in order to galvanise and coat material; this makes up about 50% of the end use for zinc.

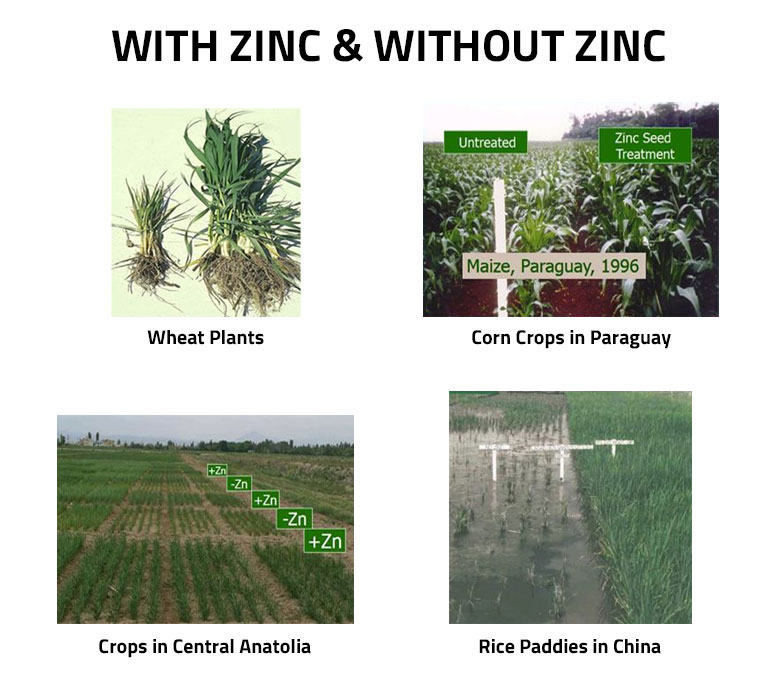

On top of industrial needs, zinc has also found a place in agriculture, further stretching the supply. According to the International Zinc Association, it’s estimated that half of the world’s agricultural soils are deficient in zinc, which leads to an overall decrease in nutritional value and crop production. Nearly 10% of all proteins in biological networks require zinc for their structure as well as their function. As an approach to boost crop production and add nutritional status for the consumption of crops, adding zinc to soils is highly beneficial.

As a result of these varying uses, demand for zinc has consistently grown 2-3% annually. Supply, however, is decreasing with the depletion of major mines, with recent, permanent shutdowns in Ireland and Australia. Additionally, because zinc is generally produced as a byproduct rather than mined as a primary metal, there are very few companies that can ramp up production to meet the growing demand.

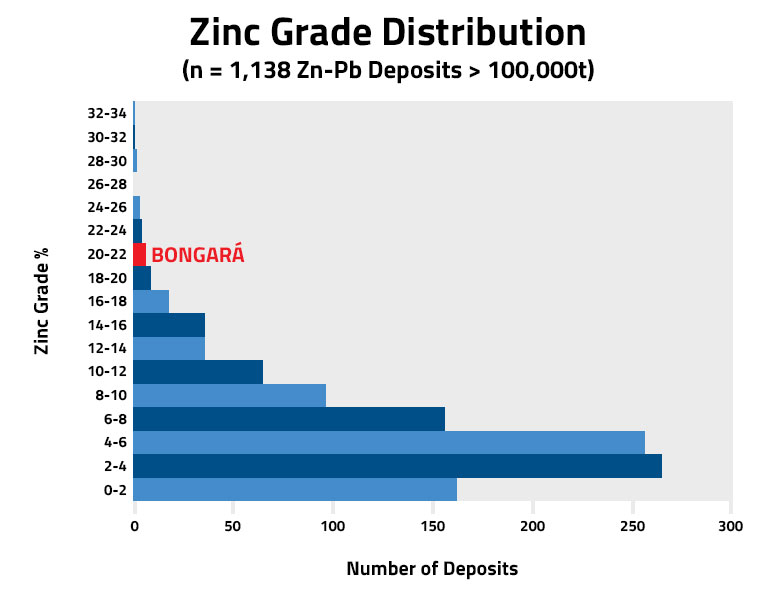

The previous operator of the Bongara past-producing mine had historical zinc grades of over 20%, which is almost unheard of. Worldwide, there are approximately 978 zinc deposits with ore grades under 10%—674 of them are actually under 6%. There are an additional 125 deposits with ore grades of 10 to 14%. Less than 100 are between 14 and 20%. Higher than 20% ore grades and we are now talking about a handful.

Zinc has come of age, and we don’t know of any other zinc story out there with this kind of catalytic property with potentially high grade zinc in the pipeline. With CAD $10 million in the bank, an undervalued market cap, Zinc One should be a company that investors should put on their watchlists.

Featured Image: Twitter